Socialist main planning has been elevated to a brand-new art kind based on control of the economy from the commanding heights of financing.

Central banks were as soon as in the cash business, in the sense of protecting its availability, liquidity, and stable worth. But the modern Fed never states a peep about the location where money arises and dwells– the financial markets– while gumming endlessly about the Main Street economy and the condition of and its targets for the elements and constituents of GDP.

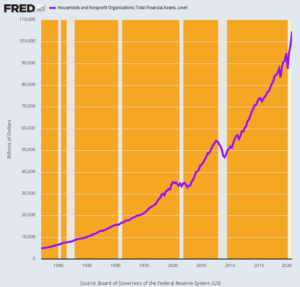

Throughout the last 43 years, total financial possessions held by the household sector have actually increased by an incredible $100 trillion. And that’s just a proxy for the enormous levels of bank deposits, money market funds, bonds, openly traded shares, and personal equities that stream through the warp and woof of the country’s $21 trillion GDP.

Total Family Financial Assets, 1977– 2020

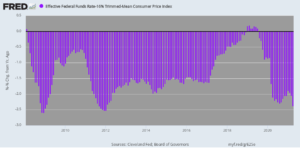

The Fed invested the last 13 years topping and smothering the cash market rate

. That’s socialism by any other name.

Ironically, it’s resulting in the very same result as in the old Soviet Union: a stopping working economy for the masses and a concentration of wealth and benefit among the couple of elites who are close to the levers of control.

The chart below programs the genuine federal funds rate, calculated by subtracting the year-over-year cut mean-CPI increase from the Fed’s target rate. Throughout the last 169 months (considering that March 2008) the rate has actually been deeply unfavorable for 96% of the time and simply a little positive for a grand total of 7 months, all in 2019. And now, after in 2015’s money-printing orgy, the genuine federal funds rate stands at — 2.37%, almost the inmost level ever.

Never in a million years would participants in voluntary exchange on the free market provide money– even overnight– at a negative genuine rate. It defies economic logic and sanity itself.

Real Federal Funds Rate, 2008– 2021

However these brand-new systems of socialist control– just like in the old Soviet Union– were not remotely approximately the job. Amongst the manifold failings and ills in the latter, was the reality that central preparation tended to produce enormous unintended malign effects owing to erroneous rewards and cost signals.

For instance, Soviet nail factory managers got determined and rewarded by the tonnage produced. The story goes that a person resourceful chap massively exceeded his quota by producing just ten-ton nails!

Successfully, that’s what is taking place in the financial markets today. The main lenders are targeting at the individual consumption expense deflator and the U-3 joblessness rate, however the huge injections of liquidity designed to keep the rate of interest control dial on target never ever really leave the canyons of Wall Street.

Instead, they significantly inflate the price of monetary possessions and deflate the bring expense of debt, thereby triggering economic actors to copy the Soviet nail factory manager.

For example, the C-suites foolishly maim their balance sheets by assigning trillions to financial engineering maneuvers such as stock buybacks and uneconomic M&A deals.

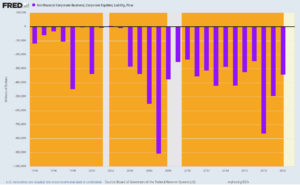

The chart below programs the net equity circulation into the United States business economy given that 1994, as tracked by the Federal Reserve. Throughout that 26-year period, there was however a single year (2002) when nonfinancial corporations raised a positive amount of net equity, while liquidating a total of $8 trillion of book equity over the period.

Stated differently for the better part of the last 3 years the C-suites of corporate America have liquidated approximately $310 billion of business equity each year.

Effectively, they are running glorified hedge funds, not Main Street companies.

Net Business Equity Raised or Liquidated, 1094– 2020

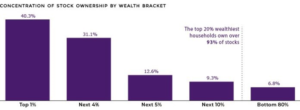

There is no mystery as to where all the corporate money used to buy back shares and buy out other companies went: the top 1% and 10%, who own 40% and 71% of the stock, respectively, and the leading 20%, who own 93% of the overall.

When it comes to the task that the free enterprise, not the main banking branch of the state, is matched for– creating increasing living requirements and real, sustainable wealth– the Fed– like the Soviet coordinators– is producing a great deal of ineffective 10-ton nails.

Editor’s Note: The Fed has already pumped massive distortions into the economy and pumped up an “everything bubble.” The next round of cash printing is most likely to bring the situation to a snapping point.

If you want to browse the complicated financial and political circumstance that is unfolding, then you need to see this newly launched video from Doug Casey and his team.

In it, Doug reveals what you need to know, and how these unsafe times could impact your wealth.