Can extremes become too severe to continue higher? We will find out.

Is anyone happy to call the top of the Everything bubble? The brief response is no. Anyone earning money handling other people’s money can not manage to be incorrect, therefore everyone in the herd prevaricates on timing. The herd has seen what happens to those who call the top and after that twist in the wind as the marketplace continues rocketing greater.

Cash supervisors reside in sections of 3 months. If you miss one quarter, the clock begins ticking. If the S&P 500 beats your fund’s return a 2nd time because you were bearish in a bubble, your doom is sealed.

When the bubble finally pops and everybody however a handful of secretive Bears is squashed, the rationalization will cover everybody’s failure: “nobody might have seen this coming.”

In fact, everybody can see it coming, however the tsunami of reserve bank liquidity has removed any semblance of rationality. My good friend and coworker Zeus Y. just recently summarized the effects of this decoupling of markets and reality:

“I utilized to be with the Bears up until the uncoupling was complete when the Fed began guaranteeing non-investment grade scrap bonds. At that point, any semblance of sanity, much less probity, much less stability was gone. Rinse and repeat with digital dollars entering into the 10s and even numerous trillions of dollars.

For twenty years we fiscal sanity-ists have actually been presuming SOME standard reality. I see none in sight and still lots of assets to ransack and pump and still resources to draw and suckers to shake down. The system is running hot and wild on its own algorithms, and actual people are lying back and just lapping up the “passive” income developed by delusion-made-reality.

With that much will which much corruption, that much greed which much desire, with a strong dosage of worry and opportunism to flavor this hazardous brew, I do not see the entity slouching far from Bethlehem anytime quickly (yes, Keats reference). The falcon has long given that not heard the falconer in its broadening gyre, however we have virtual falcons now that will do whatever we believe it is we desire (which has actually been force fed back to us).

Till this mass misconception and psychosis breaks by whatever means– monetary crash, disobedience against all the BS and go back to simple community, we are just visiting digital currency, stocks, and pretty much everything go up as 10s of trillions of prepared dollars try to find some property to ride.

This will (continue to) drive the stock exchange, gold, cybercurrency, land, everything to unsustainable and giddy heights. I no longer think a Bear market is even possible. Just soaring “evaluations” based upon fake currency and an unpredictable crash at some time in the future METHOD longer than it ever must be if we had a sane world.”

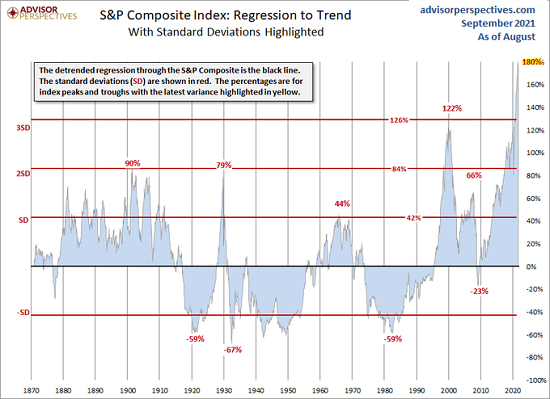

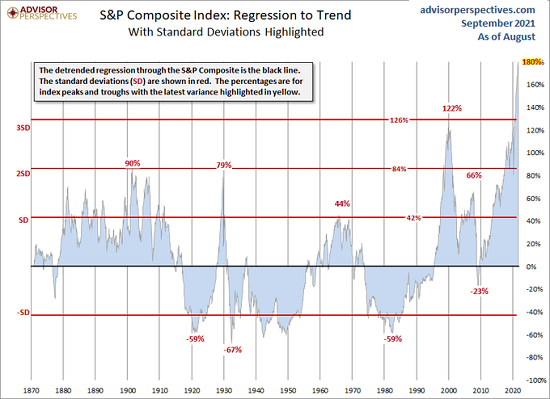

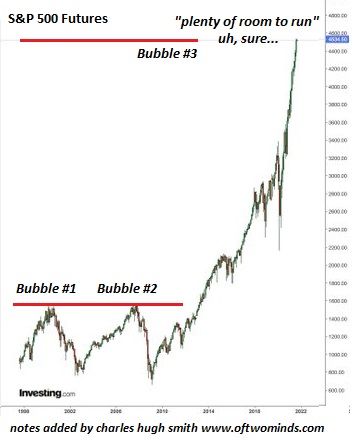

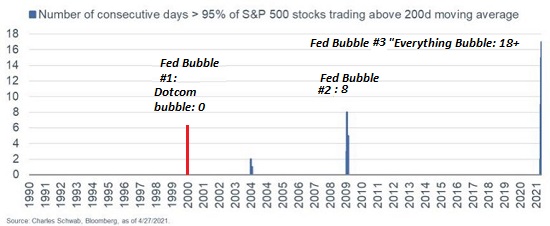

Well stated, Zeus. It is now illogical to anticipate markets to ever reconnect with reality. That stated, if you glance at the charts below, this is about as a good a time as any for the bubble to burst. Recall that bubbles don’t need a specific trigger-event to pop, they just stop going up.

Regression to pattern: ridiculous extreme.

S&P 500 stocks over 10 times yearly sales: outrageous extreme.

S&P 500 Whatever Bubble compared to bubbles # 1 and # 2: insane extreme.

S&P 500 stocks above their 200-day moving average: ridiculous extreme.

Billionaire wealth increasing in the Everything Bubble: ridiculous extreme.

Exist any limits on impracticality? Obviously not. But there are still limits in the real world and central bank liquidity is distorting the real life, not simply the imaginary world.

At the serious threat of twisting in the wind as the S&P 500 goes to 5,000, 10,000 and 100,000, let’s call September 2021 the top of the Everything Bubble. Can extremes end up being too severe to continue higher? We will discover.

If you discovered worth in this content, please join me in looking for solutions by becoming a $1/month patron of my work through patreon.com.

My brand-new book is offered! A Hacker’s Teleology: Sharing the Wealth of Our Diminishing World 20% and 15% discount rates (Kindle $7, print $17, audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Videos/Podcasts:

Charles Hugh Smith on Secular Inflation (Host Richard Bonugli, 31 min)

My current books:

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the very first area free of charge (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Distressed World

(Kindle $5, print $10, audiobook) Read the very first section free of charge (PDF).

Pathfinding our Fate: Avoiding the Last Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first area for free (PDF).

The Adventures of the Consulting Theorist: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the very first chapters totally free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the very first section totally free (PDF).

End up being a $1/month customer of my work by means of patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be offered to any other specific, company or firm.

|

Thank you, George D.A. ($54), for your incredibly generous contribution to this site– I am greatly honored by your assistance and readership. |

Thank you |

, Kent M. ($50), for your wonderfully generous contribution to this site– I am greatly honored by your unfaltering assistance and readership. |

|

Thank you, James D ($20), for your most generous contribution to this website– I am considerably honored by your assistance and readership. |

Thank you |

, Daniel K. ($25), for your splendidly generous contribution to this website– I am considerably honored by your unfaltering assistance and readership. |