Our faith in the wobbling world of hyper-financialization will quickly be checked.

It’s interesting, isn’t it, that amidst a tsunami of commentary about banks, no one points out the proverbial elephant in the room, which is the overwhelming dominance of finance in the economy and society, a dominance which raises the big concern: is the dominance of financing healthy for the economy and society?

The reason that no one even sees this elephant is we’ve come to think “it’s always been in this manner” and “this is the natural order of things.” Both are incorrect. Yes, financial obligation and loaning have actually been important to “money,” trade and civilization from the start, as David Graeber so memorably detailed in his book Debt: The Very First 5,000 Years. But important isn’t the like dominant.

Without much in the way of acknowledgment or questions, we have actually permitted financing to become the structure of the whole economy. The whole economy will now grind to a stop without trillions of dollars of credit sluicing through every rivulet, stream and river of commerce. From over night financing facilities to 30-year home mortgages, debt/credit is the lube of the economy.

What’s been forgotten is the economy that when relied not simply on credit however on savings and money. In the pre-financialization economy, capital and credit were limited; capital commanded a premium, and lending/ credit sluiced through really narrow channels: conservatively underwritten traditional 30-year home loans, debit cards such as American Express that had to be paid in full each month (and such cards were difficult to get, by the way), and conservatively underwritten loans to enterprises.

Charge card needed proof of fiscal vigilance and had low limits, usually just enough to purchase a home appliance and pay it off in a couple of months.

What we consider given– car loans and credit card limits equal to or greater than an annual wage– would have been considered as incomprehensibly imprudent and fantastical. Loans for automobiles were available, however only to the credit-worthy and if the buyer put down 50% in money.

At greater levels of financing, straight-out rip-offs such as SPACs (Special Purpose Acquisition Business) were not allowed. The foundation of ridiculous stock market overvaluations– corporate buybacks– were also restricted.

The impressive growth of credit and financialized skims and frauds are now the lifeline of the economy, and any time out in their endless expansion activates shivers of terror. Great golly, what sort of scaries would we suffer if J. Person can’t buy a $50,000 cars and truck or truck with $1,000 down? How could we survive without 3% down payment mortgages? What doom would await us if corporations were no longer able to raise billions of dollars in the credit markets and use that cash to buy back their own shares?

Instead of be viewed correctly as a needed evil that should be strictly constrained lest it consume the heart of the real economy, debt/credit is now viewed as our most precious physical fluid, without which we die. In this strange psychosis of hyper-financialization, the truth that ultra-loose credit and capital that carries no premium inevitably jacks up prices and costs to the moon, fatally misshaping the genuine economy, is not even visible.

What shows up is the “need” of putting an extravagantly over-priced Disney World holiday on a charge card and the “need” of a $60,000 brand-new pickup truck. Or what the heck, a new $110,000 Wagoneer. We all should have everything credit allows, from buying meme stocks on margin to designer jeans.

OK, so we have $160,000 in student loan debt– a university degree was “needed” despite cost. (Needless to say, the companies and owners of all that financial obligation are as rich as we are bad. That’s how credit works.) And we truly needed a trip, so that’s one $20,000 credit card maxed out. Then there were “surprises” (what we when called “typical everyday life”) such as a broken water heater.

Hey why is everything so badly made now? Globalization. You understand, quality no longer matters, only the “low” (heh) cost. ( Stainless Steal.)

We’re too tired to cook real food (but manage to spend hours every day staring at screens after work) so we require to buy meal delivery, and keep your house well-stocked with unhealthy treats and drinks, and so on top of all the other “surprises” in an inflationary international economy, there’s another $20,000 charge card maxed out.

Our clunker cars and truck required repair work so it was necessary to get a $30,000 car loan for a brand-new vehicle– the least expensive one on the lot.

This profligacy and dependence on ever-expanding credit just to sustain “regular life” is scale-invariant, implying every city, county, state and federal company likewise requires ever-expanding credit simply to ward off collapse, and every zombie business/ entity likewise needs ever-expanding credit simply to avoid the slippery slope to personal bankruptcy and liquidation.

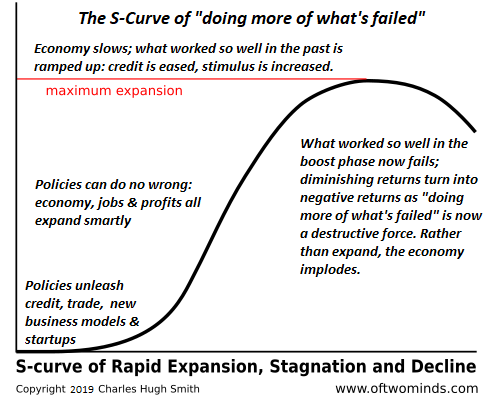

The elephant no one even sees much less gets alarmed about is the entire financialization period has actually slipped over the top of the S-Curve. Doing more of what worked in the past only speeds up the slide to additional extremes, more distortions, increasing instability and ultimate “modification,” i.e. reckoning.

Our faith in credit, financial obligation and financing is forced, as we have actually forgotten how to live without it. Sort of like, you know, ahem, an addict for whom the next repair is not viewed as a disaster however as the remediation of an unsteady pretense of stability.

Our faith in the wobbling world of hyper-financialization will quickly be evaluated. As soon as we lose faith in this state of fiscal psychosis, then we can awaken to the truth that the treatment for unaffordable lifestyles is a collapse of hyper-financialization and the possession bubbles it inevitably inflates.

New Podcast:

New Podcast:

Chaos Ahead As We Enter The New Age Of’Shortage'( 53 minutes ) My new book is now readily available at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the first chapter totally free(PDF)Read excerpts of all three chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century (43 minutes)My

Chaos Ahead As We Enter The New Age Of’Shortage'( 53 minutes ) My new book is now readily available at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Check out the first chapter totally free(PDF)Read excerpts of all three chapters Podcast with Richard Bonugli : Self Dependence in the 21st Century (43 minutes)My

recent books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the very first area totally free(PDF)Worldwide Crisis, National Renewal: A(Revolutionary )Grand Method for the United States(Kindle$9.95, print$24, audiobook)Check Out Chapter One free of charge (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet(Kindle$ 8.95, print$20, audiobook$17.46)Check out the very first section for free(PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print$10, audiobook) Read the very first area totally free(PDF). The Experiences of the Consulting Philosopher: The Disappearance of Drake

(Unique)$4.95 Kindle,$ 10.95 print); checked out the first chapters totally free (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Check out the first section totally free Become a$1/month patron of my work via patreon.com. NOTE: Contributions/subscriptions are acknowledged in the order got. Your name and e-mail stay confidential and will not be provided to any other private, company or agency. Thank you, Roger Van V.($120), for your outrageously generous contribution to this website– I am greatly honored by your support and readership. Thank you, Marty M. ($5/month), for your marvelously generous pledge to this website– I am greatly honored by your assistance and readership.