Extremes keep getting more extreme, but for those at the top of the heap, it’s all fine. For everyone else slipping down the ladder, all that FINE adds up to Fragile, Insecure, Ridiculous, Pricey.

Readers occasionally point out I’ve been anticipating that unsustainable extremes will eventually unwind for 10+ years, yet whatever’s still great. Yes, everything’s still great, perhaps even peachy, but possibly we should explain “great” due to the policy extremes that keep getting more severe to keep all that fineness duct-taped together.

How about this for FINE:

Fragile

Insecure

Nonsensical

Expensive

To examine just how extreme things have ended up being below the placid surface area of peachiness, let’s take a look at federal debt, the Fed balance sheet and Household Web Worth in relation to inflation and GDP, two basic steps of development.

All else being equal, many economic-financial metrics will approximately track either inflation or Gross Domestic Product (GDP), the broad step of the economy’s activity/ expansion/ contraction.

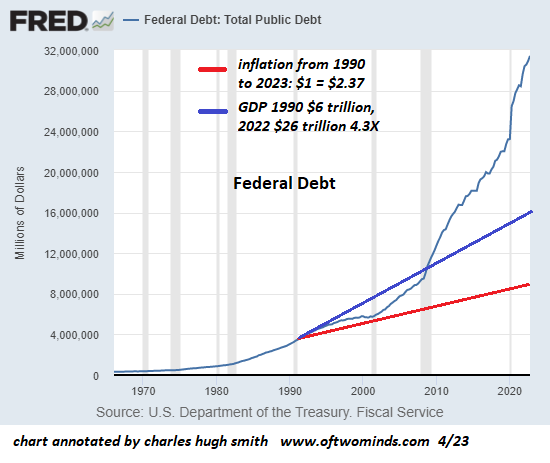

Simply put, one method to identify extremes is to search for metrics that are way out of line with GDP and inflation. Think about federal debt as an example. We can be forgiven for presuming federal loaning would more or less track the growth of GDP.

However as the chart below shows, if federal debt had actually tracked GDP since 1990, it would be around $16 trillion, half of its present bloat of $32 trillion. Hmm, $16 trillion here, $16 trillion there and quite soon you’re talking genuine money.

The GDP of Japan is around $4.3 trillion, the GDP of Germany has to do with $4 trillion, so that $16 trillion in “excess federal loaning and costs” is the comparable to 4 GDPs of the 3rd and fourth biggest economies on the planet (simply behind the US and China).

Does an “excess $16 trillion” of federal financial obligation certify as severe? I believe the reasonable conclusion is “yes.”

Next up, the Federal Reserve Balance Sheet, which shows the amount created out of thin air to buy US Treasury bonds and mortgage-backed securities as the ways to inject gobs of United States dollars into the financial system as liquidity for speculation.

Hmm, if the Fed balance sheet had actually tracked GDP, it would have risen from around $700 billion in the early 2000s to a weak $1.8 trillion, a far cry from its existing level of $8.6 trillion. In round numbers, this is about $7 trillion in “excess Federal Reserve stimulus,” not rather the combined GDPs of Japan and Germany however hey, $1 trillion at these levels is a simple rounding mistake, right?

Now let’s take a look at the actually, really fine part of the extremes, Home Net Worth: all the plump, juicy wealth produced for the leading 10% who own the vast majority of financial properties to enjoy.

If Home Internet Worth had tracked GDP, it would amount to about $90 trillion, $50 trillion less than its present level of $140 trillion. You see what’s really great here: the federal government injects $16 trillion in excess stimulus, the Federal Reserve injects $7 trillion in excess stimulus for an overall of $23 trillion, and the top 10% enjoy $50 trillion in excess wealth: yowza, that’s a really fine financial investment!

Of course private and corporate debt has actually skyrocketed along with federal debt, however never mind the information. $50 trillion in excess wealth is approximately twice the size of America’s GDP of $26 trillion. That’s a lot of incredibly great wealth to have fun with.

But all this truly fine wealth hasn’t exactly been equally dispersed. It ends up the bottom 50% of households lost ground given that 1990, as their share of the overall home wealth fell from about 4.5% to 3% (see chart listed below).

The middle class (the 50% to 90% section of homes) likewise lost ground, as their share of wealth fell from above 36% to less than 29%. A 7% decline may not sound like much, however recall that each 1% is $1.4 trillion, so that 7% decline adds up to roughly $10 trillion in today’s overall wealth of $140 trillion.

On the other hand, back at the Actually Great Ranch, the leading 1% saw its share of the wealth soar by 40%, from 23% to 32%. It appears some have received more fineness than others.

Extremes keep getting more extreme, however for those at the top of the heap, it’s all fine. For everyone else slipping down the ladder, all that FINE adds up to Fragile, Insecure, Ridiculous, Pricey.

New Podcast: Its a Waterfall -Threat, Security & Efficiency(48 min) My brand-new book is now readily available at a 10 % discount rate( $8.95 ebook, $18 print): Self-Reliance in the 21st Century. Check out the first chapter free of charge(PDF)Read excerpts of all three chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century(43

minutes)My current books: The Asian Heroine Who Seduced Me (Novel)

print$10.95, Kindle$6.95 Read an

excerpt free of charge(PDF )When You Can’t Go On: Burnout , Reckoning and Renewal $18 print,$8.95 Kindle ebook; audiobook Read the very first area for free( PDF) Worldwide Crisis, National Renewal: A(Revolutionary) Grand Technique for the United States (Kindle$9.95, print $24, audiobook )Check Out Chapter One totally free(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World(Kindle$8.95, print$20, audiobook$17.46)Read the first area totally free (PDF ). Will You Be Richer or Poorer?: Revenue

, Power, and AI in a Traumatized World(Kindle$5, print$10, audiobook)Read the first area free of charge(PDF). The Adventures of the Consulting Thinker: The Disappearance of Drake(Unique)$4.95 Kindle, $10.95 print); checked out the first chapters for

complimentary(PDF)Cash and Work Unchained$6.95 Kindle, $15 print)Read the very first section free of charge Become a $1/month client of my work via patreon.com. NOTE: Contributions/subscriptions are acknowledged in the order got. Your name and email remain private and will not be provided to any other individual, business or firm. Thank you, Cozmin L. ($ 100) , for your outrageously generous contribution to