Even though reserve banks all over the world have been raising rates of interest in recent months, food prices just continue to go up. There are a number of reasons this is occurring. To start with, need for food is really inelastic. To put it simply, no matter how high or how low prices go, individuals are still going to need to eat. So even if the Federal Reserve sent out rates of interest into the stratosphere, people would still need to go the supermarket to get food for themselves and their households. Second of all, we are facing some serious long-term supply issues. As I have detailed in previous posts, food production is being significantly prevented in a variety of different methods, and that isn’t going to alter any time soon. There merely is not enough food to feed everyone in the world, and supplies are only going to get tighter in the months and years ahead. No matter what central banks do, this is going to press food prices progressively greater.

Even though reserve banks all over the world have been raising rates of interest in recent months, food prices just continue to go up. There are a number of reasons this is occurring. To start with, need for food is really inelastic. To put it simply, no matter how high or how low prices go, individuals are still going to need to eat. So even if the Federal Reserve sent out rates of interest into the stratosphere, people would still need to go the supermarket to get food for themselves and their households. Second of all, we are facing some serious long-term supply issues. As I have detailed in previous posts, food production is being significantly prevented in a variety of different methods, and that isn’t going to alter any time soon. There merely is not enough food to feed everyone in the world, and supplies are only going to get tighter in the months and years ahead. No matter what central banks do, this is going to press food prices progressively greater.

But even though higher rates of interest have not had much of an impact on food costs, we knew that they would dramatically impact western economies in many other ways. Financial activity is beginning to dry up all over the western world, and as I discussed recently, Europe has actually currently plunged into an economic downturn.

In addition, higher interest rates have burst the worldwide housing bubble, and here in the United States we have entered what will eventually end up being the greatest industrial realty crisis in our whole history.

On top of everything else, hundreds of little and mid-size banks are now struggling to survive because greater rates have actually blown huge black holes in their balance sheets.

After seeing all the damage that they have caused, authorities at the Federal Reserve finally chose to “pause” their interest rate hiking campaign on Wednesday…

Federal Reserve policymakers left the reserve bank’s benchmark rate of interest the same regardless of inflation that has actually run above its target for over 2 years, stating the pause would enable it to assess the effects of earlier hikes on the economy.

The Fed said on Wednesday that it would hold its benchmark rate at a series of 5 percent to 5.25 percent, the variety it set at its May conference and the highest considering that the Fed cut rates at the summer of 2007. At the exact same time, the Fed indicated that it expects to trek at least 2 more times this year.

If they had any sense, they would begin cutting rates.

But that most likely won’t happen for a while.

The bright side is that higher rates have actually crushed economic activity enough that the overall rate of inflation has actually begun to come down…

Overall, consumer costs increased 4% from a year previously, below 4.9% in April and a 40-year high of 9.1% last June, according to the Labor Department’s customer price index.

Naturally you have to take those numbers with a grain of salt.

If the inflation rate was still computed the way that it was back in 1980, it would still be well into double digits today.

And when you take a look at core CPI, it has “hardly budged” over the previous year …

And when you dig into core CPI, the news isn’t nearly so great. In reality, it’s downright bad.

Core CPI, omitting food and energy prices, increased 0.4% month-on-month. On a yearly basis, core CPI rose by 5.3%.

To put that number into point of view, the core CPI increase in May 2022 was 6%. That implies the increase in core CPI has barely budged.

That is really unpleasant.

And what is even more troubling is the truth that food rates in the U.S. just continue to increase…

But what the information also revealed is that food rates continue to increase. According to the brand-new government information, food in your home rates went up 5.8% for the year ending in May. For food away from home, prices have jumped 8.3%.

When once again, it is necessary to remember that the method inflation is computed has changed considerably over the years.

If food inflation was still computed the manner in which it was back in 1980, those numbers would be method into the double digits.

And even with all of the massaging that they do to the numbers these days, there are specific categories of food where the main numbers that we have been provided in fact reveal double digit inflation on an annual basis …

Frozen veggies (18.7%)

Frozen drinks (15.8%)

Bread (12.5%)

Fats and oils (11.8%)

Candy (11.6%)

Cakes, cookies and cupcakes (11%)

Baby food and formula (10.1 )

The expense of living has been escalating much faster than our incomes have, and this is putting huge monetary stress on American households.

Thanks to the quickly increasing cost of living, more U.S. adults than ever are being required to discover a “side hustle”…

As lots of as 2 in five adults in the U.S. have a side hustle, according to a recent Bankrate surveyof 2,500-plus grownups, supporting LendingTree datafrom previously this year that discovered side gigs are up by 13% over the previous two yearsand current Deloitteinformation that discovered more millennials and Gen Zers are adding on part-time tasks. More youthful employees are most likely to need an extra task: 53% of Gen Zers and half of millennials have one, Bankrate discovers, compared to only 40% of Gen Xers and 24% of baby boomers.

It’s a reflection of the state of the economy, which has left numerous Americans– even those making 6 figures– sensation like they’re living paycheck to income. At the end of the day, side hustles have actually ended up being a need for lots of who are having a hard time to take on the speed of inflation and attempting to conserve in the middle of recession fears.

And food inflation is likewise among the reasons that demand at food banks around the country has actually been definitely taking off in current months.

For instance, simply have a look at what is occurring in one area of Oklahoma…

Food banks throughout Green Country are seeing a spike in the variety of people utilizing their services.

Two problems are at play: it’s more pricey to make ends fulfill because of inflation and emergency situation SNAP benefits are ending.

Just since March, the food bank said there’s been a 50-percent boost in people who require aid.

Sadly, this isn’t simply taking place in the United States.

In truth, food inflation is a much bigger problem over in Europe today…

Whether in Spain, Hungary, or Italy, food costs keep increasing in Europe even as inflation relents. Food inflation reached a historical peak in March, up 19.2% over the previous year, and fell to 12.5% in Might. Governments across the continent are attempting to come up with services: Spain waived its 5% tax on food, France reached a three-month pricing contract with grocery stores, and Croatia mandated price controls.

However the interventions don’t seem to be sufficient, and even staples or normal items are impacted. In Italy, the rate of pasta has actually surged by 14% in the previous year, twice as much as total inflation, and the country’s tables are paying a high price for greater energy costs following Russia’s intrusion of Ukraine, together with the resulting wheat scarcities.

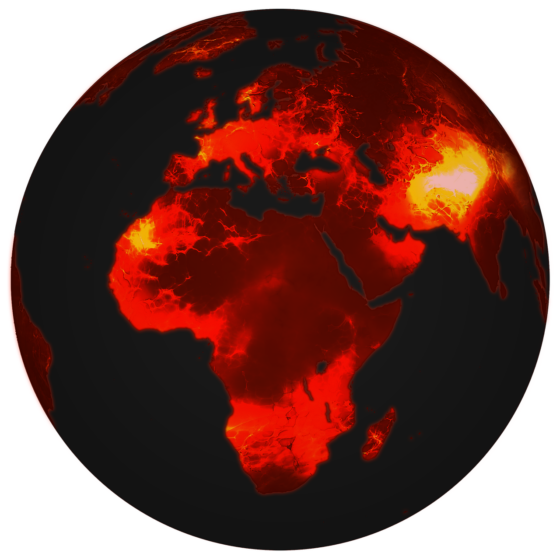

All over the world, food prices are moving up faster than incomes are.

And the outlook for global food production in 2023 is not promising.

Regretfully, this is just the very beginning of this crisis. In my latest book I invest numerous chapters detailing a number of horrible long-term trends that are going to absolutely crush global food production during the years to come.

No matter what our leaders do now, worldwide scarcity is unavoidable.

We aren’t able to feed everybody worldwide today, and international food materials are only going to get tighter.

But most people do not understand the long-lasting trends that we are facing.

Most people simply assume that the “bumps in the road” that we are currently facing are just short-lived and that whatever will be “simply fine” in the long run.

Do not be among those individuals.

Michael’s new book entitled “End Times” is now offered in paperbackand for the Kindleon Amazon.com, and you can check out his brand-new Substack newsletter right here.

About the Author: My name is Michael and my brand name brand-new book entitled”End Times” is now offered on Amazon.com. In addition to my brand-new book I have actually written 6 other books that are available on Amazon.comconsisting of “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Starting Of The End”, and “Living A Life That Really Matters”. (#CommissionsEarned) When you purchase any of these books you help to support the work that I am doing, and one manner in which you can really assist is by sending copies as giftsto family and friends. Time is brief, and I require assistance getting these warnings into the hands of as many individuals as possible. I have actually likewise begun a brand new Substack newsletter, and I encourage you to subscribe so that you won’t miss any of my articles. I have actually released countless posts on The Economic Collapse Blog Site, End Of The American Dreamand One Of The Most Important News, and the short articles that I publish on those websites are republished on dozens of other prominent sites all over the world. I constantly freely and happily allow others to republish my articles by themselves websites, however I also ask that they include this “About the Author” section with each short article. The material included in this article is for general details functions only, and readers need to consult certified experts before making any legal, organization, financial or health choices. I motivate you to follow me on social networks on Facebookand Twitter, and any way that you can share these articles with others is definitely an excellent aid. These are such distressed times, and individuals need hope. John 3:16 tells us about the hope that God has actually given us through Jesus Christ: “For God so liked the world, that he offered his only begotten Boy, that whosoever believeth in him must not perish, but have long lasting life.” If you have not currently done so, I strongly advise you to invite Jesus Christ to be your Lord and Herotoday.