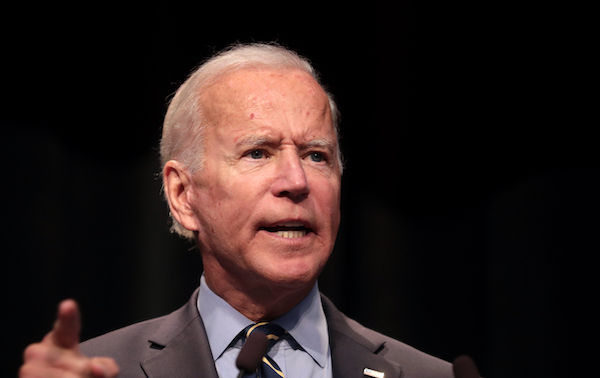

Every once in a while Sleepy Joe channels truth, unintentionally or otherwise, and did so just recently in spades. When asked by a reporter how he was going to slim down his huge $3.5 trillion social spending boondoggle to bring Senator Manchin and other moderates into the “yes” column, he let the budget gimmick cat right out of the bag:

For example– you’ve heard me state this previously, but it matters– when Roosevelt passed Social Security, it didn’t bear any similarity to what it is now. Therefore, the concept that (what)… gets passed is going to be the totality of what it’s going to end up being……. Look, it’s very important to develop the principle– the principle that is consisted of in the modification, such as childcare, the Child Tax Credit. Well, it may be that the Kid Tax Credit gets modified in regards to quantity. But once it’s put in place, although it’s just for a number of years, it gets harder and harder to take it out. And that’s my point to individuals. We do not have to get whatever all at once.

So let’s cut the to the chase. The as soon as deserving concept of 10-year spending plan projections has been developed into an outright fraud by the bipartisan duopoly on Capitol Hill through a trick called early expiration. That is, Dems tend to cause costs programs to look less expensive in the 10-year forecasts by having them expire in, say, year # 5, while the GOP did the very same thing in spades with early expiration of the 2017 tax cuts.

Obviously, when these expiration dates come, they get regularly extended at the 11th hour due to the fact that already it is purportedly “unimaginable” to hit beneficiaries with a cold turkey cut or taxpayers with an undesirable increase. Accordingly, the numbers video game as between Biden’s $3.5 trillion versus Senator Manchin’s $1.5 trillion and a possible compromise someplace in between $1.9 trillion and $2.2 trillion is simply Washington’s version of legal Kabuki Theater.

What truly matters, naturally, is the production of huge new universal entitlements (i.e., not work and means-tested) for children, maternity leave, child care, complimentary college and expanded Medicare, Medicaid and ObamaCare– plus a whole slew of climate change based crony capitalist rubbish—- not the gimmick-ridden book-keeping by which the legal language is formally scored.

For example, making the $3,600/$3,000 refundable child tax credit permanently readily available to essentially 90% of the population will cost $110 billion annually or $1.1 trillion over the 10-year spending plan horizon. But if they compose it to expire in September 2024 on the eve of the next governmental election, two things are certain.

First, the CBO (Congressional Budget plan Office) will be required to score it as costing $330 billion, not $1.1 trillion, on a real 10-year basis. And, second of all, that expiration will never take place in a month of Sundays. Both parties will pledge to “secure American households” at all hazards throughout their summer season conventions and after that make a noisy show of extending these child tax credits prior to they adjourn to project for the 2024 elections.

The fact is, there is nearly absolutely nothing in the plan that won’t end up being long-term due to deeply ingrained constituencies once they “plant a flag” on new entitlements and climate modification pork barrels, as one of the more honest Congressional Dems described a couple of days ago:

Rep. Jamie Raskin (D., Md.) informed liberal activists on a call Monday night that he wished to consist of a long list of programs that he hoped would show popular enough that lawmakers in the future would feel forced to continue them.

“Let’s plant a flag on everything that we need and everything that we desire and we will prove to America how essential it is, how crucial it is to our people and after that we will live to combat another day,” he said.

Needless to say, if a corporate CEO explained his financial declarations this way, he ‘d soon have some hotdog US Attorney perp-walking him to the nearby Federal court house. So, for the sake of sincerity within the cesspool of Washington’s budgetary corruption and malfeasance, here are the pertinent realities.

According to our pals at the Committee for A Responsible Federal Budget (stated “committee” is generally composed of old timers who left Washington decades ago!), the Biden/Dem plan will cost a minimum of $500 billion annually or 2.3% of GDP. That’s far north of $5 trillion over the 10-year budget plan horizon when you factor in the cost of added financial obligation and the profits tricks which won’t start to yield their forecasted cost savings (e.g. $800 billion of included profits from doubling the number of internal revenue service representatives).

Long-term Cost Each Year Of Biden/Dem Investing Strategy:

- $3,600/$3,000 Child Tax Credit: $110.0 billion;

- Child Care Tax Credit and Aid: $35.0 billion;

- Paid Household Leave: $22.5 billion;

- Universal Pre-K: $16.5 billion;

- Free 2-Year College and Increased grants: $28.5 billion;

- Medicare growth to dental, hearing and eye care: $37.0 billion;

- Broadened ObamaCare and Medicaid: $46.5 billion;

- Broadened house and community based healthcare service & RX subsidies: $52.0 billion;

- Tidy energy and EV tax rewards: $33.0 billion;

- Other tidy energy boondoggles: $23.0 billion;

- Housing aids: $19.0 billion;

- R&D subsidies: $18.5 billion;

- Employee training, production and small company aids: $33.0 billion;

- Other pork barrels: $25.5 billion

- Grand Overall Before Debt Service Expenses: $500 billion Each year

Self-evidently, it doesn’t take excessive imagination to recognize that almost all of these steps have “permanent” marked on their forehead, regardless of how their expiration dates are gimmicked in the final legislation. For example, the moms and dads of an approximated 35 million kids will receive the Kid Tax Credit, consisting of tens of millions who will get $300 to $1,500 of monthly payments (for one to five qualified kids), whether they owe any Federal taxes or not.

Likewise, every one of America’s 83.7 million households will be eligible for 12 weeks of paid family and medical leave. Benefits are based on a moving scale of wage replacement like Social Security, beginning at 85% at the bottom tier of incomes (under $15,000) and phasing out at 5% for earnings in between $100,000 and $250,000.

What that means. of course, is that a $20,000 annually hamburger flipper would be eligible for about $3,800 of Washington moneyed paid leave per year, while a $250,000 junior financial investment banker might gather $14,400. Do we see an iota of reasoning in spending $22.5 billion annually on that kind of upside-down malfeasance?

We do not. But we likewise understand that it’s modeled on the Social Security wage replacement formula– so it will never ever disappear when the ink is dry.

Even the products that are not strictly legal privileges are mainly in like flynn. Thus, with every car OEM joining the race to produce electrical vehicles, the opportunity that the combined lobbies of Tesla and General Motors and everyone else in between will ever let the proposed $12,000 EV credit go away are somewhere in between slim and none.

Similarly, the childcare industry in the United States is currently a $54 billion annually company (2019 ). Accordingly, when Drowsy Joe and the Dems layer on another $35 billion in new childcare tax credits and direct subsidies, operators in that area will believe they have actually passed away and gone to heaven.

More to the point, when you broaden a market by 65% by means of suckling it on the Federal teat, what we initially called the “social pork barrel” method back in 1978 comes politically alive with a revenge. The combined forces of 10s of millions of household beneficiaries and 10s of countless childcare suppliers and care givers would merely become insuperable.

And that gets us to the gravamen of the case versus the Biden Boondoggle. Particularly, that owing to massive, chronic deficit financing and the out of balance structure of Federal taxation, upwards of 130 million of America’s 144 million tax-filers pay virtually no earnings tax and just 7.6% of their incomes for the employee share of payroll taxes. This implies that the frustrating share of Federal spending is borrowed or spent for by the rich and corporations.

To be sure, all of it comes out in the wash under full effects economics. Customers, workers and investors eventually pay the business tax and the rich provide the financial investment capital that keeps the primary street economy going. However when it pertains to directly feeling Uncle Sam’s existence in household budgets, it is already the case that benefits gotten far surpass direct taxes paid by those 130 million units; and now the Biden social well-being expansion of the century with its many new universal privileges will make it a lot more preponderantly so.

Undoubtedly, when you in fact pencil it out, you start to question if there would be any net taxpayers left at all. While the example listed below is somewhat on the overstated side since it is based upon a household of 4 kids, one maternity leave and 2 wage-earning adults, it is however a gobsmacker when you compare present law taxes with the new benefits under the Biden/Dem plan.

Our example is based upon a two-earner family with $150,000 in wages and incomes, of which the major earner makes $110,000. 3 of the kids (including the newborn) are under 6 years, one is under 18 years, and one remains in two-year college, and the higher earning partner takes 12 weeks of maternity delegate look after the fifth kid.

Based on these specifications, the family would get $49,100 per year in advantages under the Biden/Dem plan:

- 12 weeks of Family Leave at $1,066 each week: $12,800;

- Kid Tax Credits for 3 kids under 6 years: $10,800;

- 2 child care credits: $8,000;

- One Kid Tax Credit under 18 years: $3,000;

- One totally free junior college education per College Board average cost: $14,500;

- Overall Biden/Dem benefits: $49,100.

By contrast, here is the earnings and payroll tax estimation for the exact same family under current law with $150,000 of made earnings and taking the standard deduction (it does not detail):

- Changed Gross Earnings: $150,000;

- Standard reduction: $19,550;

- Gross income: $130,450;

- 10% tax on very first $10,275: $1,028;

- 12% tax on $19,275-$41,775: $3,780;

- 22% tax on $41,775-89,075: $10,406;

- 24% tax on $89,075 to $130,450: $9,930;

- Total Federal earnings tax liability prior to tax credits: $25,144;

- 6.2% Social Security tax on $150,000 of joint incomes: $9,300;

- 1.45% Medicare tax on $150,000 of joint incomes: $2,175;

- Total Federal income and payroll taxes: $36,619.

There you have it. This family would remain in the top 10% of all taxpayers, yet it would get Biden/Dem advantages equal to 134% of its current income and payroll tax liabilities.

So, the question repeats. How worldwide does the Federal federal government financing itself if even $150,000 each year families are not net taxpayers?

A quick breakout of the estimated investments and invoices for the now finished FY 2021 reveals the unclean secret and informs you all you require to understand. To wit, just 15% of approximated outlays of $7.25 trillion were directly paid by the bottom 130 million or 90% of tax filers. The rest was obtained or credited service and the wealthiest 15 million taxpayers.

Simply put, Washington’s financial policy has actually deteriorated to “do not tax you, don’t tax me– tax and obtain from the fellow behind the tree”.

Breakout of Funding For FY 2021 Outlays of $7.25 Trillion:

- Income taxes paid by bottom 90% (130 million filers): $511 billion;

- Payroll taxes paid by the bottom 90%: $585 billion;

- Subtotal, direct taxes paid by bottom 90%: $1,096 billion (15%)

- Business earnings and payroll taxes paid by companies: $916 billion;

- Income, estate and payroll taxes paid by the wealthiest 10%: $1,280 billion;

- Tariffs, excise taxes and Fed payment: $312 billion;

- Borrowings charged to future taxpayers: $3,668 billion;

- Overall paid by business, the rich, future taxpayers and indirect: $6,153 billion (85%);

- Overall FY 2021 outlays: $7,249 billion

Needless to state, the above is before the so-called generational expansion of the Well-being State embodied in the Biden/Dem plan.

So, what we have coming down the pike is a fiscal doomsday device. The bottom 90% will money an even smaller sized share of Federal investments and get even more privileges and free things from Washington.

So, yes, the Biden Boondoggle is even worse than you think. Quite even worse.

Editor’s Note: The coming economic and political crisis is going to be much even worse, a lot longer, and really different than what we’ve seen in the past.

That’s precisely why New York Times bestselling author Doug Casey and his group just released an immediate new report entitled Doug Casey’s Leading 7 Forecasts for the Raging 2020s.