After decades of unhinged money-pumping, the Fed has driven real interest rates so low that there disappear bond financiers– simply traders and suckers.

The previous have actually driven the 10-year yield in recent days to just 150 basis points in small terms (and deeply into the red in real terms in the face of surging regular monthly inflation numbers), due to the fact that they are “pricing-in” something and something just: simple and supreme self-confidence that the spineless fanatics who inhabit the Eccles Building will keep purchasing $120 billion each month of federal government and quasi-government financial obligation.

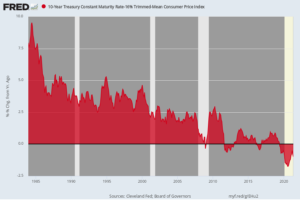

Genuine Yield on 10-Year UST, 1985– 2021

These are no longer even “markets “by any historical sense of the term. The bond markets and the stock market are just meaningless gambling casinos.

Inflation-adjusted yields had actually formerly meandered around the 10%+ level for a number of years. However no more. The genuine yield is so low that yield starved fund supervisors are throwing caution to the wind and setting themselves up for massive future losses.

That’s not a sincere rate discovery. It’s the crazed trading that has been fostered by fanatical central lenders who have actually lost touch with history, reality and every canon of noise finance.

There is $80+ trillion of public and private financial obligation outstanding and it totals up to a shocking 380%+ of GDP.

Below is the overall debt-to-GDP ratio for the last 73 years.

Total Take Advantage Of Ratio for the United States Economy: Debt-to-GDP, 1947– 2020

Do the enthusiasts in the Eccles Building have any clue about the fact that their policies total up to an enormous signal flood to the United States economy to bury itself in debt?

Seemingly, they do not. But with each passing month of negative real yields and $120 billion of freshly minted fiat credit, the US economy slouches in precisely that direction.

Yearly Boost in Nonfinancial Service Debt, 2000– 2020

Throughout 2020– the year of the sweeping COVID Lockdown– conventional economics would suggest a liquidation of business financial obligation, especially when organization take advantage of levels had previously reached dangerous, all-time highs.

However not in the Fed’s hothouse monetary markets. To the contrary, organization debt soared by $1.5 trillion in 2020 or by 50% more than the peak borrowing year of 2007 when companies were on a borrowing binge.

This is genuinely aberrational.

In the past, the business take advantage of ratio stood at 35% in 1947 and had actually plateaued at about 60% by the 1970s. Once the Fed got into the financial repression business huge time, the ratio was off to the races. The staggering amount of service debt now amounts to an off-the-chart 111%!

Can the clowns set down in the Eccles Structure discuss how the United States economy can grow in the future when it is submerged in so much financial obligation?

Can they likewise discuss how rates of interest can ever be stabilized in genuine terms without blowing up the whole monetary edifice?

And do they have a clue regarding what will occur if they continue to indicate personal and public celebrations to borrow like there is no tomorrow by keeping real rate of interest immersed in negative territory?

The response is, of course: No.

Editor’s Note: The Fed has actually currently pumped massive distortions into the economy and inflated an “everything bubble.” The next round of cash printing is likely to bring the scenario to a breaking point.

If you wish to browse the complex financial and political circumstance that is unfolding, then you require to see this freshly launched video from Doug Casey and his team.

In it, Doug reveals what you need to understand, and how these unsafe times could impact your wealth.