The hazardous impacts of the Fed’s relentless rates of interest repression are numerous, but among the worst has actually been the outright savaging of bank depositors.

Interest rates on 12-month CDs (under $100,000) dropped below the inflation rate in October 2009 and have actually been pinned there since.

There is no other word for this than “expropriation”– an unconstitutional taking of home from tens of countless homes that required to keep their funds liquid and didn’t want to chance in the junk bond market or stocks.

Worse still, the resulting huge transfer of income from depositors to banks has resulted in an egregious, synthetic ballooning of bank earnings and stock costs.

For example, the combined market cap of the top 6 United States banking institution– JP Morgan, Bank of America, Citigroup, Wells Fargo, Morgan Stanley and Goldman Sachs– has actually increased from $200 billion at the bottom of the monetary crisis during the winter of 2008-2009, where it showed their real worth missing federal government bailouts, to $1.5 trillion recently.

That 7.5 X gain, which was 100% managed by the Fed, is an unspeakable gift to the rich who own the majority of the stocks and particularly to top bank executives who have cashed-in on greatly valued alternatives.

Needless to say, this huge bubble in banks and other financial stocks is unsustainable. When the Fed is finally forced to close down its printing presses, the bank stocks will be amongst the first to dive into the void.

While this might represent condign justice from a policy and fair perspective, the level of the harm to daily Americans can not be gainsaid.

That’s since Wall Street is choosing one more bite at the apple, claiming that the currently accelerating rate of inflation benefits bank stocks.

Agreement stock price projections for JPMorgan are up 20% by 2023 and for Goldman Sachs by 70%.

Needless to say, this is simply another 11th hour lure from big cash speculators looking to discharge greatly misestimated stocks on unwary retail investors.

Accelerating inflation apparently portends higher development and loan need, but that’s a total humbug because what we actually see in the market is stagflation. And that will top loan demand even as it squeezes net interest margins, triggering bank profits to fall huge time.

The approaching demise of bank stocks is implicit in the way in which the $1.5 trillion rip-off presently shown in the bloated market cap of the Big 6 institutions came about. The Fed controls especially the front-end of the yield curve and will bring no interference from market forces– so the shouting injustice illustrated below is its deliberate handiwork.

On average, the after-inflation yield throughout the 11-year duration was -1.40%.

Inflation-Adjusted Net Interest Margin of Banks Versus Real Returns On 1 Year CDs, 2009-2021

Upwards of one-fifth of the real wealth of depositors has actually been seized by Fed-enabled lenders during the last decade alone.

We question whether a more perverse reverse Robinhood redistribution might be pictured.

The Fed policy has actually literally turned everyday depositors (black bars) into the indentured monetary serfs of the banking system (red bars).

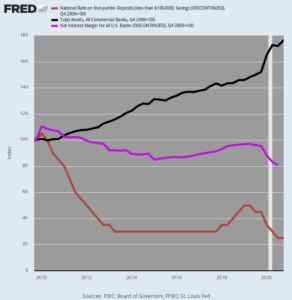

Cumulative Modification in CD Rates, Overall Bank Assets and Bank Net Interest Margin, 2009– 2021

The chart above is indexed to Q4 2009 levels and reveals that over the last

- 11-year period: CD yields fell by 75%;

- Bank net interest margins come by 19%;

- Total Bank properties soared by 79%.

Needless to state, the above combination did marvels for bank profitability.

On the one hand, the Fed’s money-pumping cultivated an eruption of debt and other securities issuance. The aggregate balance sheets of the nation’s banks, for that reason, broadened from $11.8 trillion to $21.1 trillion of overall properties during the period.

Even with lower interest rates and yields on these assets, overall bank interest earnings rose from $545 billion in 2009 to $576 billion throughout the last twelve months duration ending in March 2021.

On the other hand, the rates banks paid depositors plunged by 50-75% depending upon deposit type and size.

In a word, the nation’s lenders not just emerged untouched from the Great Financial crisis owing to the Washington and Fed bailouts, but during the following years certainly believed they had died and gone to lenders’ heaven.

For essentially not doing anything other than scooping up their share of the tsunami of business and government financial obligation and collecting almost cost-free deposits, the net margin of the banking system rose by $122 billion per year or 30%.

The chart listed below shows this ill-gotten profit gain on a quarterly basis.

Eruption of Bank Internet Interest Margin, 2009– 2021

Not in a million years would this have happened under a routine of sound cash and sincere free market prices in the money and capital markets.

Editor’s Note: The economic trajectory is bothering. Regrettably, there’s little any person can practically do to change the course of these patterns in motion.

The best you can and need to do is to remain notified so that you can safeguard yourself in the very best method possible, and even profit from the scenario.

That’s exactly why bestselling author Doug Casey and his colleagues simply released an immediate brand-new PDF report that discusses what might follow and what you can do about it.