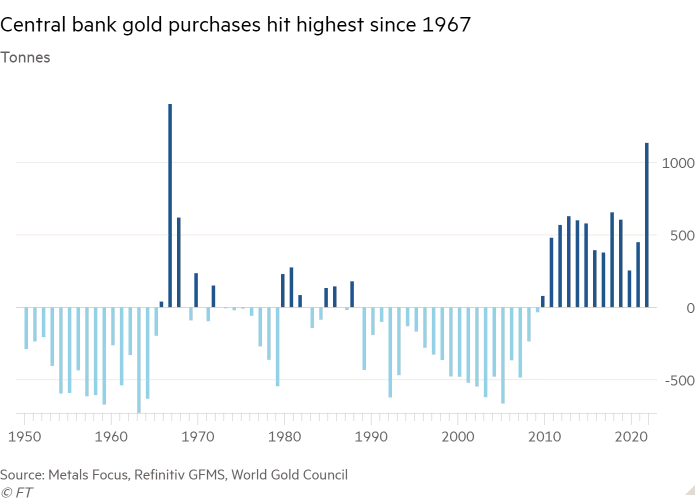

Did you know that reserve banks bought more gold last year than any year in the previous 55 years– since 1967?

Though the majority of don’t recognize it, 1967 was a significant year in monetary history, mainly due to the occasions at the London Gold Pool.

The London Gold Pool was a contract among central banks of the United States and Western European nations to support the rate of gold. The objective was to preserve the rate of gold at $35 per ounce by jointly purchasing or offering gold as required.

Nevertheless, in 1967 the London Gold Pool collapsed due to a lack of gold and increased need for the metal. That’s since European reserve banks bought enormous quantities of gold as they began to question the United States federal government’s promise to back the dollar to gold at $35/ounce. The buying diminished the London Gold Pool’s reserves and pushed the rate of gold greater.

Simply put, 1967 was the start of the end of the Bretton Woods international monetary system that had actually remained in place considering that the end of World War 2. It eventually caused severing the US dollar’s last link to gold in 1971. The dollar has been unbacked fiat confetti since– though the petrodollar system and coercion have actually propped it up.

The point is big global gold flows can be an indication that a paradigm shift in the worldwide monetary system is imminent.

Central banks are the biggest players in the gold market. And now that we have just experienced the largest year for reserve bank gold purchases because 1967, it’s clear to me something huge is coming quickly.

And those are just the main numbers that federal governments report. The actual gold purchases could be much greater because governments are frequently opaque about their gold holdings, which they consider an essential part of their economic security.

Today, I think we are on the cusp of a transformation in the worldwide monetary system with profound implications. Yet, few understand what is happening and its enormous significance.

I think many people will be taken by surprise– and it will not be an enjoyable one. They’ll be the ones holding the bag for a stopping working financial system.

But it doesn’t need to be a disaster for everyone …

Those who get positioned properly ahead of this paradigm shift might make fortunes.

The Genuine Factor for China’s Massive Gold Stash

According to the Financial Times, the huge buyers of gold in 2022 were China and Middle East oil manufacturers. That’s not a coincidence, as these nations will be at the center of the modifications to the international monetary system.

It’s clear that China has actually been stashing away as much gold as possible for several years.

China is the world’s biggest manufacturer and buyer of gold. Most of that gold finds its method into the Chinese federal government’s treasury.

No one understands the specific amount of gold China has, but most observers believe it is numerous multiples of what the federal government declares.

Today it’s clear why China has had a pressing demand for gold.

Beijing has actually been waiting for the right moment to pull the carpet from underneath the United States dollar. And now is that minute …

The essential to understanding it all is Chinese President Xi’s current historical check out to Saudi Arabia and other Gulf Cooperation Council (GCC) mentions to launch, in his words, “a brand-new paradigm of all-dimensional energy cooperation.”

The GCC consists of Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, and the United Arab Emirates. These nations account for more than 25% of the world’s oil exports, with Saudi Arabia alone contributing around 17%. In addition, more than 25% of China’s oil imports originate from Saudi Arabia.

China is the GCC’s largest trading partner.

The conferences show a natural– and growing– trade relationship between China, the world’s biggest oil importer, and the GCC, the world’s biggest oil exporters.

Throughout Xi’s go to, he made the following crucial remarks (emphasis mine):

“China will continue to import big quantities of crude oil from GCC countries, broaden imports of melted natural gas, reinforce cooperation in upstream oil and gas advancement, engineering services, storage, transport and refining, and make complete usage of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.”

After years of preparation, the Shanghai International Energy Exchange (INE) released a petroleum futures agreement denominated in Chinese yuan in March 2018. It’s the very first oil futures contract to be sold China. The contract is based upon Brent petroleum, the international standard for oil costs, and is settled in money.

Since then, any oil manufacturer can sell its oil for something besides United States dollars … in this case, the Chinese yuan.

The INE yuan oil futures agreement offers a brand-new pricing benchmark for the global oil market, which the United States dollar has typically dominated. By trading in yuan, the agreement is anticipated to increase making use of the Chinese currency in worldwide trade and minimize the dependence on the US dollar.

Its significance lies in its prospective to move the balance of power in the oil market away from the US and towards China and to increase using the Chinese yuan in worldwide trade.

There’s one huge problem, though. The majority of oil producers do not want to accumulate a big yuan reserve, and China understands this.

That’s why China has clearly linked the crude futures agreement with the capability to convert yuan into physical gold– without touching China’s main reserves– through gold exchanges in Shanghai (the world’s biggest physical gold market) and Hong Kong.

PetroChina and Sinopec, two Chinese oil business, supply liquidity to the yuan crude futures by being huge buyers. So, if any oil manufacturer wishes to offer their oil in yuan (and gold indirectly), there will constantly be a bid.

After years of growth and working out the kinks, the INE yuan oil future agreement is now prepared for prime-time television. Xi would not guarantee the GCC big and constant oil purchases if it wasn’t prepared.

Why is China buying oil and gas from the GCC in yuan crucial?

Because it undercuts the petrodollar system, which has actually been the bedrock of the US and worldwide financial system because the Bretton Woods system broke down in 1971.

The Saudis Acquiesce and What Occurs Next

For nearly 50 years, the Saudis had constantly firmly insisted anybody desiring their oil would require to pay with United States dollars, maintaining their end of the petrodollar system.

However that all altered just recently.

After Xi’s historical visit and bombshell announcement, the Saudi government isn’t concealing its objective to sell oil in yuan. According to a recent Bloomberg report:

“Saudi Arabia is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s financing minister.”

In short, the Saudis don’t believe the United States is holding up its end of the petrodollar deal. So they don’t seem like they must hold up their part.

The Saudis are angry at the US for not supporting it enough in its war against Yemen. They were additional puzzled by the United States withdrawal from Afghanistan and the nuclear negotiations with Iran.

In this context, China swooped in and, after several years, lastly obliged the Saudis to accept yuan as payment.

It was bound to occur.

China is already the world’s largest oil importer. Moreover, the amount of oil it imports continues to grow as it fuels an economy of over 1.4 billion individuals (more than 4x bigger than the United States).

The sheer size of the Chinese market made it difficult for Saudi Arabia– and other oil exporters– to overlook China’s demands to pay in yuan indefinitely. The Shanghai International Energy Exchange further sweetens the offer for oil exporters.

Here’s the bottom line.

Saudi Arabia– the linchpin of the petrodollar system– is freely agreeing not to offer its oil solely in United States dollars.

It signals an imminent and enormous modification for anyone holding US dollars. It would be extremely absurd to neglect this huge red indication.

Even the WSJ admits such a relocation would be disastrous for the United States dollar.

“The Saudi move might chip away at the supremacy of the United States dollar in the global monetary system, which Washington has actually counted on for decades to print Treasury costs it utilizes to fund its deficit spending.”

Ron Paul is an American politician and physician who has actually been a singing critic of the present worldwide financial system for decades. Nixon’s relocate to end the dollar’s link to gold in 1971 at first motivated him to enter politics. He is understood for his views on financial policy, central banking, and the Federal Reserve. Ron Paul has composed several books on these topics and promoted for a return to sound cash and a gold-backed financial system.

In short, Ron Paul knows more about the worldwide monetary system than nearly anyone alive.

He as soon as provided a speech called “Completion of Dollar Hegemony,” where he mentioned the one thing that would precipitate the United States dollar’s collapse.

Here’s the pertinent part:

“The economic law that sincere exchange needs just things of real value as currency can not be rescinded.

The chaos that one day will occur from our experiment with worldwide fiat cash will require a return to money of genuine worth.

We will know that day is approaching when oil-producing nations require gold, or its comparable, for their oil instead of dollars or euros.

The quicker the better.”

Here’s the bottom line.

The end of the petrodollar system impends.

For over 50 years, this arrangement has enabled the US federal government and numerous Americans to live method beyond their methods.

The United States takes this distinct position for approved. However it will soon vanish.

There will be a great deal of additional dollars drifting around all of a sudden searching for a home now that they are not required to acquire oil.

As a result, a lot of oil money– numerous billions of dollars and perhaps trillions– that would typically flow through banks in New york city in United States dollars into US Treasuries will rather stream through Shanghai into yuan and gold.

Completion of the petrodollar system is bad news for Americans. Regrettably, there’s little any person can virtually do to change the course of these patterns in movement.

The very best you can and must do is to remain informed so that you can protect yourself in the very best method possible, and even make money from the scenario.

That’s specifically why I simply released an urgent report on where this is all headed and what you can do about it … including three techniques everyone needs today.