The reality is America has lost its way if commoners pay a rate of 40% however its billionaires pay next to nothing.

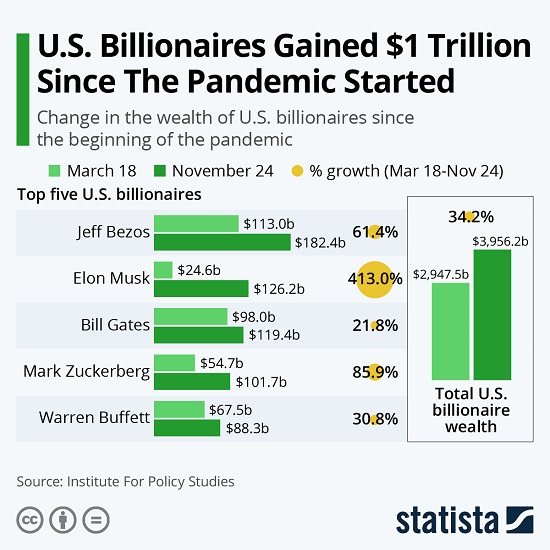

Similar to everything else in polarized America, billionaires proclaiming space tourism is the next huge thing for humanity neatly divides opinion into two camps: those who laud the initiative, hard work and developments of the billionaires as examples of the American Can-Do Dream, and those who wanted the billionaire space tourists had actually taken a one-way flight to a far-off orbit of blissful silence.

Reserving that bitter divide, let’s check out another divide: how our two-tier tax system makes it possible for billionaires to end up being billionaires while the rest of us get poorer. Whenever I go over the taxes of the non-billionaire self-employed, armies of apologists jump to the defense of the status quo with various quibbles: the 0.9% Medicare surcharge only kicks in above $200,000, the cap on Social Security taxes is $142,800, and so on.

Reserving the quibbles– and recall the tax code with regulative notes is thousands of pages– let’s deal with the genuine issue, which is that billionaires and their corporations pay a thin slice of taxes as a percentage of total income/gains if they pay any at all, while self-employed and small company pay extraordinarily high tax rates.

To all the quibblers: please add the 15.3% Social Security/Medicare tax rate (self-employed/ sole proprietors pay both the staff member and company share of this tax) to the federal tax rate of 24% for income above $85,520. It’s 39.3%.

Simply how hard would it be to conclude that everyone making more than $142,000 should pay at least the same rate the rest people pay? Aren’t we showing all those same laudable qualities of the billionaires, just on a smaller sized scale? Why should we pay 40% and the billionaires pay basically zero?

Gee, do you reckon paying no taxes might help folks end up being richer? Garsh, no one ever asked that question before. And do you reckon paying 40% of your income might make you poorer over time? Golly gee, how come the talking heads worshiping the billionaires never ever ask these questions?

Since Social Security and Medicare/Medicaid are the bedrock of America’s social safeguard, why shouldn’t billionaires pay to support these programs? Well, why not? Just how lame do the reasons need to be to be acknowledged as laughably self-serving?

Here’s the trick billionaires utilize to avert taxes. There are many methods for the super-wealthy to avert taxes– funnel earnings through an Irish post office box, purchase a tax break in Washington DC, slide the money into among dozens of global tax havens, and so on.

But an easy one is to report no income and live big off obtained money. As the billions of dollars in capital gains accumulate as the billionaire’s stock holdings skyrocket (thanks, Federal Reserve, for the free trillions; dreadful swell of you to provide us all that complimentary money), there’s no income created till the billionaire sells some shares. No sale, no earnings. Just pay yourself $1 a year in wage, borrow against your billions at super-low rates of interest, and voila, you’re tax-free while you develop your super-yacht, buy your private island, and so on.

Simply as a thought experiment, expect the very first $50,000 in incomes for everybody were tax-free, and a 40% tax rate was collected on all earnings above $1 million, both made and unearned (capital gains), not when the gains were realized in a sale but at the end of every tax year, whether the shares that increased in worth were offered or not.

So Billionaire Space Tourist reaped $10 billion in capital gains from the appreciation of stocks held, then the Billionaire pays 40% of those gains: $4 billion. There is a method to not pay any taxes on capital gains– have your portfolio lose value. No gains, no taxes. And to close all the loopholes, the tax rate is on all assets and income linked in any way, shape or form with the U.S. First they pay the U.S. taxes, then if they want to pay other countries’ taxes too, be my guest. But the 40% is due and payable no matter any other conditions.

You do not like it, then stop offering any products in the U.S. or holding any possessions in the U.S. Why should billionaires get to set up immensely successful monopolies, quasi-monopolies, cartels and corporations in the U.S. however pay near-zero in taxes? Why should billionaires be free to make money from America’s economy but pay nothing to support its citizenry?

What specifically is the reasoning of minimizing taxes on the wealthiest few to near-zero? If there is no logic, then we’re entrusted to corruption: America is an ethical cesspool.

The reality is America has actually lost its method if citizens pay a rate of 40% but its billionaires pay next to nothing. Please note Karma and Divine Retribution are not controlled by the billionaire’s lackeys and apparatchiks in the Federal Reserve. The pendulum of exploitation has actually reached its severe, and the reversal to the opposite extreme is underway.

If you found value in this content, please join me in seeking services by becoming a $1/month patron of my work through patreon.com.

My brand-new book is readily available! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World 20% and 15% discount rates (Kindle $7, print $17, audiobook now readily available $17.46)

Read excerpts of the book totally free (PDF).

The Story Behind the Book and the Intro.

Current Videos/Podcasts:

AoE Beauty salon # 44: We say “Satyagraha”, they say “sedition” with author Max Borders (1:03 hrs)

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the very first section totally free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Distressed World

(Kindle $5, print $10, audiobook) Read the very first section for free (PDF).

Pathfinding our Fate: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the very first section totally free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters totally free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Check out the first section for free (PDF).

Become a $1/month client of my work via patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and email remain private and will not be offered to any other private, business or company.

|

Thank you, Mike B. ($5/month), for your wonderfully generous pledge to this site– I am considerably honored by your support and readership. |

Thank you |

, Julian B. ($5/month), for your monstrously generous promise to this website– I am significantly honored by your assistance and readership. |

|

Thank you, John C. ($5/month), for your monumentally generous pledge to this website– I am greatly honored by your assistance and readership. |

Thank you |

, Augustine W. ($5/month), for your splendidly generous promise to this website– I am considerably honored by your support and readership. |