Economists and experts steer well clear of the eventual social and political effects of America’s entrenched neofeudal wealth-income inequality.

Economic experts and pundits are falling all over themselves to state the US is downing along splendidly, and to reveal their aggravation with the general public for their curmudgeonly lack of enthusiasm. For instance: If this is a bad economy, please inform me what a good economy would appear like We need to acknowledge that things are working out, even as we continue to search for issues to solve and How the Recession Doomers Got the U.S. Economy So Incorrect.

My objective is not to slam Noah Smith or Derek Thompson. I follow their work and gain worth from their analysis.

The point I want to make is we just manage what we determine, and the dependence on statistics that are excessively broad and quickly distorted/gamed results in generalizations that disregard substantial domino effect: we are deceived by excessively broad and easily distorted/gamed statistics and enlightened by taking a look at what is not determined or determined improperly.

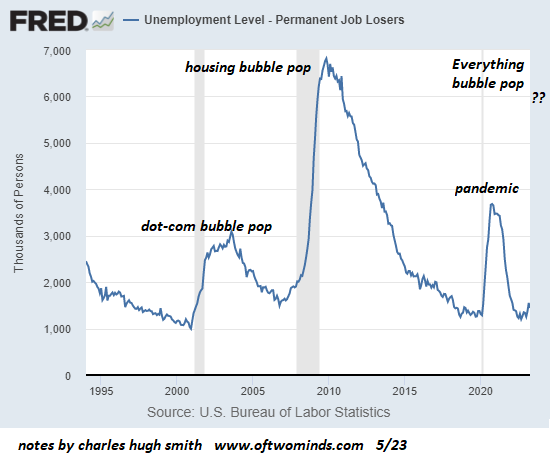

The agreement holds that inflation is decreasing rapidly and joblessness stays low, so the economy is doing excellent. Please glimpse at Chart # 1 listed below to see what excites the mainstream: the joblessness rate is near historic lows.

But this procedure excludes a good deal of consequential elements. It’s popular that the unemployment rate is distorted/ gamed by neglecting everyone who is in the workforce but not “actively seeking work.” So what does this main unemployment rate in fact measure? Not the portion of the workforce that works.

Nor does it measure underemployment– those working far listed below their capacity– or job insecurity or the percentage of workers being pressed into burnout– all substantial reflections of the real economy. All of these are potentially causal factors in why US performance has fallen so drastically.

And speaking of efficiency, that’s the supreme source of prosperity– not speculative bubbles or debt-binging. If performance is tanking, ultimately there are unfavorable economic consequences that will be dispersed to some sections of the populace, most likely asymmetrically.

Such a broad-brush measure likewise disregards the effects of demographics. Please look at chart # 2 below, of the 55 and over population and labor force. Note that essentially all the 20+ million jobs the US economy added in the previous two decades remain in this older labor force, which is naturally steaming gradually into retirement, even as the portion of this cohort who continues working has actually skyrocketed.

In other words, practically all the task development is the result of older workers working longer. Yes, 70 is the brand-new 50, however attempt doing the same work at 70 that you did when you were 50. Sure, some individuals bypass retirement since they like their work so much, however we don’t measure how many are still working because they have to for pushing financial factors.

Have you observed the age of service employees and proficient employees just recently? Do you reckon they really love working at Burger King so much that they’re doing it for satisfaction?

What if we determined financial pressures and job insecurity rather than risibly bogus “unemployment”? Would the economy still look so wonderful and resistant?

Chart # 3 shows that practically all the population growth ahead is in the accomplice of older workers 65+ years of ages heading into retirement. So the labor force is rapidly aging and the unmentioned/ unexamined assumption is 10s of countless brand-new workers will get in the workforce with the same abilities, motivation, devotion and worths as the 10s of millions retiring.

But the demographics just do not support this breezy assumption. Now look at chart # 4 which portrays the remarkable rise in the number of employees who are now disabled. The reasons for this are being debated (the pandemic undoubtedly plays a role), but 2.5 million employees leaving the labor force in a couple of years is something that might be consequential if the pattern continues. A presumption that this is a one-off is unwarranted until proven otherwise.

Once again, demographics, performance and factors such as special needs and burnout are not part of the joblessness, GDP and inflation steps presently being promoted as proof of financial nirvana.

Item # 1 of what’s not even determined is the crapification of goods and services. I addressed this in The “Crapification” of the U.S. Economy Is Now Complete (February 9, 2022) and Stainless Steal (February 26, 2023).

How do we measure the “inflation”– i.e. a loss of acquiring power– when home appliances that lasted twenty years a generation earlier now break down in 5 years? Where does that 75% decrease in utility and sturdiness show up in the main inflation data? How about the tools that when lasted a life time now breaking after a few years?

It’s been estimated that America’s food has lost 30% of its nutritious worth in the past couple of decades. Protein per gram has actually dropped, trace nutrients have dropped, and so on. Instead of pursue sustainably nutrient-rich soil, Big Ag has made the most of profits by dumping natural-gas-derived chemical fertilizers on depleted soil to improve production of nutrient-poor, unsavory “item.” An item deemed “natural” offers no assurance that the soil isn’t depleted of nutrients.

Could this decrease have anything to do with the American population’s significantly poor health? No one understands since these huge decreases in quality and value aren’t measured and are definitely not part of the risibly fake steps of joblessness, GDP and inflation.

The main inflation rate ignores the multi-decade decline in the buying power of earnings. Leas have actually skyrocketed 25% in a couple of years, and financial experts are taking a look at 5% increases in incomes and worrying about the potential inflationary impact of employees’ earnings not keeping up with real-world inflation.

Cheerleading financial experts and experts never point out the $50 trillion siphoned from labor by capital over the past 45 years. They likewise don’t mention the rising pattern of loading more deal with staff members rather than hire more staff members, or as a reaction to not being able to find competent new hires.

Amusing how rosy the photo can be tinted when all the substantial forces are disregarded. But this studied ignorance characterizes the American elite, who enjoy whimpering about airlines tickets and travel delays, and discovering someone to repair their swimming pool pump. I resolve our Terminally Stratified Society here:

The Wealthy Are Not Like You and Me– Our Terminally Stratified Society (August 3, 2023)

This protected elite don’t need to bear with the crapified goods and services which create their capital gains and income. Their wealth and income enable their detachment from the crapified economy the bottom 90% experience. Their experience of the bottom 90% is as service workers, shipment people, etc who serve their entitled tastes.

Correspondent Tomasz G. supplied a telling excerpt from Houellebecq’s The Possibility of an Island:

“… the abundant definitely like the business of the rich, no doubt it relaxes them, it’s nice for them to fulfill beings based on the exact same torments as they are, and who appear to form a relationship with them that is not absolutely about money; it’s nice for them to persuade themselves that the human types is not uniquely made up of predators and parasites … “

As reporter Ryan R. observed, America’s privileged elites “were born on third, stole home (via property inflation) and still think they hit that home run.”

We know who the parasites are, but economic experts and experts are securely blind to America’s neofeudal aristocracy. After all, who butters the bread of financial experts and experts?

Is it unsurprising there are no steps of neofeudalism or elite privilege? When it comes to the amazing concentration of wealth in the leading tiers and the resulting decrease in the bottom 90%’s share of the nation’s wealth– nothing to see here, simply globalization and financialization doing their thing. What matters is scheduling my next flight to yet another conference of financial experts and pundits where we nod our heads and dare not admit all the conferences are nothing however echo chambers of the fortunate elites.

Cheerleading financial experts and experts totally overlook the consequences of the system being rigged to favor capital and the already-wealthy who were given the means to purchase properties back when they were inexpensive and inexpensive to the middle-class. Now that the system creates speculative credit-asset bubbles to create “the wealth impact,” assets such as houses in desirable regions run out reach of the bottom 90%.

Please study the six charts below of wealth inequality. Try not to laugh aloud when you see that the top 1% reckon that “coming from a rich family” has near-zero impact on “getting ahead in America.”

Also keep in mind the consistent decline in the center class portion of national wealth, and how the middle class’s share just rises when the credit-asset bubbles that have enriched the top 10% deflate, a bubble-pop that never lasts longer than a couple of months thanks to the policies that favor the already-rich at the expenditure of those who do not own stocks, rental homes, local bonds, and so on.

Economists and experts guide well clear of the eventual social and political repercussions of America’s established neofeudal wealth-income inequality. That this neofeudal configuration is inherently destabilizing– never ever mind, we do not measure that, look at the wunnerful unemployment and inflation charts!

Last but not least, think about the escalating federal debt in terms of the number of jobs are produced in the era of skyrocketing federal spending and financial obligation. (Charts courtesy of CH/ Economica) Financial obligation doesn’t matter to financial experts and pundits, and neither does its lessening impact on GDP and employment. The exact same can be stated of overall debt (public and personal), which is escalating (last chart): reducing returns writ big as greater interest rates are embedded in the policy excesses and neofeudal structure of the previous 45 years.

In essence, nothing that is consequential is appropriately measured, so the expert class keeps firmly insisting whatever is wunnerful and is mystified why individuals are so foolishly disappointed with our wunnerful economy. The reason why people are not buying the fantasyland story is they have to live and work in the crapified genuine economy, as serfs serving the economist-punditry-elite upper class.

If we want to avoid being led astray by misinforming steps, we need to seek enlightenment in what isn’t being determined or is cast aside as inconvenient to the “economy is wunnerful” celebration line.

My brand-new book is now available at a 10

print$10.95, Kindle$6.95 Read an

excerpt free of charge(PDF )When You Can’t Go On: Burnout , Numeration and Renewal $18 print,$8.95 Kindle ebook; audiobook Check out the very first area free of charge( PDF) International Crisis, National Renewal: A(Revolutionary) Grand Technique for the United States (Kindle$9.95, print $24, audiobook )Check Out Chapter One for free(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet(Kindle$8.95, print$20, audiobook$17.46)Check out the very first area totally free (PDF ). Will You Be Richer or Poorer?: Earnings

, Power, and AI in a Traumatized World(Kindle$5, print$10, audiobook)Read the first area free of charge(PDF). The Adventures of the Consulting Theorist: The Disappearance of Drake(Novel)$4.95 Kindle, $10.95 print); read the first chapters for