Editor’s Note: Alex Krainer is a buddy of Doug Casey. He’s a products trader, author, and the developer of I-System Pattern Following. Alex writes one of the very best pattern following newsletters on the marketplace, providing dependable, versatile and reliable day-to-day decision assistance for financiers and traders.

His book “Mastering Unpredictability in Commodities Trading,” was ranked the # 1 book on Economist UK’s list of “The 5 Finest Commodities Books for Financiers and Traders” for 2021 and 2022.

— I do not think we’ll have another major banking crisis. In June of 2007, two Bear Stearns hedge funds had large margin calls (over $400 million), which they were not able to fulfill. The fallout from that occasion was limited, and we had a lot of assurances that this was a little hiccup, nothing to worry about, the system was sound, and so on. However the system was not sound at all– it was, and still is very delicate and crisis-prone. For instance, between 1992 and 2002, more than 65 significant financial crises emerged all over the world.

This time, it’s different

The huge one– the Global Financial Crisis of 2008– took place 8 months after the Bear Stearns crisis with the “unexpected” failure of Lehman Brothers. But I do not think that failures of the Silicon Valley Bank and Signature Bank will trigger a cascading avalanche as the Bear Stearns hedge funds set off 14 years back. This time, it’s different. Remember, back in 2008 the Fed was unable to bail out the banking system without Congressional approval. Treasury Secretary Hank Paulson needed to plead for a $700 billion bailout of “too huge to stop working” banks literally on his knees. However such prostration is no longer needed: today the Fed has complete discretion to bail out banking organizations as required. And the requirement is far higher than it was in 2008:

The system is well and really broken; US banks have accumulated massive losses on their bond financial investments, and without a bailout they might be required to offer assets on their books. That would speed up a crisis much worse than what we experienced in 2008. This is that “seed of doom,” which is baked into the fractional reserve banking formula from the start: the bank failures are only a matter of time.

However in a world where central banks have the center to “print” infinite amounts of currency to backstop the losses of the corporate and banking system, stopped working banks can continue to operate, undead for many years and possibly years. The present crisis will most likely used to combine the industry and we might see lots of little local banks stop working or be soaked up as the monopolists gobble up competition, but a failure of the system will not be enabled.

We remain in socialism now, child

So, if the central banks choose to keep the system afloat– bad debts, losses and all– what we undoubtedly get is inflation and a progressive collapse of the currency. In a capitalistic free market system, this should not occur: stopping working banks stopped working and in a free market, bank runs were a periodic occurrence. However we are no longer operating because system: a silent banking coup has taken place and it ushered socialism, though just for the too huge to stop working banks and large corporations. For everyone else, it’s still the rugged, cut-throat capitalism.

I grew up in Socialism and much of what I observe today advises me of my youth. In the former Yugoslavia, we had a bad crisis of stagflation throughout the 1970s and 1980s, however never a banking crisis. I was too young to question how the system worked back then, however it was clear that the central bank was supplying all the liquidity required to keep the system afloat and keep workers employed. But the cost was paid by everyone jointly through inflation which slowly accelerated till the currency became totally useless.

The Fed will print …

I think that the Federal Reserve will tread the same path. The advantage of choosing that path is that the crisis will unfold gradually. The option, permitting the big banks to fail and corporations to declare bankruptcy, would precipitate a fast collapse with mass joblessness and disturbances that might let loose social uprisings with a fallout that might be incredibly difficult to control.

So the choice for main lenders throughout the industrialized world is either to permit free enterprises to operate, or to welcome socialism. It’s an option in between a sudden-onset collapse and an uncontrollable crisis, or “printing” all the currency required to paper over the open financial holes in the system and having a amore gradual and more workable unravelling. I believe no reserve bank worldwide will select the free market commercialism at this moment.

Inflation will flare once again

The consequence of that option will be that the crisis of inflation will continue, inflicting extremely substantial losses on investors. According to Stanley Fsicher’s “Modern Hyper- and High Inflations,” because 1960, more than two thirds of the world’s market economies experienced episodes of inflation of 25% or higher. Usually, investors lost 53% of their acquiring power throughout such episodes. Oftentimes, the losses were much even worse. During the 1970s inflation, United States financiers lost as much as 65% in genuine terms.

In some episodes, like the Weimar Republic 100 years back, the losses came close to 100 %. So what to do? For sure, investors ought to take vibrant action to safeguard their portfolios, and there aren’t very many excellent alternatives.

How to hedge versus inflation?

Contrary to popular opinions, stocks on the whole are not an excellent inflation hedge. Gold and Silver will ultimately shine through and should definitely be thought about. Farmland is another viable alternative. Prior to 2021 I would have recommended Bitcoin as well, but it is not a riskless panacea and I believe it needs to just be regarded as among the possessions to include in a broadly varied portfolio. Nevertheless, there is one property class that surpasses all others when it concerns inflation hedging …

The best hedge: product futures

As a currency’s acquiring power decreases, the prices of genuine things that individuals utilize in their lives will rise, especially energy, metals and agricultural products. This common sense concept is likewise supported by much empirical evidence.

For instance, in the paper titled, “Assessing Managed Futures as an Inflation Hedge Within a Multi-Asset Framework,” released in the Journal of Wealth Management (April 2011), the authors concluded that, “Managed futures outperform the other property classes … No other asset class emerges as a practical inflation hedge.”

Their finding supported an earlier Alliance Bernstein’s research which found that “handled futures” (i.e. direct exposure to product futures prices) had the highest inflation beta of all possession classes:

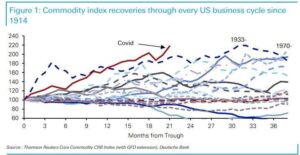

Well, the current crisis of inflation gave us another verification for this: as inflationary pressures slowly developed, Goldman Sachs Product Index skyrocketed more than 3.5-fold, from 231 in April 2020 to 830 in June 2022. Current research from Deutsche Bank’s Jim Reid revealed that this commodities cycle has actually up until now been the strongest on record, eclipsing all of the previous 20 cycles considering that 1914, as the following chart programs:

Product futures double up as

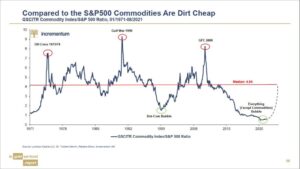

a portfolio diversifier Product futures offer investors with another benefit: they are the ideal portfolio diversifier. If stocks and bonds prices collapse, they’ll take the majority of the property classes with them and there will be couple of escape paths for investors. While commodities could experience sharp corrections in the short term, their down-side is probably really shallow relative to the up-side we could see over the longer term. The chart below shows the historical relationship in between product rates and equities, and we are still near the historic lowest levels:

A simple reversion towards “typical”appraisal levels may present an attractive financial investment opportunity in its own right along with a real means of diversity simply when this is most urgently required. Including exposure to commodities like energy, metals and essential farming commodities should be among the most engaging financial investment alternatives for the years of 2020s.

Markets move in trends

A word of warning is in order: it will not do to simply buy a products ETF and ride the cycle passively might not be the best approach. Commodity rates can be volatile and they tend to be rather sensitive to liquidity conditions on the market. I think that the best, and perhaps the only sustainable solution to uncertainty of market value change is trend following, and preferably methodical trend following.

Trend following deals financiers a variety of crucial advantages, the first of which is fact. Particularly, pattern following is based on the only source of market info that is true, unambiguous and timely: the cost of securities itself. Trend fans can overlook all other info which insulates their decision making from prejudiced reporting, flawed information, incorrect analyses and lies.

Second, trend following totally absolves us of the requirement to be right about the future of markets. The technique will keep you long through up patterns, short throughout down-trends and it will “alter its mind,” when market events necessitate it, unburdened by beliefs and convictions that might show incorrect.

Third, pattern following can considerably enhance financiers’ flexibility and diversity. Since the technique is only worried about evaluating security cost changes, it can be used in any market. You can just as easily trade stocks, bonds, currencies or products, even if you know little or absolutely nothing about those markets. If you think that I overemphasize, I’ll confess that during my career I’ve sold more than 50 different monetary and commodity futures markets and I know next to nothing about most of them. In spite of that I had the ability to consistently outperform my method criteria for 13 years directly.

The adaptability of systematic pattern following could be particularly essential in today’s market conditions. The capability to diversify from the overinflated conventional possession classes and diversify into commodities like crude oil, copper or silver, or even agricultural products like wheat, corn, cotton and coffee could show decisive.

Editor’s Note: The truth is, we’re on the cusp of an economic crisis that might eclipse anything we have actually seen before. And many people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his group just released a free report with all the information on how to survive a financial collapse. Click on this link to download the PDF now.