Four thousand years ago, the rulers of ancient Babylon found a technique to stave off violent revolts.

In ancient times, there was a propensity for people to end up being hopelessly in financial obligation to their creditors. Ultimately, they would rise and trigger instability that could threaten the entire judgment system.

The rulers of the ancient world acknowledged this dynamic.

Their solution was to enact prevalent financial obligation cancellation– a financial obligation jubilee.

Debt jubilees acted as a social pressure release valve when there were no other choices.

The practice spread in the ancient world and ended up being codified in different civilizations.

For instance, the Book of Leviticus acknowledges debt jubilees as the end of a 49-year biblical cycle– seven cycles of 7 years.

I believe this ancient practice will make a big resurgence soon as federal government, corporate, and individual financial obligation have all reached excruciating levels today.

In truth, the debt jubilees have already begun … and the investment repercussions will be extensive.

The Biggest Wealth Transfer in History

It is necessary to note that debt jubilees do not amazingly create new wealth.

They just redistribute it.

Financial obligation jubilees are federal government decrees that amount to a huge wealth transfer with huge winners and losers.

The PPP loan forgiveness throughout the Covid hysteria was the prelude.

President Biden’s student loan forgiveness took it to the next level.

The trainee loan forgiveness was unprecedented. Unilateral executive action of this size has actually never ever happened throughout a time of peace. Furthermore, Congress, not the president, is supposed to make spending choices of this magnitude.

It is estimated that the instant and deferred expenses of the trainee loan forgiveness to be a minimum of $590 billion.

Biden’s student loan debt jubilee went too far for even Obama’s previous primary economic consultant, Jason Furman, who described it as:

“Putting approximately half trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

Aside from the inflationary effects– which I’ll get to in a moment– the trainee loan jubilee also set a precedent that I believe will be impossible to reverse.

Consider how the people who behaved prudently feel.

These individuals took different career paths to avoid trainee loans, cut down on their spending so they could pay for college without loaning, or settled their trainee financial obligation.

These people are probably seeming like suckers now.

Not only do they not get any debt relief, but they will need to foot the bill in one way or another to pay for those who had their student loans forgiven.

I think of these people will be angry and most likely have substantial car, mortgage, and credit card debt, as numerous Americans do. So they will desire financial obligation relief too … and I wager they will get it.

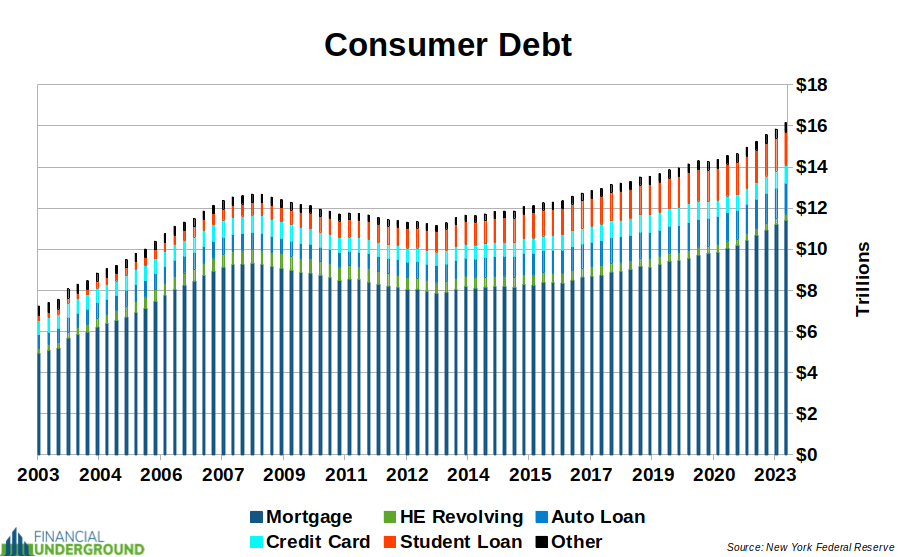

Amidst increasing costs, consumer debt is escalating. It is at an all-time high of over $16 trillion, as seen in the chart below.

With rate of interest increasing, the expense of servicing this record financial obligation is becoming unbearable for numerous. As a result, many Americans have actually reached their optimal debt saturation and are striking a financial snapping point.

As Biden demonstrated, all it takes is a President’s pen stroke to wipe out numerous billions in financial obligation.

I think the political pressure to do this again will be tempting– particularly before elections– as a way to court voters.

The trainee loan jubilee set a precedent.

I do not think it will be long before we see a credit card jubilee, a car loan jubilee, or a mortgage jubilee.

How will the federal government spend for all these jubilees?

It’s improbable they could raise taxes enough to pay for them.

It likewise would not make sense to release more debt to cancel other financial obligations.

That leaves cash printing as the only way they can finance these jubilees. So my guess is that’s what they’ll do.

That’s why the coming debt jubilees will put “gas on the inflationary fire that is currently burning.”

But it’s not just customer debt that has ended up being excruciating. The huge enchilada is the US federal government’s federal debt.

The Coming Federal Debt Jubilee

The US federal government has the biggest debt in the history of the world. And it’s continuing to grow at a fast, unstoppable pace.

In short, the United States federal government is fast approaching the financial endgame.

Here’s why …

Today, the US federal debt has gone parabolic and is scores of trillions.

To put it in viewpoint, if you made $1 a 2nd 24/7/365– about $31 million per year– it would take you over 1,008,378 YEARS to settle the United States federal debt.

And that’s with the impractical assumption that it would stop growing.

The fact is, the debt will keep accumulating unless Congress makes some politically difficult choices to cut spending. However don’t depend on that taking place. In truth, they’re racing in the opposite instructions now that they have actually normalized multitrillion-dollar deficits.

The amount of debt is so severe that even a return of interest rates to their historic average would imply paying the interest cost on the debt would take in over half of existing tax profits. Interest cost would eclipse Social Security and defense costs and become the largest item in the federal budget plan.

Second, a go back to the historical typical rates of interest will not be enough to rule in inflation– not even close. An extreme rise in interest rates is needed. If that happened, it might imply that the US federal government is paying more for the interest cost than it takes in from taxes.

In other words, the Federal Reserve is caught.

Raising rates of interest high enough to damage inflation would bankrupt the United States federal government.

Simply put, it’s game over. They have no choice but to “reset” the system– that’s what federal governments do when they are trapped.

How are they going to reset the system?

Nobody understands for sure. However I ‘d bet a debt jubilee of scriptural percentages will be a big part of it.

So then, how will the United States government repudiate its impossible federal debt concern?

My guess is that they will not be specific. That would look excessive like a default. It would ruin the role of the US as the center of the world’s monetary system.

Provided an option, I don’t think the US government would pick immediate self-destruction. Considering that power does not relinquish itself willingly, we ought to presume they’ll decide to stealthily execute their federal financial obligation jubilee through inflation.

Inflation is a huge reward to debtors. It allows you to borrow in dollars and repay in cents.

And considering that the US government is the biggest debtor in the history of the world, it is the single biggest beneficiary of inflation.

That’s why I think the federal financial obligation jubilee will be available in the type of a massive wave of inflation.

Here’s the bottom line.

The coming debt jubilees might have the impact of erasing many trillions worth of liabilities and developing previously unfathomable inflation.

That might trigger the biggest wealth transfer in history.

Keep in mind, debt does not exist within a vacuum. It is a liability to the customer and a possession to loan provider.

Those saving their wealth in government currencies, shareholders, and lenders will be the huge losers.

Debtors and those who own unencumbered scarce assets will be the big winners.

It’s certainly not a just result.

Sensible savers should not be made to pay for the excesses of the debtors.

But notions of what is just or not did not hinder Biden’s student loan jubilee– and they definitely will not for the coming jubilees.

Although that will be regrettable for many individuals, there is simply nothing anybody can do now.

The debt levels have currently reached a point of saturation, and the federal government might soon see jubilees as a politically appealing option.

That’s why it is best to acknowledge the reality of this Broad view and get located accordingly.

That suggests owning limited and important possessions that are not simultaneously someone else’s liability.

Crucially, this excludes fiat currency in savings account.

Remember, fiat currency is the unbacked liability of an insolvent government.

Even more, once you deposit currency into a bank, it is no longer yours. Technically and legally, it is the bank’s residential or commercial property, and what you own rather is an unsecured liability of the bank.

In a period of jubilees in which debts are wiped tidy, you won’t want to be on the other end of unsecured liabilities or IOUs of any kind.

I believe it could all go down quickly … and it will not be quite for numerous.

The majority of people have no idea how bad things can get … not to mention how to prepare.

That’s why I have actually recently published a how-to guide detailing the best ways to protect your savings. It’s called The Most Unsafe Recession in 100 Years … the Top 3 Techniques You Required Right Now.