By Tom LUONGO

Every Wednesday and Sunday morning I tape-record a private podcast for my patrons. I cover gold, silver, oil, the Dow Jones and Bitcoin at a minimum. This past Sunday I mentioned throughout my oil commentary I thought the six-month long weakness in oil was exaggerated.

Recently’s price action plainly concurred with me as the futures markets finally saw some position squaring into the quarterly close on Friday.

At least that’s what I thought at the time. It turns out that there were a great deal of individuals who must have understood that OPEC+ was going to announce a surprise production cut while I was yammering into a microphone Sunday early morning. Since they bid oil up into the quarterly close using the tailwinds of strong closes throughout the whole ‘concrete properties’ space– gold, stocks, United States treasuries, commercial metals, and so on– as cover.

The ‘deflation trade’ hit its peak when Brent unrefined futures bottomed near $70 per barrel on March 19th.

Thanks to OPEC+’s announcement Brent Crude gapped open at ~$85 per barrel. West Texas Intermediate (WTI) moved above $80 and the Brent/WTI spread is trending towards $3.

It was $8+ a few months ago. This is great news for United States producers and exporters. The oil market had a fundamental supply and need mismatch. Back in January even the IEA was talking almost a 1 million bbl/day mismatch between supply growth(1.9 millionbbls/day). Which was with an economic downturn on everyone’s lips to begin the year and China locked down. Today their outlook more sanguine but mainly on disruption due to the embargoes against Russian oil.

That disturbance, like all things, is short-lived. Carry expenses will increase due to rising inefficiencies however the structural demand will stay the exact same. This supports, not weakens, greater oil rates. Goldman Sachs, whose statements one ought to always salt to taste, has been screaming that the action in the oil pits has

defied reason for months. As veteran readers well know I’ve been grumbling that this move down in oil into the $70’s was complete nonsense, an item of futures adjustment through headings and constantly dubious inventory information. Seeing the Volatility Splash By … I have actually viewed the volatility in oil take off considering that”Biden’s”war on Russia started

. You can see it plainly in the weekly

charts … just take a look at the candlesticks on each half of the chart below (demarcated by the

vertical black line). You do not require numbers or years of market analysis behind you, simply utilize your eyes. The war isn’t simply being combated on the ground in Ukraine. It’s being fought in the capital markets. Oil is the most crucial market on the planet, even more crucial than the United States dollar or the US Treasury markets. Here I disagree with Martin Armstrong, not due to the fact that those markets are n’t bigger and impact worldwide capital flows more than oil (they do), however because without a relatively

steady market for pricing oil there can be no trade. The instability of our interest rate and currency markets are downstream of this increased volatility in oil. The same thing, by the way, took place to the Dow Jones after President Trump was chosen

. I had to modify my information sets for determining my quantitative tools for assessing the weekly state of the Dow because volatility tripled. This made older information useless in assisting me in seeing the chances of moving greater or lower week to week. Targeting the United States stock exchange with volatility was a way to undermine Trump while pressing the United States dollar lower although Jerome Powell was attempting to raise rates of interest pre-COVID-19, only to be assaulted by means of COVID and Trump’s short-sightedness.

The bottom line is this: the way to damage a market is to make it too volatile for the average person or even little hedge fund to trade. Constantly whipsawing the cost from hither to yon and back again makes it impossible for the small players

in the futures markets to preserve their margin requirements. Eventually, they are either the victim of ‘volatility washing’or just quit and go trade something that isn’t batshit outrageous. When you do this, flush out the little specifications(speculator, s )you reduce market liquidity and make it the toy of those with the inmost pockets. This has been the playbook utilized in the rare-earth elements for years which guys like Craig Hemke(TF Metals Report)and others appropriately grumble about. Multi-Front War Do you see why OPEC+would reveal a significant production cut at this moment in time? Brent is becoming a damaged market. Biden left the US vulnerable to a price shock with an empty SPR while preparing for at least one ground/naval war. Europe is already screwed. Lagarde is protecting the euro to offset energy imports at greater costs from the United States,

now Europe’s biggest provider. This is eliminating US/EU credit spreads. Because Lagarde can either secure credit spreads or she can secure the

euro however she can’t do both without outdoors aid. Biden was supposed to help Europe(and Davos) by selling

them the SPR as the rate came down and locking out Russia via sanctions and Janet Yellen’s moronic price cap. They were supposed to have control over oil costs such that they could drive them into the$50s or perhaps the$40s to break Putin’s and bail out Europe’s economy. This would have crushed inflation, stopped the rates of interest hikes, and quelled the unrest around the continent

. Rather OPEC+did precisely what you would expect them to do in this scenario, reveal a production cut and require the reserve banks of energy importers to protect their currencies. The person laughing his ass off right now is Jerome Powell. Take a look at the marketplaces today and you’ll see what I see– a massive cost-push inflation trade.

Gold through$2000, Silver up, Oil up, bond yields down, stocks up strong. But at the exact same time those signals can likewise be reinterpreted as ‘cash getting to ground ‘rather than being let loose because of new economic growth. In any case it does not matter, these market responses tell you heading inflation, not just core inflation, is likely to stop falling here as oil reverses and OPEC +takes it back towards $100/bbl. Oil’s refrained from doing rising here. OPEC + will safeguard its cumulative bottom line and press the fiat kids to their limit. I mean if somebody declared war on you would you sell them your primary export and the actual fuel for that war at a major discount rate? Just if you hated your own nation … … however enough about Barack Obama.

As I went over because video for my clients, Saudi Arabia is making very big moves to modify its obligations– far from the West and towards the RIC Alliance (Russia, Iran, China). This is the core of the much larger BRIICSS alliance– which now consists of India and Saudi Arabia. These are long-term moves, making an enormous oil refinery handle China, stabilizing relations and ending up being a’dialogue partner’with the Shanghai Cooperation Company(SCO ), just among others. And considering that the Saudis

are not a’democracy’their government can not be gamed through electioneering.

Davos stated war on oil the second Russian tanks crossed the border into Ukraine last February. They tried to bully OPEC into

separating Russia, kicking them out of OPEC+. They stopped working stunningly. The defection of the Saudis is the biggest tactical defeat of this entire war. Without a compliant KSA there is no managing oil costs and, by extension, the ability to control asset costs worldwide through currency trading. Here we are 13+months into this fight and Ukraine has all but lost the war

. Bahkmut is done. Zelenskyy has actually lost the support of the military and only the warmongers at the top of NATO and the EU desire this war to continue. And continue it will.

Finland‘s Davos government fell on its sword on its method out the door to make it a combatant by signing up with NATO. There is too much smoke out there that the West is getting ready for a commercial war

against Russia and China in the

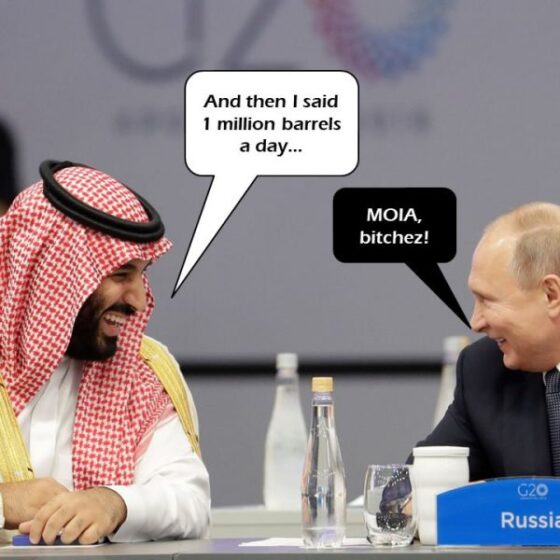

2024-25 timespan. They might lose in Ukraine but another front is simply around the corner. But for all of the focus on Ukraine and the insane disaster of it, the oil pits and the diplomatic backrooms is where the war is really being combated. MOIA or Bust I’ve been screaming MOIA– Make Oil Investible Again– for months in my public interviews since this is how we begin to restore what these vandals have actually currently broken. They still have control of the baseball bat in the

international financial China store. In order to MOIA the manufacturers need to take control over the market. There is no much better method to do that than to require a $10 turnaround in rate in a couple of days to volatility clean the huge Davos specifications out of the marketplace and move a higher portion of oil trading off US and London markets. In March 2020 what started

the financial crisis wasn’t COVID-19, it was OPEC+stating no to production cuts at Putin’s insistence. I composed a post about Russia stating”No. “While I’m not completely in contract with this post today, knowing that Davos utilized this minute to begin its war on humankind through COVID-19, the basic property is still the very same. Putin stated”No”to Saudi Arabia to end up being the de facto leader of OPEC+by utilizing his lower production expenses to get the Saudis to knuckle under and stop playing footsie with the United States who was utilizing them as a weapon versus Russia and the entire International South. This was Putin’s chance to finally strike back at Russia’s tormentors and cause genuine pain for their unethical habits in locations like Iran, Iraq, Syria, Ukraine, Yemen, Venezuela and Afghanistan. He is now in a position to extract maximum concessions from the U.S. and the OPEC nations who are supporting U.S. belligerence against Russia’s allies in China, Iran and Syria. We saw the beginnings of this in his dealings with Turkish President Erdoganin Moscow, extracting a ceasefire agreement that was nothing short of a Turkish surrender.

Erdogan asked to be saved from his own stupidity and Russia stated,”No.” This was the turning point in the oil markets. Russia used its position as the provider of the minimal barrel to force OPEC to heel and put pressure on US neocon foreign policy. Obviously Europe would cut itself off from Russia, considering that it’s been their stated policy for decades, c.f. the Environment Change Hoax. However if you do that and don’t bring the producers to heel, if you don’t break the cartel, you can’t manage the rate. Putin acquiring control over OPEC+

and after that treating the cartel, which the United States had been trying desperately to break, like kings rather than’ the aid,’he set the phase for the in 2015 when the KSA led the rest of OPEC in defying the US/EU/UK over sanctions on Russia’s markets. Davos’ reaction was foreseeable, attack oil costs through the futures markets by destroying liquidity while requiring costs listed below the all-in-sustaining expenses for

nations like Saudi Arabia. Powell undermined Yellen’s quest to break oil by pressing European capital markets while they were vulnerable to not only energy rate shocks but likewise interest rate and credit shocks. Seen that method the mother of all monetary nuclear weapons has actually detonated over Europe but the radiation cloud hasn’t rather killed everybody. The Saudis, predictably, courted China to pay in yuan and join the institutions constructed by Russia/Iran/China to limit their currency direct exposure and lower their internal expenses. All Russia and KSA needed to do then was wait for the perfect

minute (1st trading day of Q2 2023)to reverse the March 2020″No” minute, by supporting oil prices rather than combining power over them. What this does now is make sure that any war the neocons have planned for the future will be fought with much greater interest rates, much weaker currencies and much higher effective oil costs. Cost-push inflation will return in the second half of this year.”Biden”will not have the ability to fill up the SPR. Debt ceiling talks must end with Matt Gaetz informing”

Biden” and Yellen to pound sand, we’re cutting costs while the leveraged Eurodollar markets continue diminishing alongside the petrodollar. And the neocons, at that point, can only whimper

and try one last time to engineer a false flag that no one will think, due to the fact that they have actually cried’Russian bear’ a lot of times. The economic crisis on the horizon Powell has actually purposefully stimulated to erase the dumb collectivism funded by Yellen’s ZIRP bucks need to drive political instability in Europe that far dwarfs the carnival barker sideshow of Trump’s indictment.

Tree fulfill saw. Examine and mate. tomluongo.me