Unanticipated things tend to happen when the real source of issues are papered over and then all of a sudden reality intrudes.

What an intriguing juncture we have actually reached. We’re continuously guaranteed all is well with what matters– the economy– as the all-powerful Federal Reserve has handled not simply the hoped-for “soft landing” however a revival of growth: yowza, no economic downturn.

The list of good things stands out: unemployment is low, incomes are increasing, the wealth result from explosive increases in real estate costs has actually fattened the house equity of homes and the soaring stock exchange has actually pressed the economy to giddy heights of wealth and confidence.

The area of bother with inflation has actually declined and everybody prepares for rate of interest will soon follow inflation back towards no. China has gotten in a rough spot but it will not affect us. And so on.

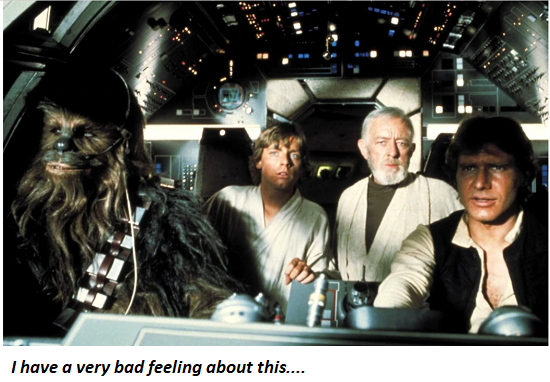

In spite of all this consistently great news, something about the scenario is setting off alarms: I have a really tension about this.

Possibly the root of the sensation that danger is far closer than we determine is the universal confidence that finance can constantly fix any and all real-world problems. Whatever the problem, reserve banks can solve it by decreasing interest rates and flooding the monetary/ banking system with liquidity, i.e. monetary alleviating, making it simpler and cheaper for business and homes to obtain more money.

On the government-spending side, the main state can repair any and all issues by borrowing and spending nevertheless many trillions are required– fiscal stimulus.

To put it simply, we do not require to suffer any bothersome sacrifices or systemic modifications, we just need to borrow more and invest more. This is certainly a tidy service to all issues: borrow more and spend more. Whatever in the real world can be repaired with monetary and financial relieving and stimulus.

What’s interesting about this option is there is no feedback at all: it’s a clean trajectory: borrow and invest more, and real-world problems go away. There is never ever any feedback from the real-world– for example, borrowing and costs don’t in fact fix the problem— nor exists any consequence for continuously obtaining more and spending more: we can keep borrowing and spending more with no limit or effect.

But does this confidence in monetary fixes actually map reality? In real lived experience (instead of pleased stories and cherry-picked information), there are problems that aren’t resolved through obtaining more and investing more, and consequences of borrowing more and investing more.

But the real-world effects of counting on finance to fix everything are offered brief shrift in the “everything’s wunnerful” stories and policies. In the real world, flooding stopping working systems with trillions in obtained money doesn’t actually fix issues, it makes them worse– much even worse. Experts are incentivized not to fix the issues however to skim the “totally free money” and keep the problem active, so the ‘complimentary money” keeps streaming.

Throwing more money at the issue generates decreasing returns and unintentional consequences as the limitless flood of “free cash” distorts rewards and snuffs out the discipline of deficiency required to require actual options instead of paper them over with PR.

Complexity is easily included– more layers of management, more compliance, more guidelines– and tossing more cash at this source of ineffectiveness and decomposing productivity only causes it to expand even more.

Then there’s the funny thing that features loaning: interest payments. The more we borrow, the mnore interest we need to pay as the hill of debt grows into a magnificent mountain. This increasing cost of debt service crowds out other spending, requiring us to borrow much more (perish the idea of tightening our belts and cutting costs!) and to invest less and consume less.

Simply put, counting on obtaining more so we can spend more eventually makes us poorer. That’s difficult, of course, because all this borrowing and spending is “investment” that amazingly “grows the economy” so we “grow our way out of debt.” It’s a very pleasant idea, however as the borrowed cash increasingly goes to paying interest and consumption instead of investment in performance, the economy stagnates rather than grows.

The “one unusual technique” to resolve this problem is to lower interest rates to near-zero so financial obligation service takes only a modest slice of income. But all this ever-expanding loaning more and spending more eventually produces inflation, i.e. money and incomes lose acquiring power. As soon as inflation emerges from its sleep, the “one strange technique” goes from being an option to the source of the problem.

Then there are the perverse incentives generated by reliance on simple cash and deficit spending: credit-fueled asset bubbles pump up as most of this “free money” streams to the top of the pyramid, where the top 10% use the affordable money to purchase properties that will increase in worth as more and more stimulus is discarded into the economy. As possessions skyrocket in worth, the not-yet-wealthy are outbid and left in the dust as neofeudal serfs.

This asymmetric circulation of the alleviating and stimulus straps a rocket booster under wealth and income inequality. Because those who’ve ended up being much, much richer run the economy, this strikes them as a remarkably favorable outcome.

However underneath the happy-story surface (considering that I’m doing fantastic, everyone should be doing fantastic), skyrocketing wealth and earnings inequality is dismantling the structures of society: the social agreement, the ladders of upward mobility, the legitimacy of the government and financial system (it’s all rigged to benefit the couple of at the expense of the many), and the authenticity of the media and organizations that are expected to be unbiased (if we inform you whatever’s wunnerful, then think us, because your compliance advantages us.)

The rich not only get richer and the slice of the wealth owned by the poor shrinks, ethical risk is enhanced: because there will always be more “complimentary money” available, there’s no reward to restrict risk, as the consequences of higher threat will constantly be balanced out by more reserve bank/ central state “conserves,” stimulus, backstops, etc.

So go on and make incredibly risky bets, and utilize up those bets: if you win, the earnings are yours to keep (with a piece deducted for taxes, obviously); and if you lose, the Fed and/ or government will bail you out. What’s not to like?

These distortions end up being problems that obtaining more and investing more just speed up. The supposed “service” ends up being the “problem” that the “service” can not solve.

Unanticipated things tend to take place when the real source of issues are papered over and then unexpectedly reality intrudes. Something that constantly surprises the leading 10% who own 90% of the income-producing possessions is markets unexpectedly crashing after years or years of lofting greater on the limitless reducing and stimulus. After all, everyone understands that possessions never ever decrease for long, they only loft higher.

This holds true till the relieving and stimulus that pumped up the possessions end up being the issue. The feedback loops that were overlooked or lessened with financial hoax suddenly ended up being self-reinforcing, and all the tricks that worked for years now push the system into instability and disorderly collapse.

So by all means, keep supreme confidence in the empire of financial obligation and deceptiveness and its one “service,” obtain more, spend more. A few of us have an extremely tension about this, and we’re no longer kneeling at the altar of the Fed or mumbling prayers to the incorrect idols of relieving and stimulus. When the idols fall, the world they supposedly rule crashes around them.

An economy that’s dependent on financial “repairs” is fatally misshaped. Beneath the artifice, it has lost the capability to actually resolve real-world problems.

My new book is now available at a 10 % discount($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the first chapter totally free(PDF)Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 minutes)My

My new book is now available at a 10 % discount($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the first chapter totally free(PDF)Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 minutes)My

current books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the very first section totally free(PDF)Global Crisis, National Renewal: A(Revolutionary )Grand Technique for the United States(Kindle$9.95, print$24, audiobook)Read Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing World(Kindle$ 8.95, print$20, audiobook$17.46)Check out the first section for free(PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Shocked World

(Kindle $5, print$10, audiobook) Check out the first section for free(PDF). The Experiences of the Consulting Theorist: The Disappearance of Drake

(Unique)$4.95 Kindle,$ 10.95 print); checked out the first chapters free of charge (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Check out the very first section free of charge End up being a$1/month patron of my work via patreon.com. Subscribe to my Substack

for free NOTE: Contributions/subscriptions are acknowledged in the order got.

Your name and e-mail remain confidential and will not be provided to any other private, business or agency. Thank you, Michael D.($50), for your splendidly generous contribution to this site– I am significantly honored by your unfaltering assistance and readership. Thank you, Barry W.($5/month), for your marvelously generous subscription to this website– I am greatly honored by your steadfast assistance and readership.