The global risk premium has increased drastically and is increasing in an unforeseeable arc. This structural pattern of higher dangers will reprice everything.

The international economy is changing in basic methods, and this is repricing whatever: the cost of money/credit, the rate of assets, the worth of hedges and insurance coverage, and so on. The core chauffeur in all this repricing is danger, for it’s the reappraisal of threat that forces the repricing of everything.

When danger is low and transparent, the danger premium is low and this is reflected in low, stable expenses. When risk skyrockets and is challenging to examine, the threat premium rises and this presses costs higher.

In terms of property assessments, greater threats reprice possessions greater or lower based upon the threat profile: what occurs to the possession if liquidity dries up in a risk-driven crisis? If credit dries up, what occurs to require for the asset?

Danger tends to be self-reinforcing. If we look around and see everyone else is confident that danger is theoretical rather than genuine, we stop purchasing hedges against bad things taking place, and we pay a premium for assets that do well in low-risk ages.

However if we see other individuals getting defensive– selling possessions, paying down debt, decreasing costs and risk-on investing– then we pull in our horns, too.

What changed?

The worldwide economy began a cycle in the early 1990s of declining danger throughout the system due to these risk-reducing modifications:

1. The dissolution of the USSR and completion of the hyper-expensive, heightened-risk Cold War.

2. The flood of low-cost oil as all the super-giant fields found in the 1970s started peak production.

3. China emerged as the low-cost “workshop of the world,” allowing thirty years of skyrocketing corporate profits as corporations decreased costs by offshoring production to China.

4. This offshoring boosted revenues while deflating the expenses of production due to much lower labor costs, lax/ non-existent ecological requirements and Chinese manufacturers’ willingness to accept razor-thin earnings margins.

5. The reduction in international risk and the deflationary effect of Globalization (offshoring and opening brand-new markets) made it possible for central banks to lower rates of interest for 30 years without stimulating inflation and private-sector banking/lending to broaden credit and take advantage of, effectively globalizing/ commoditizing financial instruments that hedged risks (Financialization).

6. After a decade-long lag (the 1980s), the advances in individual computing, software application and desktop publishing finally began generating performance increases.

7. The economic faith of Neoliberalism was embraced globally. Neoliberalism declares “markets fix all problems” therefore the universal option is to turn whatever into a market by decreasing policies and state oversight.

All of these forces tended to limit rates of products, goods and services and lower systemic threats while expanding markets, financial “innovations” and earnings. This created a global “virtuous cycle” in which each vibrant strengthened the others.

This “virtuous cycle” ended in the 2008-09 Global Financial Disaster, but was papered over for a years by extreme policies:

1. China launched the biggest credit expansion in history (Russell Napier’s expression) to counter the meltdown

2. The Federal Reserve and other reserve banks began a policy of monetary repression (i.e. centrally handling financial markets instead of let market forces determine liquidity, cost, risk, etc), leading to Zero Rates of interest Policy (ZIRP) that was efficiently negative-rates since inflation continued sputtering along at 1.5% tp 2%.

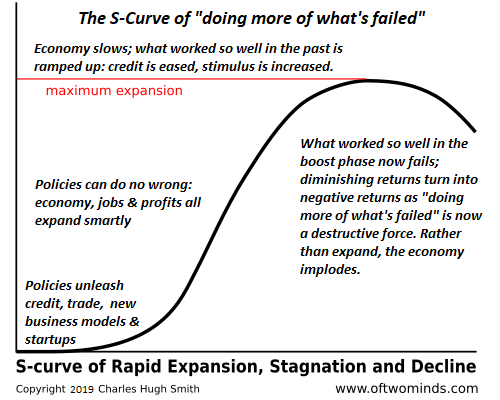

Why did the “virtuous cycle” end? The standard response is diminishing returns: the returns on any brand-new policy or dynamic such as Neoliberalism, globalization or financialization follow an S-Curve, where the initial returns are stupendous (the boost phase) and after that as the characteristics end up being common, the returns diminish until they stagnate. At that point, the system decays unless brand-new more extreme procedures are used– for example, China’s debt to GDP ratio doubling from 140% to 280% and rates of interest being reduced to absolutely no.

Another factor is the cannibalization of domestic markets when globalization had skimmed the simple returns. Financialization starts out looking “ingenious” by declaring it can hedge all risks at low expense, efficiently decreasing the risk of playing financial games to absolutely no. As Benoit Mandelbrot and other described, this isn’t possible for structural/mathematical reasons (markets are naturally fractal and prone to instability),

As the simple gains lessen, financialization takes properties that were once low-risk and commoditizes them into “instruments” that can be offered worldwide, suppressing the presence of danger with deceptive packaging. This is what took place to home mortgages, which went from being extremely managed and low-risk to being badly regulated/ fraudulent and packaged into highly misleading mortgage-backed securities that masked the true threat– high– behind flim-flam claims of low threat.

As costs increased in China and other producing countries, labor costs started increasing, along with higher taxes and some efforts to reduce the choking air pollution and poisoned water/soil that undoubtedly arise from unchecked industrialization.

Suppressing the expense of capital/credit to near-zero created a tsunami wave of obtained capital, both within the banking sector and the ballooning non-banking (shadow banking) sectors. This low-cost credit was then released into worldwide markets to chase after any high-yield investment, which naturally implies gambling on dangerous properties while apparently hedging the bets versus losses.

All this financial engineering– ZIRP, inexpensive, abundant credit, the chase for yield– ultimately depends on liquidity, i.e. the presence of buyers in size to produce a market for anyone who seeks to sell a possession. If liquidity dries up for whatever reason– a bank crisis, a market panic, and so on– then sellers run out of buyers and the marketplace reprices the asset at lower and lower levels till purchasers emerge. In a collapsing-liquidity market, there are few buyers at any rate.

The prospective wipeout of “wealth” i.e. asset appraisals would lower the entire global monetary system, for all those assets are security for the world’s enormous mountain of credit/debt.

The evaporation of liquidity in 2008-09 is what previous Fed Chairman Alan Greenspan recognized as the risk he did not prepare for.

So what changed around 2007-09? Globalization and Financialization moved from “virtuous cycle” to stagnation/ decrease, policies became more extreme to bury rising systemic risks, and the addition of a billion new workers desiring all the commodity-consuming luxuries of the middle class lifestyle took in surplus production of oil and other products. With surpluses gone, costs needed to begin increasing.

Post-Covid lockdown and healing, China’s policies changed from “available to the world” and “tranquil increase” to aggressive militarization and territorial claims and the constraint of Chinese society’s access to the outdoors world.

All of these factors exposed the threats that had been successfully obscured: the dangers that global supply chains can break down or be disrupted by geopolitics; the danger that financialization video games can explode; the threat that Neoliberalism stopped working to suppress risks of scams and exploitation; the dangers that soaring financial obligation outpaces expansion of the real-world economy, producing debt crises, and the dangers of severe policies producing unintentional consequences (moral threat, extreme risk-taking, excessive financial obligation, etc) and blowback (re-industrialization, trade wars, and so on).

On top of these dangers, there are now demographic, capital, labor and resource sources of dangers. Geopolitical stress are increasing, which is traditionally typical in ages where essential products end up being scarce and/or not available/ pricey. This is incentivizing re-industrialization, reshoring, friendshoring, and so on, all of which are national-security problems focused on lowering reliance on rivals or risky supply chains.

In effect, the nation-state has to take the motorist’s seat from quasi-deregulated markets, the Neoliberal ideal. In truth, decontrolled is the happy-story codeword for centrally managed to benefit the couple of at the expenditure of the lots of.

This re-industrialization is also driven by the transition to non-hydrocarbon energy sources, a goal that will require far more capital than most expect even as it underperforms impractical expectations. The demand for trillions in brand-new investment will push credit for intake (brand-new homes, cars, getaways, etc), pushing the expense of credit higher regardless of any other conditions.

In the previous decade, birth rates in many established and establishing economies have cratered while the labor force ages and goes into retirement. Both of these advancements indicate pension and social welfare programs launched when there where 5 employees for each senior citizen are no longer sustainable now that there are only 2 fulltime employees for every retiree/recipient of social well-being.

The decrease of the workforce also introduces two other dynamics: prospective labor scarcities and the stagnancy of demand, as older people consume far less than new households having kids. As marital relationship rates and birth rates plunge, so do the prospects for consumption-driven financial development.

The policy extremes of ZIRP, moral danger, credit growth and the chasing of yields has actually inflated The Everything Bubble which has put the price of housing and automobiles out of reach of the bottom 60% (or in numerous areas, the bottom 80%) of households.)

This rising inequality erodes social cohesion and cultivates an alternative lifestyle in which young employees opt out of the rat race to obtain an upper-middle class income and wealth. This lessens the swimming pool of possible purchasers of all the overpriced assets, further minimizing liquidity on a demographic/structural basis.

Put simply, the increasing tide of wealth and earnings hasn’t raised all boats. The leading 5% have garnered the vast bulk of the gains in asset appreciation, capital gains and revenues. This produces a background of increasing risk of social disorder.

On top of all this, thirty years of moderate inflation have reversed into a period of sustained inflation, which in spite of the hopes of lots of commentators, will not be temporal. This period of inflation is driven by: 1. Excessive financial obligation levels that can just be handled by pumping up the financial obligation down to workable levels 2. Deficiencies of essentials which push costs above what consumers can manage while not being high enough to money massive brand-new investments needed to increase supply. 3. The cost of capital must rise to show the rising risk premium globally.

All the tricks released to restore self-confidence in 2008-09 have actually reached such extremes that now systemic threat— of default, conflicts, broken supply chains, geopolitical blackmail, scarcities of important products and possibly the least understood danger, the evaporation of liquidity as credit and buyers of risk-on assets become limited–is increasing significantly.

These dangers are difficult to assess or hedge completely, and the inter-dependence of the global economy and financial system– a firmly bound system– imply risk in one area quickly infects the rest of the system.

This structural increase in systemic dangers raises expenses and changes the risk-reward computation on every property.

Take real estate as an example. When we’re confident real estate will increase 30% every years like clockwork, we’ll pay today’s rates with the expectation that the house will gain 30% in the coming decade. But as the monetary danger premium increases, and we need to consider the danger that your house might lose 30% of its value going forward, we become wary of paying today’s high cost.

As others also end up being careful, the recognition of risk reinforces itself and as costs drop, our wariness increases and we decide to wait till the threats of further decline ended up being clearer.

The issue with examining threat is the complete threats are never clear up until it’s too late.

Whatever is being repriced, including danger, the cost of capital and labor and the value of all properties. This repricing is currently modest, but as dangers manifest, we can prepare for an acceleration of repricing. If liquidity dries up– buyers for houses and stocks all of a sudden withdraw from the market– the rate declines can be dramatic and self-reinforcing.

In a system preserved by ever-greater extremes, confidence deteriorates very rapidly once the next extreme stops working to move the needle. At that point, all bets are off due to the fact that self-confidence in the policymakers’ capability to “conserve the day” disappears. And when self-confidence vanishes, so does liquidity. As soon as markets are illiquid, the issue isn’t restricted to the decreasing appraisal–the genuine problem ends up being finding a buyer who will allow you to transform the property into cash.

The worldwide danger premium has actually increased dramatically and is increasing in an unpredictable arc. This structural pattern of higher threats will reprice everything.

This will produce repercussions and opportunities which I go over in my books Global Crisis, National Renewal and Self-Reliance in the 21st Century.

This essay was drawn from my Weekly Musings Reports sent out exclusively to customers, customers and Substack subscribers. Thank you very much for supporting my work.

New Podcast: Charles Hugh Smith on Preparing for a Genuine Economic crisis (38 min) (38 min)

My new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

My new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

Check out the very first chapter free of charge (PDF)

Read excerpts of all 3 chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 minutes)

My current books:

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Check out an excerpt totally free (PDF)

When You Can’t Go On: Burnout, Numeration and Renewal $18 print, $8.95 Kindle ebook; audiobook Check out the very first section totally free (PDF)

Worldwide Crisis, National Renewal: A (Revolutionary) Grand Method for the United States (Kindle $9.95, print $24, audiobook) Check Out Chapter One totally free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World (Kindle $8.95, print $20, audiobook $17.46) Read the very first area free of charge (PDF).

Will You Be Richer or Poorer?: Revenue, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Check out the first section for free (PDF).

The Experiences of the Consulting Thinker: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Cash and Work Unchained $6.95 Kindle, $15 print) Check out the very first section for free

Become a $1/month client of my work via patreon.com.

Register for my Substack totally free

NOTE: Contributions/subscriptions are acknowledged in the order got. Your name and email remain confidential and will not be given to any other specific, business or firm.

|

Thank you, Suzanne S. ($70), for your monumentally generous contribution to this site– I am greatly honored by your steadfast support and readership. |

Thank you |

, John G. ($5/month), for your most generous pledge to this site– I am significantly honored by your support and readership. |

|

Thank you, Allan H. ($10/month), for your outrageously generous pledge to this site– I am greatly honored by your unfaltering support and readership. |

Thank you |

, Daniel T. ($1/month), for your most generous promise to this website– I am significantly honored by your support and readership. |