When we lose small companies, we lose More than tax profits.

Small businesses receive lots of lip service but extremely little appreciation– up until they’re gone. Already it’s too late to do anything however mutter, “you do not know what you’ve got until it’s gone.”

Small companies aren’t simply sources of tax earnings, they’re sources of a large range of tasks that can’t be changed by Corporate America or the federal government. Simply as importantly, small business owners and business owners are advocates for the neighborhoods, districts and cities they depend on for clients and suppliers.

The livelihoods of the owners and their employees depend on maintaining the viability of their neighborhood/ district/ city, that includes public safety and services such as transport and garbage collection, and a minimum density of other private-sector services and features which provide homeowners a safe, enticing atmosphere worth checking out.

59.9 million Americans operate at small companies across the nation. An approximated 47% of Americans store at small companies a minimum of twice a week, producing about 45% of the nation’s financial activity. According to the most recent readily available numbers from the U.S. Census, around 47% of U.S. workers work for small businesses, compared to 54.5% in 1988.

Small business entrepreneurs are running the risk of whatever they need to open and run a business. They have even more skin in the video game than city functionaries charged with enforcing regulations and gathering business-related costs or their employees, who have the freedom to quit and seek employment in other places.

Citizens tend to feel helpless to stop the decay of their community safety, services and facilities. They attempted calling their elected authorities or local functionaries and were given a worthless feel-good reply which everyone included understands is empty.

Small company owners are more happy to use meaningful pressure due to the fact that they know the decay follows a sobering slide in which incremental declines accumulate and ultimately set off a phase modification in which the character of the neighborhood/ district/ city discusses a cliff nobody discerned: minor crime boosts, leading the way for more major criminal offenses to multiply; clients thin out and after that become limited, and the zeitgeist goes from friendly to wary to unforeseeable or even dangerous.

The core attribute of neofeudal economy and society is that it’s two-tier: there are two tiers of “criminal justice,” one of wrist-slaps and vast white-collar criminal activities ignored for elites and the wealthy, and another even more harsh and Kafkaesque for the rest of us.

In regards to commerce, Huge Tech is complimentary to establish monopolies and Finance escapes all the expected regulatory safeguards, while small company is throttled with endlessly multiplying minor regulations that have little or nothing to do with public security or employee labor rights. Corporate America has the immense wealth and power to gut any guidelines it finds burdensome, however small company has a hard time to pay the soaring costs of compliance and the tripling of junk charges such as company license renewals.

City-provided services break down but the expenses for the opportunity of doing business triple.

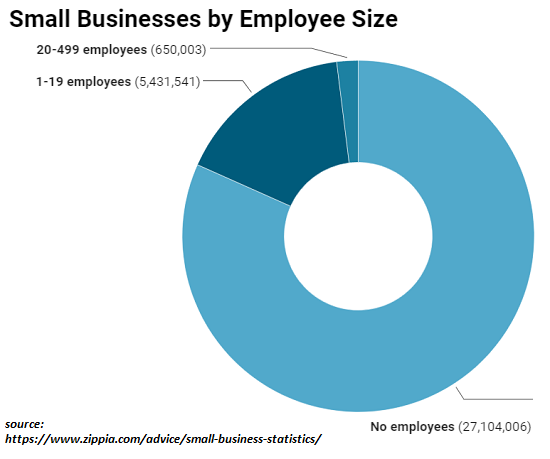

The majority of small companies are sole owners. (see chart below) Much of these are online or at-home business that are invisible to locals strolling down the walkway. The 5.4 million small companies with less than 20 staff members are noticeably substantial to the practicality of bricks-and-mortar community commerce.

Demographics play a big role in the practicality of small businesses. About 40% of all small companies are owned by Boomers nearing retirement or currently past the age of normal retirement. It won’t take much in the way of losses or tension to nudge these owners into selling or closing business.

However if conditions are decaying, who’s going to purchase a having a hard time organization? The grim reality is “no one.” Owners are already working long hours and withstanding high levels of tension. This self-exploitation can only presume before the owners’ health and/or financial resources break down in burnout or losses.

Municipal administrations tend to see small company tax donkeys as something they can rely on similar to a gushing spring. Ought to one tax donkey collapse and close an organization, another tax donkey will magically appear to pick up the self-exploitation harness and start a new organization in the same space.

Local-economy boosters love to mention the flood of new company applications as evidence the spring is still gushing, however much of these brand-new enterprises are sole proprietorships without any storefront existence and no workers. Many brand-new companies that flourished in the post-pandemic boom will soon come across the headwinds of recession for the first time, and many will discover their business blown onto the unforgiving rocks of monetary losses.

The phase-change shift in the character and zeitgeist of communities, districts and cities is challenging to reverse. Once people no longer feel safe, they will not return. As soon as the empty stores and homeless encampments control the landscape, they will not return. As soon as services degrade and trash builds up, they will not return.

Municipal bureaucracies are largely staffed by people who have actually never ever experienced what a real recession (such as 1981-2) can do to commerce, tax incomes and small companies having a hard time to endure. They’re confident that history shows any slump will be quick and the tax donkeys will look like normal to fill the empty stores, lofts and offices.

However this time will be various. No brand-new tax donkeys will appear to gamble their fortunes and lives on starting a stupidly expensive-to-operate service, pay prevailing incomes and advantages and all the taxes, licenses and junk charges municipalities have piled on small business.

When we lose small businesses, we lose more than tax profits. We lose the engines of employment and the industrial foundation of neighborhoods and districts. When these structures fall apart, those residents who see the slide down the domino effect of decay sell their houses and get out while the getting’s excellent. Those who remain will regret their inaction.

Tax donkeys do not appear by magic. There has to be an infrastructure in place that enables a real chance to scrape out a living despite the high costs and formidable obstacles. If the infrastructure and character of a location decay, so does the chance, and small companies merge air when it’s longer worth the struggle.

New Podcast: Its a Waterfall-Danger, Security & Productivity(48 minutes) My new book is now available at a 10 % discount rate($8.95 ebook,$ 18 print): Self-Reliance in the 21st Century. Read the very first chapterfree of charge(PDF)Read excerpts of all 3 chapters Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 minutes)My

recent books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the first area for free(PDF)Worldwide Crisis, National Renewal: A(Revolutionary )Grand Method for the United States(Kindle$9.95, print$24, audiobook)Read Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet(Kindle$ 8.95, print$20, audiobook$17.46)Read the first area free of charge(PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Distressed World

(Kindle $5, print$10, audiobook) Check out the very first area for free(PDF). The Experiences of the Consulting Thinker: The Disappearance of Drake

(Unique)$4.95 Kindle,$ 10.95 print); checked out the very first chapters free of charge (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Read the very first area free of charge Become a$1/month patron of my work through patreon.com. KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail stay personal and will not be offered to any other private, business or firm. Thank you, Thomas W.($50), for your splendidly generous contribution to this site– I am greatly honored by your support and readership. Thank you, David A. ($ 50 ), for your magnificently

generous contribution to this website– I am greatly honored by your support and readership

. Thank you, Thomas H. ($10.80), for your most generous contribution to this site– I am greatly honored by your support and readership . Thank you, Robert W. ($15)

, for your incredibly generous contribution to this website– I am greatly honored by your support and