The massive leveraging of United States nonfinancial organizations over the last several decades is utterly incompatible with the stock exchange cap rising from 62% to 204% of GDP.

The US organization economy is now bring 13X more leverage than it did 50 years earlier.

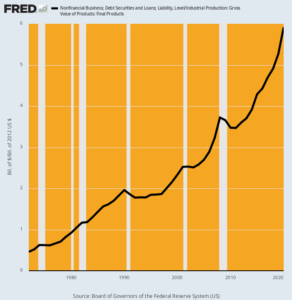

Nonfinancial Service Financial Obligation as % of Gross Production, 1972– 2020

Here is what has really taken place to business balance sheets:

- Back in 1972, overall business debt impressive of $634 billion amounted to just 46% of the gross worth of US commercial production, which was $1.38 trillion.

- By 2007, service financial obligation had actually skyrocketed to $10.1 trillion and stood at 321% of the gross commercial production of $3.15 trillion.

- By 2020 the financial obligation figure had risen to $17.7 trillion even as the value of industrial production had stayed pinned to the flat line. That is to say, at the end of last year’s Fed-fueled borrowing spree in the US company economy, the leverage ratio clocked in at an off-the-charts 592%.

With this high take advantage of, growth and profits-generation will end up being steadily weaker in time. This suggests that the stock exchange capitalization rate of the nationwide earnings ought to be falling, not heading skyward as explained above.

Undoubtedly, because March 2009 equity investors have come to recognize that any correction would result in a bounce and a new upward run. At the starting it took a long period of time prior to favorable trading emotions and Pavlovian rewards emerged, however as the bull run sped up, the rewards came much faster and faster.

Up until really just recently.

Previously, all the dips– even micro-dips– were practically instantly bought by the herd of traders and homegamers driven by Pavlovian reflexes, thereby reinforcing the power of positive feedback loops. But as Absolutely no Hedge observed, this loop might lastly be reaching its sell-by date:

Something’s different this time.

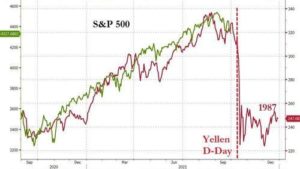

For the very first time because the collapse in March 2020, the S&P 500 has failed to rebound back to new highs after checking its key uptrend technical levels.

Source: Bloomberg The bigger issue is the threat that an external shock– a black swan– will break the entire chain of dip-buying and options-based speculation and ultimately activate a put-buying stampede, specifically among the homegamers who have actually never experienced a down market.

Their Reddit experts will tell them they can ride out the storm and safely hold on to their FANGMAN, Teslas, and meme stocks by buying “protection” via puts on their portfolios. That, naturally, will trigger more delta hedging amongst options dealers, more ETF liquidations, and more temptations for the fast cash to engage in open shorting of a market suspended on a sky-hook.

As one expert pointed out, the 1987 crash is an excellent illustration of the threats associated with out-of-control positive feedback. In the chart below, he laid the current S&P 500 run against the last 12-months preceding the 30% stock market crisis in October 1987.

We have no idea whether the high has actually yet been reached or what “shock” may trigger the present coiled spring to lunge into reverse. But with each passing episode of sharp selloffs and just partial BTFD (buy the freaking dip) rebounds, the chances of a meltdown reversal continue to increase.

Editor’s Note: Washington DC political leaders and main coordinators have let loose the most destructive monetary policies in the country’s history. It’s a silly monetary gamble that will make sure the damage of the economy, individuals’s livelihoods, and ultimately the United States dollar.

The reality is, the greatest danger to your financial future is even larger than the trillions of dollars in stimulus.

There are still actions you can require to ensure you endure the coming turmoil with your money undamaged.

That’s why bestselling author Doug Casey and his team just released an urgent brand-new PDF report that explains how you to make it through and thrive in the months ahead. Click on this link to download it now.