The problem with bubbles of gotten knowledge and herd-euphoria is conditions alter however the threat of something unfortunate taking place is still viewed as inconsequentially low.

All bubbles pop– and not just stock exchange bubbles. A speculative bubble is a psychological-social phenomenon in which confidence in the stability of future gains reaches levels where doubts are eliminated and threats have dissipated into thin air. This self-confidence can be euphoric or it can be the standard: this (ensured gains) is the way the world works.

This baseline confidence in the system is a form of received wisdom based upon recency predisposition: considering that gains keep notching higher, the evidence supports expectations of future gains. Hence accepting what is plainly over-confidence (i.e. a bubble) is perceived as logical, and doubting future gains as irrational.

For example, the College Bubble is popping. The PR machinery that produced the self-confidence that borrowing immense fortunes to pay for university diplomas was a way to securing guaranteed lifetime gains is breaking down.

This confidence was not blissful, it was gotten knowledge based on recency predisposition: research study after research study showed those with any flavor of four-year college degree earned far more over their life times than those with only high school diplomas.

But beneath this apparently rock-solid evidence, the realities of financial obligation, supply, need and the altering nature of work and the economy were wearing down the cost-benefit of obtaining fortunes to pay for college. As the percentage of the labor force with college diplomas rose, the deficiency worth of degrees decreased. The gap in between the low level of real productive skills acquired in the majority of college programs and the demands of employers for high levels of real abilities widened.

With the cash spigots of trainee debt gushing hundreds of billions of dollars into the higher education sector, universities had no incentives to limit costs and every incentive to work with more administrators at ample incomes and construct expensive new buildings.

The risks created by student debts also increased. The received knowledge held that obtaining $120,000 would automatically generate a monetary return of many several of the overall financial obligation payments. However considered that the accrued interest, charges and late charges can double the preliminary amount obtained, this drag on lifetime income ends up being consequential when integrated with the decay of minimal returns on having a college degree.

Now enrollments are plunging, even in more affordable community colleges. The self-confidence in ensured gains from investing the time and cash to get a diploma has actually been broken, and now bloated, inadequate (in regards to quantifiable productive skills discovered by graduates) universities and colleges are facing decreases in profits that they are unprepared to manage.

5 Charts That Explain the Student Financial Obligation Crisis

The higher education bubble is not just a distortion of perceived danger and return; it’s a financial bubble of enormous financial obligation, profiteering and mal-investment. Please glimpse at the chart listed below of trainee loan financial obligation, which soared from near zero 20 years ago to $1.77 trillion in extremely rewarding, high-interest loans owned by the wealthy at the expenditure of credulous students.

Confidence in guaranteed future gains in the stock exchange is both received wisdom and a run-with-the-herd euphoria. Human beings are social animals acutely attuned to the zeitgeist of the herd. There are strong rewards to sign up with the herd and run with it, and the feeling of bliss as the herd starts running is extreme and gratifying.

Integrate the recency bias generated by continual “saves” by the Federal Reserve since 2008 (and perhaps from 1998) with the bliss of the stampeding herd, and the outcome is a heady super-confidence that threat has actually dropped to “completely low levels” while stocks have reached “what looks like a completely high plateau.”

The issue with bubbles of received knowledge and herd-euphoria is conditions alter but the danger of something unfortunate occurring is still perceived as inconsequentially low. Think About the South Seas Bubble. In the early days of globalization and colonial growth, the chance produced by the granting of a monopoly for all future profiteering in a vast undeveloped area of the world was certainly compelling. It was plainly a no-brainer to bank on gains.

Early financiers were rewarded, therefore were those who purchased the dip. Even late-comers notched gains, and naysayers and skeptics were silenced by the huge gains accumulated by the herd.

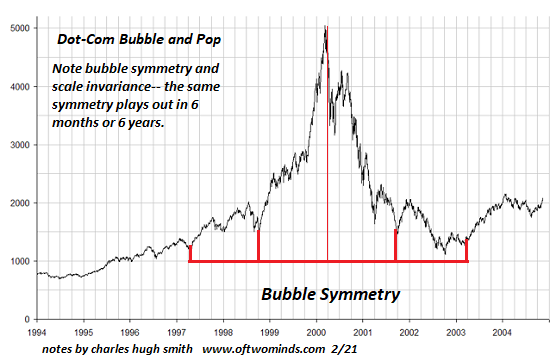

Then the bubble popped, as all bubbles do, and the wealth disappeared into the ether. Self-confidence has lots of sources, and recency bias and the herd are the most trustworthy and convincing. The Internet will grow for decades, and so profits can grow for years. This got knowledge, goosed by Fed liquidity, produced a herd-euphoria in 1999 and 2000 that produced spectacular gains for everybody in the herd.

Then the herd went off the cliff, as herds tend to do when risk is perceived as inconsequentially low.

My new book is now readily available at a 10 % discount($8.95 ebook,$ 18 print): Self-Reliance in the 21st Century. Read the very first chapterfor free(PDF) Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 minutes)My

My new book is now readily available at a 10 % discount($8.95 ebook,$ 18 print): Self-Reliance in the 21st Century. Read the very first chapterfor free(PDF) Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 minutes)My

current books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Read an excerpt totally free (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Check out the very first area totally free(PDF)Worldwide Crisis, National Renewal: A(Revolutionary )Grand Method for the United States(Kindle$9.95, print$24, audiobook)Check Out Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet(Kindle$ 8.95, print$20, audiobook$17.46)Read the first section free of charge(PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Shocked World

(Kindle $5, print$10, audiobook) Check out the first area free of charge(PDF). The Adventures of the Consulting Thinker: The Disappearance of Drake

(Unique)$4.95 Kindle,$ 10.95 print); read the first chapters totally free (PDF)Money and Work Unchained $6.95 Kindle,$15 print)Check out the first section totally free End up being a$1/month patron of my work through patreon.com. Subscribe to my Substack

for free NOTE: Contributions/subscriptions are acknowledged in the order got.

Your name and email remain personal and will not be provided to any other private, company or firm. Thank you, Angela B.($5/month), for your marvelously generous promise to this site– I am greatly honored by your support and readership. Thank you, rmhoperenton ($ 5/month), for your splendidly generous Substack subscription to this website– I am greatly honored by your assistance and readership.