And what happens next? Bubble balance: valuations fall at the exact same rate as they increased, decreasing back to the beginning point over an approximately equivalent time duration.

All speculative bubbles share particular qualities: the desertion of caution, the bliss of apparently unlimited gains, the ultimate re-connect with truth (i.e. the bubble pops) and bubble balance as the waterfall decline mirrors the blissful ascent.

At the same time, the particular origin and nature of each bubble is distinct to its era and circumstance. The housing bubble that popped with such destructive repercussions in 2007-08 was the outcome of the vast growth of subprime home loan lending which began as a progressive goal of expanding home ownership to the lower-middle class by decreasing credit requirements.

This perfect quickly morphed into the explosive growth of whole markets exploiting this brand-new pool of subprime borrowers by means of outright scams: no-document loans (a.k.a. phony loans), unfavorable interest home loans, interest-only mortgages, etc, all fueled by the product packaging of guaranteed-to-default home mortgages in mortgage-backed securities fraudulently veneered with a low-risk rating released by captured scores companies.

The rock that starts the landslide doesn’t need to be all that large. The whole subprime mortgage sector was a relatively modest percentage of the mortgage market and a small slice of the global financial system, however it is the nature of bubbles to be a pyramid house of cards in which the whole bubble is based upon debt expanding on the allegedly solid foundation of quickly rising collateral: the McMansion that sold for $300,000 a couple of months earlier has doubled in worth and now supports a $500,000 mortgage.

The thrilled speculator takes the “free money” $200,000 and buys another McMansion, and so on, pyramiding the very first home into a mini-empire of homes, all gaining value as the bubble expands. This virtuous feedback expands housing appraisals, security and debt that is released to buy more houses.

Then the feedback loop reverses. When the bubble pops, appraisals decline, collateral reduces and eventually all the home mortgages are underwater, i.e. unsupported by security. At the same time, earnings generated by the possessions decreases, making it difficult for the owner to service the debt, which perversely, stays the same as assessments drop.

This time around, the source of the bubble isn’t subprime purchasers, it’s rich investors and corporations using “excess cost savings” and easy credit to get homes and rental apartment or condos as “safe” places to park their excess capital. Excess savings remains in quotes because the “excess” money isn’t savings per se, it’s unearned gains created by purchasing assets long earlier at low rates of interest. As evaluations soared, the rich owners of capital have been “strained” with the task of where to park all these massive gains.

Macro-economists reference this “excess cost savings” as an issue without checking out the truth it’s only the leading 5% which have this “issue”: as numerous have actually documented, the vast majority of the gains created by the economy/assets have accumulated to the top 5% who purchased properties early in the cycle and used their skills, connections and capital to skim most of the earnings gets in addition to most of the capital appreciation.

Globalization and financialization concentrated the economy’s gains in corporations, which likewise acquired the “problem” of what to do with all this “excess cost savings.” One popular option is utilize the money to redeem shares, an “investment” that improves revenues per share by decreasing the number of shares outstanding and that accrues to investors and those managers who have impressive stock choices based on the worth of shares.

Both the wealth 5% and corporations likewise had access to affordable credit. Adequate earnings, substantial possessions– these are extremely appealing to lenders, and so the best rates are readily available to the already-wealthy who can then tap this credit to purchase possessions which yield higher returns.

Realty is a favored location to park “excess capital” internationally for three reasons:

1. As a basic rule, it’s a stable, rewarding source of income by means of rents, either long-lasting or short-term holiday rentals (Airbnb).

2. Realty normally has a lower threat profile than assets such as stocks.

3. In eras of broadening credit, leverage and population, real estate generally increases in worth as supply is naturally limited by location and other elements.

The short-term leasing fad is an under-appreciated chauffeur of the craze to buy houses and flats worldwide. The leading 5% checked out accounts of owners banking huge earnings from short-term rentals in desirable locales and in reaction they deployed a few of their excess capital/credit to going after the short-term rental market by buying homes sight unseen.

In hot real estate markets, rich purchasers grabbed homes to hold for capital gratitude. Since renters are possible sources of problems, these absentee owners choose not to bother renting out the flat or house; they purposefully leave it empty since they do not even require a rental income to cover the costs.

The net result of these pressures to park excess capital in real estate? Hundreds of countless empty homes and flats. By siphoning these residential or commercial properties off the marketplace, the rich parking excess capital have developed synthetic scarcities in long-lasting rentals and “homes for sale,” boosting rents and pressing assessments to the moon.

Corporations have actually bought up tens of thousands of houses and constructed or purchased tens of thousands of rental houses to lock in the low-risk returns of gathering lease and capital appreciation.

Note the virtuous feedback for the rich: the more properties they own and deflect the market, the higher the upward pressure on leas and assessments, and the higher their income and appreciation.

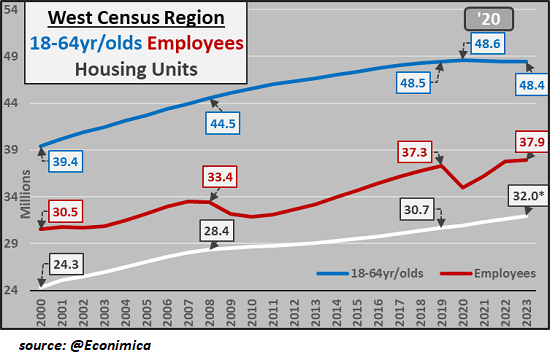

In the very first chart below (thanks to CH @Econimica), note that the population and variety of staff members 18-64 years of age in the American West stayed basically flat while the variety of housing systems increased by 1.3 million. And yet there’s apparently an abrupt scarcity of real estate for rent/sale? Any shortage isn’t the result of population growth, it’s the outcome of rentier-investors purchasing units as financial investments and holding them off the long-term rental/ ownership markets.

There’s likewise a demographic part: the variety of youths who can manage to buy a flat or house from the absentee-rentier wealthy/ corporate owners has actually reduced as rates of interest have actually increased and real estate rates have actually soared. In effect, this concentration of ownership in the hands of rentier rich and corporations has stripmined the marketplace of standard home buyers.

In effect, liquidity has actually been withdrawn from the realty market. The wealthy can sell to other wealthy households, however because that’s 5% of the population at finest, the marketplace is thin/ illiquid. Once offering commences, there are couple of buyers to support evaluations. Illiquid markets are prone to crashes or waterfall declines, a dynamic noticeable in the chart listed below of the current housing bubble bust decline.

Though couple of seem to mention it, housing demand is flexible. People move back home, move in with their adult kids, take boarders/ roommates, etc. There is no law that states an increasing population guarantees a population of people who can pay for $2,500 rent for a small flat or $750,000 for a falling apart cottage.

In an economic crisis, leas drop. Real estate demand sags and jobs increase, pressing rents lower. Once rents drop, assessments follow, as valuations ultimately reconnect with the fundamentals of income produced by the property.

When prices of homes and flats start dropping, owners can no longer depend on gratitude. Suddenly, a low-risk possession acquires a various danger profile: it’s declining, not getting value.

To secure gains, the wealthy rentier class and corporations have to sell. Nice, however to whom? Having actually outpriced homes and stripmined the younger generations with sky-high rents, the rich and the corporations will discover there aren’t enough purchasers to support current appraisals. Once absentee owners attempt to sell en masse, the marketplace crashes.

Distortions eventually have effects. Concentrate wealth and earnings in the top 5% and corporations, and provide the already-wealthy plentiful affordable credit to focus ownership of properties, and you get a distorted economy in which the couple of have actually outpriced the lots of and skimmed most of the earnings.

Who’s left to buy overvalued assets? Too couple of to prop up nosebleed appraisals.

And what takes place next? Bubble proportion: assessments fall at the very same rate as they increased, decreasing back to the starting point over an approximately comparable time period. (see chart listed below).

Thank you, all who responded so kindly to my rattling of the asking bowl this past weekend. I am honored and humbled by your assistance and support.

New Podcast: Turmoil Ahead As We Get In The New Era Of ‘Scarcity’ (53 minutes)

My brand-new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

My brand-new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

Check out the first chapter free of charge (PDF)

Check out excerpts of all 3 chapters

Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 minutes)

My current books:

The Asian Heroine Who Seduced Me (Unique) print $10.95, Kindle $6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section free of charge (PDF)

International Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Check Out Chapter One totally free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the first section free of charge (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the very first section totally free (PDF).

The Adventures of the Consulting Thinker: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); checked out the first chapters totally free (PDF)

Cash and Work Unchained $6.95 Kindle, $15 print) Check out the very first section totally free

Become a $1/month patron of my work through patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order got. Your name and email stay private and will not be provided to any other private, company or agency.

|

Thank you, Vincent B. ($10/month), for your outrageously generous pledge to this website– I am significantly honored by your steadfast assistance and readership. |

Thank you |

, Tim K. ($50), for your marvelously generous contribution to this website– I am greatly honored by your steadfast support and readership. |

|

Thank you, Daniel T. ($1/month), for your most generous pledge to this website– I am greatly honored by your support and readership. |

Thank you |

, Ric F. ($1/month), for your very generous pledge to this site– I am considerably honored by your assistance and readership. |