Eventually, the inflationary credit discharged by the Fed works its method through the worldwide economy and comes home to roost in the kind of decreased domestic output and rising costs. In this regard, there is no more powerful tell than the round trip of the PCE deflator for resilient products during the previous 28 years.

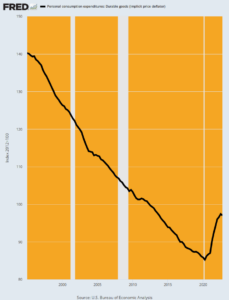

As displayed in the chart below, prices for durable goods, which are now mainly manufactured abroad, plunged continually and by a staggering 40% between early 1995 and the Covid-Lockdown bottom in Q2 2020. There is no broad-scale deflationary wind rather like it in all of recorded history.

PCE Deflator for Resilient Product, 1995-2022

What triggered it, of course, was a one-time arbitrage of labor and other local production costs on the massively broadened international supply chain enabled by contemporary innovation.

Again, however, that wasn’t a wonder of capitalism alone. What drove the global supply chain deep into the interior of China and other ultra-low labor expense venues was the Fed’s inflation-targeting policies– initially de facto under Greenspan and then eventually (2012) official under Bernanke.

The fact is, when Mr. Deng declared that to be abundant was marvelous and opened China’s fantastic export factories, sound cash in the US would have led to a continuous deflation of the considerably swollen US expense and price level that had emerged from the Great Inflation of the 1970s.

Clearly, Alan Greenspan, the once and previous champion of the gold standard, was having none of it. Had he allowed the country’s swollen cost structure to deflate in order to keep domestic production competitive, he would not have actually been the toast of the town in Washington. He would have been vilified by the politicians since the suggested remedy of skyrocketing interest rates and diminishing domestic credit on the free market would have made financing the giant Federal deficits which emerged in the Reagan period well nigh impossible.

So Greenspan pretended to be the champ of sound money by taking credit for a bogus gain he was pleased to call “disinflation”. The latter totaled up to intentionally diminishing the buying power of savers and wage earners, but simply not quite as rapidly as during the worst days before Volcker.

Needless to state, in a globalized economy inflationary money is quite the trickster. In the preliminary instance it resulted in the huge and unrelenting off-shorting of production, and the re-importing of the exact same items produced abroad through the cheap labor being requisitioned from China’s large interior rice paddies.

Inflation of the dollar came back as deflation of long lasting items rates!

It likewise permitted the Fed to claim that it had actually vanquished inflation which its altogether new difficulty was the insanity called “lowflation” or too little inflation. That’s really when the Keynesian main bankers lost their minds.

Unfortunately, the problem with “lowflation” is that it was a one-time aberration, not an irreversible or sustainable condition. As the above sharp hook in the chart attests, the sub-index for durables is now up by 15% from the bottom, even as the international supply chain continues to contract owing to the fatigue of low-cost labor in China and terribly delayed political perseverance with open market in the US and throughout the west.

Not remarkably, therefore, the deeply embedded inflation that has actually has actually been promoted by the Fed and its fellow-traveling central banks is now showing to be even more persistent than our Keynesian money-printers ever expected; and far more vicious that the clownish perma-bulls of Wall Street ever imagined.

Here is still one more tip. We have actually long-argued that the correct method to fashioning a “core” inflation gauge is not to arbitrarily drop items out of the price basket like food, energy and now shelter, too. Take that far enough and inflation drops to zero due to the fact that you are no longer determining anything that even remotely resembles the general cost level.

By contrast, the cut mean CPI hits the spot due to the fact that monthly it drops out the low and high 8% of products, respectively, however these are never ever the same components. So you are smoothing the month-to-month perturbations, not getting rid of terrific gobs of the cost structure.

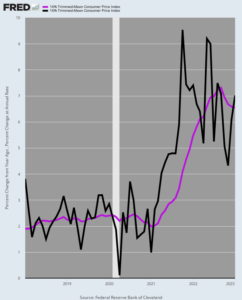

In any occasion, the chart listed below presents the 16% cut mean CPI on both a year-over-year basis (purple line) and a monthly annualized basis (black line).

16% Cut Mean CPI, Y/Y Modification Versus Annualized Rate of Monthly Modification, 2018-2023

In short, years of inflationary finance are coming house to roost. The Fed is not in charge of the cycle and it’s not over-doing its belated attempt to allow interest to return to some semblance of rationality relative to the hidden rate of inflation.

So now would be a good time to duck and cover.

They state that the Fed constantly breaks something but that is only partly true. What it really broke was the cash and capital markets long back, and now there is just more demolition to come.

Editor’s Note: The reality is, we’re on the cusp of a recession that could eclipse anything we’ve seen before. And the majority of people will not be gotten ready for what’s coming.

That’s exactly why bestselling author Doug Casey and his team simply released a complimentary report with all the details on how to survive an economic collapse. Click on this link to download the PDF now.