MicroStrategy Chairman Michael Saylor recently said, “The window to front-run institutional demand for Bitcoin is closing.”

He’s definitely right.

BlackRock, Fidelity, Schwab, Citadel Securities, and other big organizations are making huge relocations into Bitcoin.

With almost $10 trillion in assets under management, BlackRock is the world’s biggest possession manager.

Larry Fink, the CEO of BlackRock, had an exceptional turn-around concerning his views of Bitcoin.

After years of dismissing and denigrating it, Fink recently called Bitcoin “an international property” to hedge versus currency debasement that might “digitize gold” and “change financing.”

BlackRock has declared an area Bitcoin ETF. BlackRock has an ETF approval track record of 575-1, so it is most likely a matter of time prior to their spot Bitcoin ETF is authorized and potentially others. That would open the floodgates for certain large pools of capital– like standard retirement accounts– that would be otherwise unable to buy Bitcoin.

Let me be clear. I am no fan of Fink, BlackRock, and the wicked agendas they press.

Frankly, I wish to see BlackRock go bankrupt and Fink clean toilets to earn a living.

However, it is very important to keep in mind that Bitcoin is an apolitical, open, permissionless monetary network readily available to anyone and controlled by none. Nobody can be avoided from utilizing Bitcoin.

Bitcoin is for everybody, consisting of people you do not like.

Some fret that BlackRock might alter Bitcoin somehow, but that is unfounded.

Remember, no one can alter Bitcoin’s procedure– not even Elon Musk, Jeff Bezos, the Chinese federal government, the US federal government, or any of these powerful entities integrated.

Even if Satoshi Nakamoto– Bitcoin’s anonymous cypherpunk developer– returned after vanishing in 2011, he might not change Bitcoin.

The Blocksize Wars, which culminated in 2017, is proof.

That’s when a frustrating bulk of the Bitcoin miners (mainly based in China)– and other prominent insiders and large business– attempted to get together and change Bitcoin’s procedure to increase the block size.

Although they represented most Bitcoin miners, a few of the most effective experts, prominent influencers, and big corporations, their tried hostile takeover was an abysmal and humiliating failure.

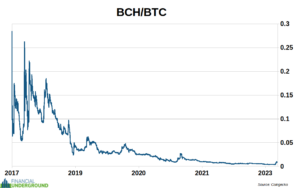

Rather of requiring a harmful change in Bitcoin– as they preferred– they simply produced a significantly worthless knock-off called Bitcoin Money.

Recently, the market cap of Bitcoin Cash (BCH) was less than 1% of the real Bitcoin’s (BTC) and is trending towards 0%.

I would not worry excessive about BlackRock attempting to make an “ESG Bitcoin” or otherwise changing it.

Even if they were absurd enough to do so, I doubt it would be more effective than Bitcoin Cash.

Another stress over BlackRock is that they will manipulate the Bitcoin rate by developing more claims on it than what actually exists.

They might offer some phony paper Bitcoin, but it would fail amazingly and be self-destructive.

Expect somebody like BlackRock wants to manipulate the price of an asset by producing more claims on it than what in fact exists.

Taking physical delivery of the underlying property would be one way to expose the scams.

If there are more claims than really exist, asking for physical shipment will reveal it because the shipment will stop working.

Think of taking physical shipment like calling the manipulator’s bluff.

It’s challenging to take shipment of physical commodities traded on large exchanges, which opens the door to developing more claims than really exist. It’s hard to call their bluffs.

Nevertheless, with Bitcoin, taking delivery is as simple as sending an email.

If anyone is idiotic enough to create more claims to Bitcoin than actually exist, revealing the fraud will be a lot easier than with other properties.

If BlackRock or some other entity attempts this stunt, consider it a present. You’ll be able to collect more Bitcoin at artificially lower costs until their Ponzi Scheme inevitably blows up.

Here’s the bottom line.

BlackRock’s gigantic shift on Bitcoin shows that big institutions could quickly flood in.

It’s a powerful prospective tailwind for Bitcoin.

I believe we might be on the cusp of Bitcoin’s next benefit surge.

That’s why I’ve simply released an urgent PDF report revealing 3 important Bitcoin strategies to guarantee you prevent the most typical– often fatal– mistakes.

Inspect it out as soon as possible because it might soon be far too late to take action. Click on this link to get it now.