For a while now we have stated that the sustainable trend is mostly an adverse effects of ultra-cheap money and low inflation. Well, it appears the chickens are now coming house to roost. According to The Guardian:

From the short article: However relying on central bank rate rises in the existing circumstance is folly for another factor: the truth of the climate crisis, which now significantly complicates the task of central banks and policymakers. One reason is apparent: greater rate of interest significantly decrease the renewable resource shift. This occurs in 2 methods.

Initially, recently used renewable energy innovations, which have fairly large front-loaded expenses, are more competitive (relative to the currently installed nonrenewable fuel source innovations) just when interest rates are low.

Engineering research studies show that the levelized expense of electricity (LCOE) of solar photovoltaics (PV) and wind onshore will increase by 11% and 25%, respectively, if rates of interest are 4-4.5% (instead of around zero). Investments in brand-new renewable energy capacity are hence only practical if market prices permit them to earn their complete LCOE.

Price quotes by the International Energy Agency suggest that the LCOE of a gas-fired power plant would increase by about 4% if rate of interest were to increase from 3% to 7%, whereas that of overseas wind and solar PV (utility scale) could rise by more than 30%.

Financial investment in renewables has fallen considerably over the last number of years, but is this adversely correlated to the rise in the expense of capital or simply a “coincidence?”

We think that the expense of capital will continue to rise. 3.6% on the United States 10-year is nothing. It might be argued that 6% is reasonable (and that only gets you back to 2000 levels). We do have to wonder what the United States 10-year yield will be when oil breaks $100?

Notice how “worldwide warming” transitioned into “climate change, “which is now increasingly called the”climate crisis. “This, folks, is NLP (neuro linguistic programming). It is likewise something else. Nonsense!

Hydrogen: All Costly Talk

There has actually been a great deal of speak about hydrogen. What everything boils down to is expense, it stays just far too pricey compared to oil and gas.

It seems that substantial relocation we saw in hydrogen stocks in the five years leading up to the start of 2021 was simply a sign of the growth theme (or whatever it was). Hydrogen stocks peaked when the ARK Development ETF (ARKK) peaked.

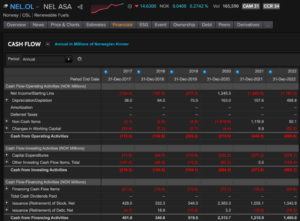

We keep in mind that hydrogen stocks continue to lose money and only exist due to the fact that of consistent equity capital injections. Nel is a great proxy for the market– look at the third to last row “issuance (retirement) of stock.”

Meanwhile, Offshore Rigs Are at Discount rate You could say that the offshore drilling sector is still priced as if we won’t be requiring too many drilling rigs come 2030. Have a look at this:

We doubt that the market cap of overseas oil drillers will trade near the replacement cost of rigs. Nevertheless, an 85 %discount rate to replacement expense suggests that there is a big margin of safety which over the long-term it will be difficult to lose cash by purchasing a basket of overseas oil drillers.

In Case You Wondered How Low the Oil Stock Is …

We discovered this chart– not something that is anything new however nonetheless it is an excellent suggestion.

Taking a look at the circumstance in the US (which would be a huge part of the chart above), stock is at the very same level as 1985. Ain’t that something!

Now, here is a brain wave: taking a look at United States crude inventories relative to United States month-to-month consumption of oil, it is about the most affordable (relative to oil consumed) as it remained in 2000. If records returned far enough, we might well find that there hasn’t been a period in a couple of generations where stock levels were this low relative to the level of oil consumed.

We don’t understand if this has any direct effect on the price of oil under typical situations, but include a geopolitical conflict or 2 in the right spot and select a price as to how high oil will go as there isn’t any margin for security. Mr, Biden and your administration, we like you!

Yet, it is remarkable how oil has remained relatively high even in the face of extremely bearish belief.

Money managers that trade derivatives connected to oil and fuel prices have to do with as bearish as they have actually remained in more than a years, suggesting they’re braced for an economic downturn that might trigger agreements from crude to jet fuel to take another tumble.

The trading positions of non-commercial gamers such as hedge funds are near the most bearish levels given that a minimum of 2011 across a mix of all major oil agreements. And in bets that are maybe most a sign of economic downturn expectations, speculators’ combined views on diesel and gasoil– fuels that power the economy– are near the most bearish levels given that early in the Covid-19 pandemic.

There is nobody sign that we count on 100%. Nevertheless, the charts listed below are very fascinating. How can sentiment be even worse than the worst of 2020 or completion of 2015? Either we are missing out on something or the next huge move for oil is up!

The marketplace is informing us oil is not required. I hope the marketplace is right because fortunately we think we have the ideal response. We can burn all the political leaders. We’ll be reducing carbon emissions and “saving the planet” in more ways than one.

Editor’s Note: The Western system is going through significant changes, and the signs of moral decay, corruption, and increasing debt are difficult to disregard. With the Great Reset in movement, the United Nations, World Economic Online Forum, IMF, WHO, World Bank, and Davos male are all promoting a combined agenda that will affect us all.

To get ahead of the turmoil, download our complimentary PDF report “Clash of the Systems: Thoughts on Investing at a Distinct Point in Time” by clicking here.