The Fed has actually trained the trading-rats all too well, and there is no chance to prevent the unintentional effects of the Fed’s large-scale human behavioral experiment.

The Federal Reserve has been running a large-scale human behavioral experiment because 2008. The outcomes are now in. Let’s start by stipulating that trading-bots are configured to trade on human behavioral circulations, i.e. trends and reactions to policy announcements and other “news” (revenues beats. etc). As an outcome, the robot-trading-rats are reacting to the very same stimuli as the human-trading-rats in the Fed’s experiment.

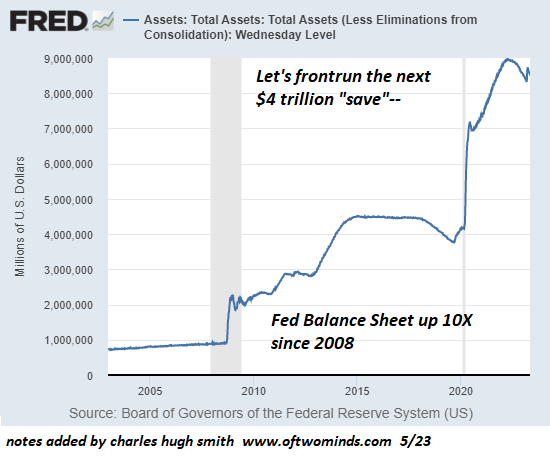

Here’s the experiment set-up. When the trading rats struck the red button, the stock exchange swoons, and the Fed leaps into action to “save the marketplace” by injecting trillions of dollars in stimulus and liquidity through various programs such as buying Treasury bonds. The trading-rats who “purchase the dip” are rewarded with hefty gains as the market skyrockets as soon as the Fed “pivots” from “hawkish” to “dovish.”

Trading-rats are clever and so they understood they didn’t require to wait on the Fed to act to reap huge gains. Considering that everybody playing the trading video game understands the Fed will pivot dovish once the marketplace swoons, then the trading-rats started front-running the Fed’s pivot, purchasing every swoon based on their supreme self-confidence that the Fed would quickly “save the marketplace” from crashing.

The Fed is now trapped by the success of its mass-scale behavioral experiment. The trading-rats have such overall self-confidence in the Fed Put, i.e. the Fed “saving the marketplace” once it swoons, due to the fact that every time they have actually hit the red button the Fed has leaped into action and launched a tsunami of stimulus and liquidity that reverses the swoon and pushes risk properties to brand-new highs.

As a result of this feedback, the market never ever swoons adequate to trigger a Fed response since every dip is purchased by front-running trading-rats. This can be viewed as a success, as the Fed no longer has to do anything to keep the marketplace raised, as the front-running trading-rats jump into action to buy every dip. The expectation of a Fed “save” is enough to keep the market in an easily raised trading variety.

The problem is the trading-rats’ confidence in the Fed Put incentivizes a near-infinite growth of ethical danger as the trading-rats can expand debt and utilize with no limit since the consequences (potentially terrible losses) have been taken off the table by the Fed’s “ensured” turnaround of any swoon in threat possessions.

Each trading-rat is focused on its own financial obligation and leverage, however there is no incentive to measure the systemic danger piled up by the Fed-generated moral threat. The Fed’s “ensured” reversal of any swoon has actually thus produced a perverse reward to handle crazy levels of risk to increase gains– an increase in danger that now threatens the stability of the whole monetary system.

No one believes a crash is possible due to the fact that the Fed will reverse the swoon once the trading-rats struck the red button. However the Fed is not supreme, and the confidence in its omnipotence has changed into hubris.

The only method the Fed can break this reward to increase risky bets is to deliver a shock when the trading-rats hit the red button. Instead of ensured gains, the trading-rats receive a shock– huge losses. To re-train the trading-rats behaviorally, the Fed will have to deliver duplicated shocks because the trading-rats have actually been trained to expect Fed goodies every time they hit the red button.

The very first time they receive a shock instead of a treat, the trading-rats will be puzzled however will go ahead and strike the red button once again. They will continue to hit the red button and get surprised till they understand the rules of the experiment have actually changed.

Needs to the Fed arbitrarily deliver deals with and shocks, the trading-rats will enter a catatonic-schizoid state of worried breakdown. The trading-rats will no longer know what to do, therefore they won’t purchase every dip to front-run the Fed, and they will no longer be positive the Fed will reverse the taking place crash.

For the Fed’s part, if they keep rewarding the trading-rats for piling on threat, then the system will end up being progressively susceptible to a cascading collapse due to outrageous levels of threat that have actually been incentivized by the Fed’s “warranty.”

If they stop reversing every swoon, the market is vulnerable to a cascading crash as the trading-rats are no longer sure the Fed will bail out their remarkably dangerous bets.

In either case, the swoon turns into an uncontrolled crash. The Fed has trained the trading-rats all too well, and there is no chance to prevent the unintentional effects of the Fed’s massive human behavioral experiment.

Possibly the Fed can ask ChatAI to fix the unresolvable problem, however that will reveal the limitations not just of Fed policy however of ChatAI.

New Podcast:

Its a Waterfall- Threat, Security & Efficiency( 48 min) My brand-new book is now available at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the very first chapter free of charge(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century (43 minutes)My

Its a Waterfall- Threat, Security & Efficiency( 48 min) My brand-new book is now available at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the very first chapter free of charge(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century (43 minutes)My

recent books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the very first section totally free(PDF)International Crisis, National Renewal: A(Revolutionary )Grand Strategy for the United States(Kindle$9.95, print$24, audiobook)Check Out Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet(Kindle$ 8.95, print$20, audiobook$17.46)Read the very first area totally free(PDF). Will You Be Richer or Poorer?: Earnings, Power, and AI in a Traumatized World

(Kindle $5, print$10, audiobook) Check out the very first section free of charge(PDF). The Experiences of the Consulting Philosopher: The Disappearance of Drake

(Novel)$4.95 Kindle,$ 10.95 print); checked out the first chapters totally free (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Check out the very first section for free End up being a$1/month patron of my work by means of patreon.com. KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be offered to any other private, company or company. Thank you, Alan P.($10), for your most generous contribution to this site– I am considerably honored by your support and readership. Thank you, Michael R.( $5/month ), for your magnificently

generous pledge to this site– I am significantly honored by your assistance and readership. Thank you, J.S.($5/month), for your monumentally generous pledge to this website– I am considerablyhonored by your assistance and readership. Thank you, Dave($1/month), for your much-appreciated generous promise to this site– I am greatly honored by your assistance and readership.