History recommends such a stratified society can not sustain as a democracy.

When we say “The Wealthy Are Not Like You and Me,” the majority of people will assume we’re discussing ultra-high-net-worth people (UHNWIs) with $30 million or more in possessions or even the hyper-rich worth hundreds of millions or billionaires.

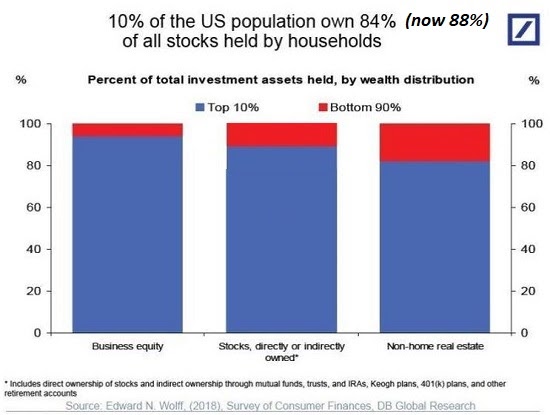

I’m not going over the tiny class of UHNWIs here, I’m discussing the 8 million homes of the leading 5% and the 13 million homes of the leading 10% who own 70% of all assets and practically 90% of income-producing assets such as stocks, bonds, rental residential or commercial properties, etc. Not the uber-wealthy or hyper-wealthy, just the wealthy who own a million or two in assets not counting their primary home.

A recent survey reports that there are 13.6 million households that have a net worth of $1 million or more (about 10% of the 132 million US families), and about 8 million US homes have a net worth of $2 million or more (about 6% of households), not including the value of their primary home.

This top 10% collect about 50% of all income and account for about 40% of all usage.

The topic here is the significantly impermeable barrier between the top 5% and the bottom 95%, a matter not just of monetary inequality but of sociological separation discussed by Christopher Lasch in his 1996 book The Revolt of the Elites and the Betrayal of Democracy.

I wish to state that I am not knocking the class of individuals I’m describing here. Rather, I am observing them as an anthropologist observes people, classes and cultures.

I recently met some old pals from our college days. At the time, they were students living in a cookie-cutter high-rise home with the typical hand-me-down furnishings and concrete-block/ pine boards book-shelving.

Now they live in a multi-million dollar house in a special neighborhood, surrounded by $5 million McMansions just recently developed on little lots after the initial homes were demolished. They too destroyed your home inherited from moms and dads and developed a brand-new luxe house.

What struck me as a journalist/ expert was how rich there are, and how all their pals are rich. They don’t engage with the bottom 95% of “typical” individuals other than as their housecleaning maids, repair or delivery person, and so on, as interchangeable, commoditized workers who are successfully peasants/ peons in our highly stratified neofeudal economy. They do not really understand any “typical” people as good friends or even colleagues; their buddies are all rich people like themselves.

We may state this impermeable class divide is natural, but this neglects three key factors.

One is that the barrier in between the rich and the not-wealthy was once again permeable. As Lasch observed, America’s elites have separated themselves from the rest of society in special enclaves and in a mobile way of life detached from location.

Other analysts have discussed the exact same sociological trend of elites living in bubbles occupied by other elites: in elite universities, in exclusive social groups, in special areas no normal home can possibly afford, and so on.

Lasch’s point was this financial/ way of life stratification is poisonous to democracy, a reality that is playing out in all sorts of ways.

Another factor is all the wealthy people I know became wealthy as a direct outcome of monetary aid from their parents. Every wealthy person I understand (with a really few exceptions)– and by that I mean people who live in houses worth $750,000 or more in value and who own other substantial monetary properties that produce capital gains and income– participated in university moneyed by their moms and dads, and whose very first house purchase was made it possible for by help from their moms and dads or in-laws.

I’ve also observed that this class of fortunate individuals frequently promote their “bootstrapping” while overlooking to note the complete step of financial backing they got from their household. Everybody wants to declare “I did it all myself” however this rings hollow once the truths of the matter come out.

This class also acquired significant wealth when their parents died, or from trusts established by the moms and dads to transfer their wealth prior to their death.

Lastly, all the wealthy people I know purchased or obtained properties long ago at rates that were economical to homes with normal middle-class incomes. At today’s valuations, the houses and assets they bought decades earlier are no longer inexpensive to any home listed below the top 10%.

Another shared quality of the wealthy who inherited their wealth and benefited greatly from the previous 30 years of property inflation is that they consistently attribute their wealth to their hard work. Yes, they strove, however so did most of the bottom 95% who aren’t rich.

The deciding factor wasn’t the wealth they developed as entrepreneurs or workers; it was the possessions they had the ability to purchase long ago as the direct result of monetary help from their moms and dads– or put another method, the wealth created by the significant inflation of properties their parents purchased decades ago.

Scrape away the 1) parents-paid university, 2) the parental assistance in buying their first property, 3) their ability to save cash in IRAs and 401Ks as an outcome of having low-cost home mortgages (or no home loan at all) and invest these cost savings in other possessions at low costs, and 4) the widespread asset inflation of the previous 30 years, and how much wealth would they own that was solely the outcome of their profits/ frugality?

Yes, there are wealthy entrepreneurs who earned their wealth by creating value in a business, but once again, scrape away the enterprises that are bubble-dependent realty and stock-market based ventures, and how many business owners actually produced wealth through producing value? Take away the thirty years of asset inflation and the answer is really few.

Much of what the wealthy claim as radiance is nothing more than the good luck of living in a multi-decade age of ever-rising possession valuations.

Some friends inherited portfolios of dividend-paying stocks that had been on auto-reinvestment of dividends for 50 or 60 years. Small stakes invested at that time are now worth $1 million or more. Others acquired gold bought at low rates years earlier. These are simply 2 examples of numerous transfers of wealth that rarely get pointed out.

As a basic guideline, the wealthy don’t expose all the aid they got, or associate their wealth to property inflation. They tout their long service in academic community or Business America, their sensible investing, their hard work, and so on.

I know this since I’ve taken advantage of the same asset inflation, though I didn’t gain from an inheritance or much help from my parents (I did receive a rusting old VW that needed an engine rebuild– a genuine plus at the time as I required an automobile to get to work). But even the achievements I can claim credit for– working my method through university by working 24-32 hours a week, completely self-supported, and constructing my own home at the age of 27– are out of reach of most of “typical people” now.

University tuition and charges have escalated, therefore have leas. It’s nearly difficult for a young adult to make enough earnings from 30 hours of work weekly to pay all the university expenses, the lease for a tiny studio ($135 per month in 1975) and maintain an old cars and truck, plus groceries, beer, and so on.

There is one other aspect that should be described in this stratification of wealth: the function of frugality. My wife and I lived in the cheapest, crummiest studio in the city for many years, worked Saturdays on building side-jobs, did our own vehicle maintenance, etc to save up the money to purchase a lot and structure products to build our own home. I understand numerous other individuals, primarily immigrants however some native-born Americans, who followed the very same route of exceptionally disciplined thriftiness to conserve up the down payment required to purchase a house.

However even the path of frugality is steeper now. The lease for even the crummiest studio is sky-high, pre-owned cars cost a little fortune and incomes have stagnated for 45 years, a truth I have actually often kept in mind in my article. Even earnings in building and construction have stagnated.

Changed for inflation/ acquiring power, I made more cash as a 23-year old carpenter/tradecraft employee in 1976 than I’ve ever made since. To put it simply, it took less hours of work in 1976 to spend for fundamental shelter, food, energies and transport than it does now. (See chart below of wages share of the economy: it topped in 1975.)

When the financial stratification was less noticable and less established, you may have had a spectrum of neighbors. Now the rich only know other wealthy people, since nobody who isn’t wealthy can potentially purchase a home in their special enclaves or enter their social circles of individuals wealthy enough to contribute to the arts or politics.

In the bubble of the rich, one hears about the travails of discovering individuals to fix pool pumps, wealthy associates who scored a beachfront rental for just $7,000 a month and endless stories of jetting around. One also hears strained efforts to show how prudent they are, as if scoring affordable airline flights is the sort of frugality that will ultimately develop a down payment for a remarkably over-valued home in their enclave.

Extreme stratification is now the standard internationally. The barrier between those who inherited wealth or who had sufficient aid to purchase possessions decades back and those without adult wealth to help them now is impenetrable. Even as younger generations lobby for more real estate to be constructed, it’s still unaffordable unless it’s heavily subsidized.

Here are a few links describing aspects of this impenetrable stratification:

New Grads Chasing ‘TikTok Lifestyles’ Battle In New York City As Leas Surge

A Tale of Paradise, Parking Lots and My Mom’s Berkeley Backyard (NYT.com) NIMBYs and YIMBYs– older wealthier locals don’t want brand-new multi-story real estate to change their enclaves, more youthful individuals want more housing to (hopefully) lower leas.

Majority of flights taken by a small portion of leaflets

A bit of realism and humbleness are in order. Yes, we worked hard, however we’re not rich due to the fact that we’re so dazzling or even due to the fact that we’re so economical. We’re wealthy because the global economy is structured to inflate possession bubbles. Those who purchased or were provided assets years back have benefited, those getting in university and the labor force now can not manage the exact same things we bought with average earnings without inheriting wealth from their households.

Those inside the bubble of wealth who just relate to other wealthy people don’t seem to see the social/ financial stratification or its exceptionally unfavorable repercussions. Perhaps they believe this is how everyone lives, fretting about discovering cheap workers and low-cost flights, or they discount their own wealth as merely “comfortable.” Perhaps they think “because I’m doing great, everyone’s doing great.”

They have actually lost touch with those who didn’t get to buy properties on the cheap, who didn’t get their university education paid for by their household, who don’t have an inheritance or a down payment provided by the Bank of Mother And Father.

History suggests such a stratified society can not sustain as a democracy.

This essay was drawn from my Weekly Musings Reports sent exclusively to subscribers, clients and Substack subscribers. Thank you quite for supporting my work.

My brand-new book is now readily available at a 10

My recent books: The Asian Heroine Who Seduced Me (Novel)

print$10.95, Kindle$6.95 Read an

excerpt totally free(PDF )When You Can’t Go On: Burnout , Reckoning and Renewal $18 print,$8.95 Kindle ebook; audiobook Check out the first section free of charge( PDF) Global Crisis, National Renewal: A(Revolutionary) Grand Method for the United States (Kindle$9.95, print $24, audiobook )Check Out Chapter One free of charge(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World(Kindle$8.95, print$20, audiobook$17.46)Check out the very first section free of charge (PDF ). Will You Be Richer or Poorer?: Profit

, Power, and AI in a Distressed World(Kindle$5, print$10, audiobook)Read the very first section for free(PDF). The Adventures of the Consulting Philosopher: The Disappearance of Drake(Novel)$4.95 Kindle, $10.95 print); read the first chapters for