Amongst all the financial market distortions and misallocations that result from the Fed’s money-pumping policies, we are difficult pushed to think of something stupider and more disadvantageous than unfavorable genuine yields on junk bonds.

The historical yield spread over inflation of riskiest United States business securities has varied between 500 and 1,000 basis points (5– 10%) or more. And for the good reason that in combination, inflation and defaults constantly consume deeply into the discount coupons so regarding remind investors why it is called “junk.”

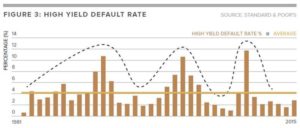

As it occurred, the junk bond yield on the eve of the dotcom crash in the spring of 2000 was 12.48%, showing an 875 basis point spread over the CPI of 3.73%.

By the eve of the Great Economic Crisis in November 2007, the scrap yield had fallen to 9.15% but that still represented a healthy spread of 478 basis points over the CPI, which had actually increased to 4.37% during the prior 12 months.

However those spreads self-evidently were inadequate when the economy plunged into the tank during 2008– 2009.

The factor the spread went nearly parabolic throughout the Great Recession is that the price of scrap bonds collapsed by 26% as investors and speculators discarded them in the face of soaring losses and company bankruptcies that topped all previous cyclical highs (dotted line).

Needless to say, the Fed was not ready to let Mr. Market have its way, nor honest rate discovery

to triumph in the bond pits. After the enormous money-pumping under Bernanke, the spread was back down to about 490 basis points. And from there it continued lower in herky-jerky fashion throughout the subsequent so-called healing, up until it reached simply 290 basis points at the pre-COVID peak in February 2020.

The rationalization for that renewed spread compression was that junk bond losses fell substantially and progressively during the course of the recovery. What is not mentioned is that the frustrating reason for the decline in defaults and losses was the magic of Wall Street’s low-cost debt-fueled refi machine.

Like house mortgages throughout the three- or four-year runup to the 2007 housing crash, junk borrowers who were in difficulty or heading there got refinanced at lower rates prior to they appeared as a Chapter 11 filing.

Needless to state, when the combination of yields after inflation and a historical realized-loss rate of about 3.0% (after recoveries from a 4.2% preliminary default rate) hit basically zero, the Fed was currently deep in the zombie breeding company.

When you give scrap ranked companies long-lasting capital at basically a no return to investors, you are going to get a lot of demand to feed a mushrooming herd of zombies– business that would otherwise be liquidated and their resources redeployed more proficiently on a sincere free enterprise.

Still, the Fed was refrained from doing by any ways.

Owing to its $4.5 trillion money-printing spree because September 2019, it has essentially damaged after-inflation returns in the sovereign financial obligation and investment grade sectors. So in desperate look for yield, financiers (speculators) have raked into the scrap bond market, driving yields listed below 4% recently.

These fools have driven the scrap bond yield to a unfavorable 100 basis points (1%) after inflation, and it will be going deeper into the red from there.

Junk Bond Spread Over Inflation, 2000– 2021

In a world of sound cash and honest rate discovery in the bond pits there would not be any considerable junk bond market at all.

Business with really dangerous but worthwhile investment jobs would sell equity, and investors looking for reliable yields would have plenty of federal government and investment grade business bonds with sufficient risk-adjusted returns to pick from.

Has actually the Fed paid attention to the truth that the development capability of the United States economy is being progressively worn down by the rise of a herd of corporate zombies?

Needless to state, it has not– not in the slightest.

Yet when the next junk market disaster sends zombies stampeding toward the Chapter 11 courts, it will be completely stunned … and then recommend another round of the type of lethal money-pumping that currently endangers capitalist success.

Editor’s Note: Did you understand that United States federal government has released the most hazardous experiment in its entire history?

In fact, what’s been unleashed is trillions of dollars of stimulus without any end in sight.

When any federal government goes on an uncontrollable cash printing spree it impacts everyone.

That’s precisely why, NY Times best offering author Doug Casey just released this immediate new video on the greatest impending danger and what you can do about it.