To understand the Fed’s responsibility for the inflationary catastrophe affecting the American economy, it is needed to start with the Big Lie that underlies all of its destructive machinations: the claim that market commercialism gravitates toward cyclical instability, economic crisis and chronic shortfall from its possible Full Employment path.

From this anticipation, there flows a supposed requirement for continuous reserve bank “stimulus.” Deft action by the main banking arm of the state is purportedly required to compensate for the fundamental prosperity-retarding flaws of the free enterprise.

If Fed policy has in fact been minimizing cyclical instability and pushing the $21 trillion United States economy ever more detailed to its Full Employment potential, then performance development ought to be increasing with time commensurate with the Fed’s more aggressive release of its “stimulus” policies.

In this context, it must be kept in mind that performance development is a purer step of monetary policy effect than total real GDP growth. That’s since the latter is in part driven by long-run demographics and the annual growth of the labor supply.

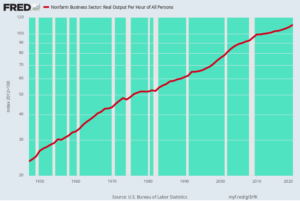

Efficiency growth has exhibited an indisputable decline over the previous 72 years, even as Fed policy has become drastically and chronically more “stimulative.” For purposes of analysis, we have divided the 1947– 2019 period, when efficiency growth balanced 2.14% per year for the whole period, into 3 sub-periods which roughly track the progressive ratcheting up of central bank stimulus policy.

During the first of these durations, the Fed was still tied to the Bretton Woods gold exchange standard and had modest room for stimulus, while during the 2nd period it was simply getting its money-printing sea legs and discovering how far it might actually opt for a pure fiat dollar.

And the final stage started with the monetary crisis of 2008, when the Fed launched stimulus unbound. In this phase the balance sheet erupted from $0.9 trillion to $7.9 trillion during the 13 years after the pre-crisis peak.

Needless to state, Fed stimulus policy and United States productivity growth are inversely correlated, and drastically so.

Nonfarm Labor Efficiency Development per Annum reduced with each phase:

- Gold-anchored dollar era, 1947– 1970: 71% per annum;

- Initial fiat dollar period, 1970– 2007: 03% per year;

- Unhinged fiat dollar age, 2007– 2019:37% per annum;

You simply plain can’t argue with the above analytical riff. Nor can the Fed heads and their apologists claim that long-lasting performance growth is not a suitable measure of their policy effectiveness.

The Fed is pitching a development and economic performance story that is completely baseless.

It’s the Excellent Lie that obfuscates the truth that it’s really in the anti-prosperity, pro-inflation money-pumping business.

Yearly Nonfarm Labor Performance Growth, 1947– 2020

Good sense and casual observation tell you that the Fed got steadily more aggressive in its stimulus policies throughout the unfolding of the 3 durations revealed above.

The following illustrates the point well:

Fed Balance Sheet Growth/ Per Annum Cash GDP Development = Stimulus Ratio

- Gold anchored dollar era, 1947– 1970: 6.6% GDP growth, 2.4% Fed balance sheet growth = 36% Stimulus Ratio;

- Initial fiat dollar age, 1970– 2007: 7.3% GDP development, 6.7% Fed balance sheet development = 92% Stimulus Ratio;

- Unhinged fiat dollar age, 2007– 2019: 3.1% GDP growth, 12.3% Fed balance sheet growth = 400% Stimulus Ratio

The above leaves out the 2020 data owing to the huge interruption of both the GDP numbers and the financial statistics brought on by the COVID-Lockdowns and the radical financial and monetary experiments carried out to counter them. In fact, the Fed’s balance sheet skyrocketed skyward by $3 trillion, even as cash GDP fell backward resulting in a 13-year trend that was even more over the top:

- Unhinged fiat dollar age, 2007– 2020: 2.9% GDP development, 17.1% Fed balance sheet growth = 590% Stimulus Ratio.

At the end of the day, the only real policy “tool” the Fed has is its printing press. Specifically, it can not really move interest rates lower, carry out QE, ease monetary conditions on Wall Street or accommodate much better financial performance on Main Street (to utilize its preferred nomenclature) except by expanding its balance sheet.

Accordingly, the ratio of Fed balance sheet growth to cash (nominal) GDP growth is a close quantitative proxy for its level of “stimulus.” And on that measure, the outcomes are the opposite of the deteriorating performance pattern shown for the three durations above.

Stimulus has actually gone parabolic.

How did efficiency grow by 2.71% per annum over 1947– 1970– double the 2007– 2019 rate– when the Fed’s balance sheet grew by a mere 2.4% per annum or simply 38% of the growth rate of small GDP?

The reality is, we are handling narrative, not facts or analytics.

The Fed’s ridiculous money-pumping is so practical for both Wall Street speculators and money-movers and Washington’s debt-addicted politicians that nobody concerns the story. Nobody points out that the emperor of enhanced economic development and performance is buck naked.

Editor’s Note: The Fed has already pumped huge distortions into the economy and pumped up an “everything bubble.” The next round of money printing is most likely to bring the circumstance to a breaking point.

If you want to browse the complex financial and political situation that is unfolding, then you need to see this freshly released video from Doug Casey and his team.

In it, Doug exposes what you require to understand, and how these harmful times could affect your wealth.