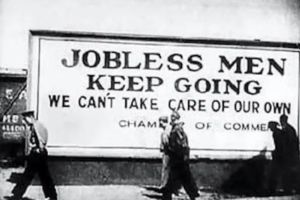

Financial experts of all types have been anticipating that the United States is heading for a financial collapse; enough of them that we need to take it seriously. While they might not settle on when it will take place or what the actual trigger will be, they agree to its inevitability.

Normally speaking, when preppers and others want to talk about the problems connected with a monetary collapse, they rely on the Argentinean collapse of 1999 as their example. While that is probably the most significant such example in recent times, they typically appear to forget that we have likewise experienced such an occasion, here in the United States.

It was called The Great Anxiety. The Argentinean collapse might be more recent, however the Great Anxiety happened to Americans. That indicates it can very quickly be a far better indication of how Americans would react to another such event.

Lots of people believe that the Great Depression was triggered by Wall Street, however it wasn’t. While the stock exchange crash of 1929 influenced it, kicking it off, that alone didn’t bring the nation to the point of economic anxiety.

With the terrific loss of wealth that the collapse of the stock exchange caused, people became more conservative in their purchases, conserving money instead of investing it. However there were other problems too, which constructed on that.

Related: How to Keep Your Money Safe for When SHTF

We can justly say that the supreme cause of the Great Depression was federal government financial policies. The Smoot-Hawley Tariff Act of 1930, lauded as an attempt to protect American company, was really an effort to increase federal government profits and control, by implementing tariffs on over 20,000 imported items.

We can justly say that the supreme cause of the Great Depression was federal government financial policies. The Smoot-Hawley Tariff Act of 1930, lauded as an attempt to protect American company, was really an effort to increase federal government profits and control, by implementing tariffs on over 20,000 imported items.

This triggered a collapse of world trade, which likewise fed into producing the Depression.

Even that wasn’t the ultimate cause of the Great Anxiety. Eventually what took an economic crisis and turned it into a depression was the general public losing faith in the banking system. This loss of faith was a natural outcome of some banks failing.

People took a look at that and understood their bank could stop working simply as well and chose that their life’s cost savings were better off under their bed mattress, rather of in the bank.

There are some political leaders who can’t keep themselves from tinkering the economy, as if they understand it and think they can make it do what they want to. But the truth is that our economy is so complex, that it is unlikely that anyone completely comprehends it.

Even financial experts, who are expected to comprehend it, can’t pertain to an arrangement on the rules it runs under. So, when Congress or the sitting President start tampering financial policy, it’s likely that the outcome will be unfavorable.

That leaves you and I with the need to take precautions, so that we do not make the same errors our forefathers did back in the 1920s and 30s.

Another Great Depression might be best around the corner and we could be setting ourselves up to be victims of it. We require to understand the errors they made, so that we can a minimum of attempt to prevent making the exact same ones.

Excessive Debt

The first and probably most significant error that individuals made, which led up to the Great Depression was too much debt. Typical people of all occupations were buying into the brand-new Stock exchange, using borrowed cash to do so. This sort of” leveraged buying “was fine as long as the companies that they purchased stock into were making money. However when they lost, the people who had secured the loans didn’t have the money to pay those loans back. This eventually resulted in the collapse of many banks.

The first and probably most significant error that individuals made, which led up to the Great Depression was too much debt. Typical people of all occupations were buying into the brand-new Stock exchange, using borrowed cash to do so. This sort of” leveraged buying “was fine as long as the companies that they purchased stock into were making money. However when they lost, the people who had secured the loans didn’t have the money to pay those loans back. This eventually resulted in the collapse of many banks.

A number of those very same individuals were excessively overloaded with financial obligation in their own lives as well, simply as people were before the Great Economic downturn of 2008/2009. When they didn’t have the cash to spend for their losses in the stock market, it harmed their households as well, with people losing their homes and other things bought on credit.

Today, the typical American family survives on 110% of their income, putting most family’s financial resources at threat, ought to they lose an income. Just as taken place during the Great Depression, we can anticipate many people to lose their houses, cars and even furnishings, if the economy turns south and they lose their jobs.

Not Having Adequate Cash Reserves

This mistake ties straight into the last, as the only method to secure yourself from excessive debt is to have cash reserves you can use to foot the bill, should something occur to your individual finances or theeconomy in basic. Related: Money Conserving Tips From Survivors Of The Great Anxiety

This mistake ties straight into the last, as the only method to secure yourself from excessive debt is to have cash reserves you can use to foot the bill, should something occur to your individual finances or theeconomy in basic. Related: Money Conserving Tips From Survivors Of The Great Anxiety

The very same people who were buying the stock market, making leveraged purchases, were doing so without any cash reserves to secure themselves versus loss.

This is mainly an issue with being extremely positive about your possibilities for success. That optimism can cause somebody to put everything into their investments, a timeless example of “all their eggs in one basket.” As long as that basket is intact, they are fine; but if anything takes place to it, they remain in problem.

Surviving on 100% Of Their Earnings

The exact same individuals who were investing in the stock market, were doing the exact same thing that many of us do today, living the very best life they could, based on the earnings they had. What this suggests is that they had no buffer between their monthly expenses and their month-to-month income, to take care of unexpected expenses.

When you buy a house today, the lender will generally determine your maximum regular monthly payment to be equal to 28 to 30 percent of your income. This quantity is thought about to be the maximum many people can pay.

If they currently have month-to-month payments, for something like a car, the amount will be lowered to reflect 28 percent of the earnings, after the cars and truck payment is gotten. In either case, that 28 percent implies that the family is living on their whole earnings.

During the Wall Street crash, many people unexpectedly discovered themselves needing to make payments that they couldn’t afford, because there was

During the Wall Street crash, many people unexpectedly discovered themselves needing to make payments that they couldn’t afford, because there was

no extra buffer in their regular monthly income. Some of these people lost their houses. Others lost cars. Those who likewise lost their tasks wound up losing whatever.

Buying Into The Panic

An important part of the Great Depression was the crash of the banking market. Some banks failed, because they had actually lent cash to individuals making leveraged stock purchases.

When those people defaulted on their loans, the banks were left holding that financial obligation. In many cases, the quantity of financial obligation sufficed to run the bank into bankruptcy.

Related: The Great Depression Was Absolutely Nothing Compared To This

The population in basic worried, starting a run on the banks, as people withdrew their funds, putting a growing number of banks into monetary jeopardy.

Although I’m listing this as an error, I’m uncertain there is a service to this issue, as that would require persuading big masses of people that their money was safe, when they might see it wasn’t. The banks which have actually failed recently have gotten a great deal of attention, leading us in the instructions of the same sort of thing happening once again.

The only method to secure ourselves is to get our money out of the banks before a run happens; but that just might assist to bring on the general panic.

Not Having Secure Deposits

When the Great Depression occurred, just the biggest banks were straight linked to the Federal Reserve.

The FDIC, which we are all knowledgeable about, remained in its infancy and most deposits were not guaranteed in any way. Little, regional banks had nothing to support their deposits

The FDIC, which we are all knowledgeable about, remained in its infancy and most deposits were not guaranteed in any way. Little, regional banks had nothing to support their deposits

, besides the loans they made with that money.

Today, deposits in numerous banks are insured by the FDIC. Deposits in other banks are guaranteed by state organizations, similar in organization and operation to the FDIC. This need to indicate that practically all deposits are insured, protecting the average American from losing the money they have actually deposited in the bank.

However there’s a catch to this. Deposits made into a bank that is backed by the FDIC are limited to $250,000 per transferred, per bank. If somebody has $500,000 transferred in a bank and the bank stops working, they won’t receive the complete $500,000, however only $250,000.

The state organizations I mentioned above, which perform a similar function have limitations too, normally lower than that of the FDIC.

No Alternative Strategy

Most likely the worst thing that anyone did, leading to their own death, was to not have a fallback strategy, to be implemented when it comes to a financial or other sort of disaster. In other words, they weren’t prepared to take care of themselves, should something take place to the country. They weren’t preppers.

In a manner, this is somewhat fantastic, as the Great Anxiety happened between World War I and The Second World War. During the First World War, the federal government was encouraging individuals to plant gardens and raise chickens, so that their households would have their own food.

The very same taken place throughout World War II, with the government encouraging people to plant “Success Gardens” in their yards. Somehow, despite the fact that individuals were accustomed to being self-dependent at the end of World War I, they considered that up in the 20 years in between those 2 wars.

It would seem that after living through World War I, individuals would see the benefit of raising their own food and being self-dependent. But that needs a great deal of extra work; work that the majority of people clearly didn’t want to do. They stopped raising their gardens, expecting “the system” to take care of them, similar to people today.

When the next depression or financial collapse occurs, it is those who are prepared to look after themselves, instead of depending upon the system, who will have the best possibilities for survival.

You may likewise like:

6 Places You Can Go Dumpster Diving For Your Prepper Stockpile

6 Places You Can Go Dumpster Diving For Your Prepper Stockpile

How To Make A Year-Round Self-Sustaining Garden (Video)

Essential Survival Know-Hows Modern Individuals Have Forgotten

Worst States To Reside In If You Need to Defend Your Residential or commercial property

Meal In A Jar Recipes You Need To Preparation While You Can Still Manage It