Four Democrat House members may have violated the federal ethics law known as the Stop Trading on Congressional Knowledge (STOCK) Act of 2012, according to Business Insider, which reviewed the members’ financial disclosure forms.

The report indicates that House Democrat Reps. Josh Gottheimer (NJ), Mary Gay Scanlon (PA), Susie Lee (NV), and Brad Schneider (IL) have all failed to adequately disclose their stock transactions within the allotted time required by the STOCK Act.

Like every lawmaker, under the STOCK Act these House members must submit a periodic transaction report within 30 to 45 days of stock transactions over $1,000 made on their behalf or their spouse’s. While the threshold for reporting is $1,000, lawmakers do not have to provide the specifics of the trade, but only a broad range.

The report showed that Gottheimer and his wife in November 2021 “exchanged” up to $15,000 worth of Meridian Bancorp, Inc. stock for Independent Bank Corp. stock. Insider reported that the disclosure report was filed on August 13 — which is months past the deadline.

Rep. Josh Gottheimer (D-NJ) speaks at a news conference on Capitol Hill, April 6, 2022 in Washington, DC. (Kevin Dietsch/Getty Images)

Despite the exchange of over $1,000 made, Gottheimer’s spokesperson Chris D’Aloia told Insider, “No shares were bought or sold here. It was just an exchange. … When our office was notified of this exchange on August 10 of this year, we immediately filed.”

The spokesperson added that before the congressman took office, he “turned over management of his retirement savings and investments to a third party, who has full investment discretion.”

Gottheimer released a statement in February saying he would take the next step by establishing a blind trust for his assets. However, it is not “formally established” according to House records since, as Insider mentioned:

Congress considers a “qualified blind trust,” a formal arrangement requiring congressional approval, to be the “most comprehensive approach” to avoiding “potential conflicts of interest or the appearance of such conflicts.” Such a blind trust requires a lawmaker officially transfers management of their financial assets to an independent trustee, and they can be expensive and time-consuming to establish.

Regarding Scanlon, the report indicated that her husband sold four stocks in February 2021, which totaled up to $95,000, in addition to exchanging $15,000 worth of shares of DuPont de Nemours in the same month. Insider reported that the disclosure report was filed on August 12 — indicating it was reported almost a year and a half past the deadline.

U.S. House Judiciary Committee member Mary Gay Scanlon (D-PA) sits in the chairman’s chair during a House Judiciary Committee markup hearing on the articles of impeachment against President Donald Trump at the Longworth House Office Building on Thursday, December 12, 2019, in Washington, DC. (Andrew Harrer – Pool/Getty Images)

Discussing the revelation, Scanlon’s spokesperson, Carina Figliuzzi, told the publication that the congresswoman “discovered that certain transactions in her husband’s retirement account, which is managed by an independent financial advisor, had not been reported in a previous filing.”

Scanlon’s spokesperson added that the congresswoman paid the $200 late fee — which Insider noted is a standard penalty for violating the law with late disclosures. Figliuzzi noted that Scanlon implemented “additional procedures to ensure that such transactions will not be overlooked in the future.” Insider noted that the congresswoman does not trade individual stocks.

Additionally, the report explained that Lee and her husband traded eight stocks during 2021 — which her filing showed occurred between January and September 2021 — and notes their worth was up to $155,000. Some of those stocks were Ally Financial Inc., Dollar Tree Inc., and Synchrony Financial. Insider acknowledged that the disclosure report was filed on August 13 — the same day as Gottheimer’s — which was also months past the deadline.

Rep. Susie Lee (D-NV) speaks at the Battle Born Progress Progressive Summit, Saturday, January 12, 2019, in North Las Vegas, Nevada. (AP Photo/John Locher)

The congresswoman’s office told Insider that her financial advisor “noted an inaccuracy in the list of trades” when preparing the annual disclosure report and filed a periodic transaction report once she realized it. The office claimed she does not make any trades herself and has a third-party money manager. They added that she’s been in contact with the House Committee on Ethics.

The report explained that Schneider’s wife, in February and December 2021, sold up to $150,000 worth of Trupanion, Inc. stock. But Insider said that the disclosure report was filed on August 13 — the same day as Gottheimer’s and Lee’s — which was months past the deadline.

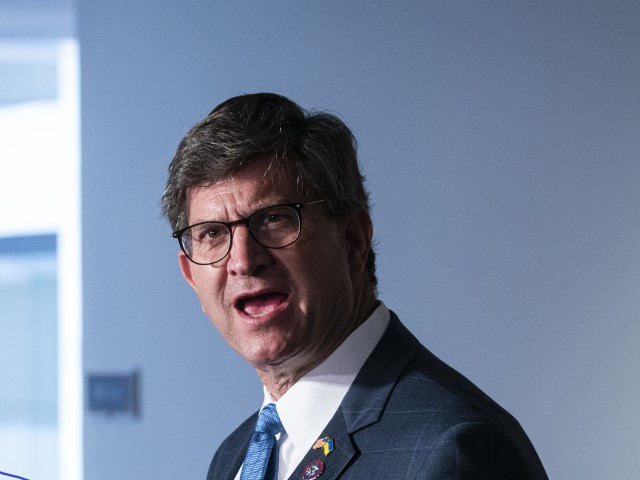

Rep. Brad Schneider (D-IL) speaks during a news conference following a Senate Judiciary Committee hearing in Washington, DC, on Wednesday, July 20, 2022. (Al Drago/Bloomberg via Getty Images)

The congressman’s chief of staff, Casey O’Shea, told Insider that “an investment partnership that his wife inherited from her father” is where the stocks came from and the wife sold them without notifying him. O’Shea noted that the congressman discovered the trades while compiling his annual financial disclosure statements and paid the $200 fine for filing late.

The STOCK Act was a bipartisan bill that banned insider trading by members of Congress and was signed into law by President Barack Obama on April 4, 2012. The legislation received overwhelming support from both parties.

In 2011, Breitbart News senior contributor and Government Accountability Institute (GAI) President Peter Schweizer rocked official Washington with his investigative revelations of insider trading by members of Congress. Left-leaning Slate hailed Schweizer’s blockbuster book on the topic, Throw Them All Out, as “the book that started the STOCK Act stampede.”

One of the leading figures featured in Schweizer’s Throw Them All Out was then-chairman of the House Financial Services Committee Spencer Bachus (R-AL), who announced he would not seek reelection after the book’s reporting.

Indeed, Bachus was the only elected official the late Andrew Breitbart ever called on to resign. CBS’s 60 Minutes did an investigative report on Schweizer’s revelations that won them the Joan Shorenstein Barone Award for excellence in Washington-based journalism.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.