This is the direct consequence of the Federal Reserve’s years of unprecedented stimulus: extremes of wealth and earnings inequality that offered the most affluent homes the means to bid up real estate to the point it’s no longer economical to the bottom 90%.

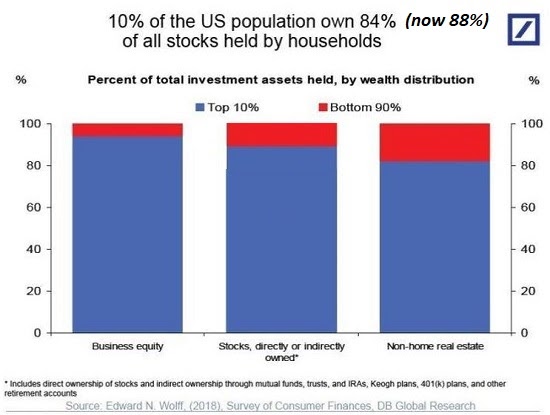

The superficial conclusion that the reason why real estate is unaffordable is a shortage of housing misses a crucial dynamic in supply and need: who has too much money and where do they park it?? The reality is obvious but conventional experts don’t see it, mostly due to the fact that it doesn’t fit the approved narratives. Here ‘s why real estate is unaffordable to the bottom 90 %: 1. The U.S. economy is a bubble economy that funnels the vast majority of gains into the top 10%who own 90%of all income producing assets. Bubbles develop astounding amounts of unearned wealth and disperse it very asymmetrically: the already-wealthy who acquired assets or got them when they were low-cost reap most of the gains. Please examine the first two charts listed below to see how this works. The first chart reveals that the top 10%

own between 85%and 95 %of all income producing possessions: company equity, stocks, bonds and other securities, and non-home realty, i.e. second homes and income-generating residential or commercial properties. The 2nd chart shows that Family Net Worth– focused in the leading 10%– skyrocketed far above GDP in the Bubble Economy, in effect developing$55 trillion out of thin air and handing 90%of it to the rich. Remember that net worth is properties minus liabilities such as financial obligation, so this is what’s left after subtracting liabilities/debts. The less rich tend to have fewer assets and more financial obligations, so someone might hold title to a$1 million house, but if their home loan is$ 900,000, their net worth is only$100,000. Also note that the family home doesn’t produce income, aside from for the owner of the mortgage; to the homeowner, it is a cost, not an earnings source. Turning to the second chart, we see that if Family Internet Worth had actually tracked the basic economy’s growth, i.e. Gross Domestic Product(GDP), it would be less than$90

trillion. Thanks to the Bubble Economy, it’s$145.9 trillion, according the Federal Reserve’s database. That$55 trillion above the real-world economy’s real expansion is an artifact of the Bubble Economy, a synthetic construct of the Federal Reserve’s years of unprecedented manipulation of interest rates and monetary stimulus. Note that in the previous real estate and stock market bubble circa 2006-08, Household Net Worth only exceeded GDP by$ 5 trillion. A nice chunk of modification, to be sure, but an order of magnitude smaller than the big $55 trillion in “bubble wealth “created in the current reserve bank Everything

Bubble. 2. As the chart below of real estate bubbles # 1 and # 2 shows, the Fed’s extraordinary stimulus inflated Housing Bubbles # and # 2. The stock exchange bubble took off around 1995( with the intro of the Netscape internet browser ), and housing’s ascent lagged a couple of years, beginning in the late 1990s.(The chart is the Case-Shiller National Home Price Index.)However Real estate Bubble # 1 truly just took off after the dot-com stock exchange bubble popped, and the Fed aggressively lowered rates of interest: the Fed Funds Rate fell from 6.5 %in summer season 2000 to 1%in the summer season of 2003. It remained at a historically low 3% well into 2005, when the housing bubble entered its rocket booster stage of euphoria. The Fed

eventually normalized rates, returning to 5 %by mid-2007, however as the real estate bubble began popping, the Fed quickly began cutting rates once again, dropping the Fed Funds Rate to near-zero by December 2008 (0.16 %). 3. The wealth produced by the Fed’s stock and bond bubbles flowed into housing. It is not a coincidence that the Real estate Bubble # 1 broadened rapidly from 2000 onward. As the stock market bubble deflated, those who had enjoyed the gains looked for a new place to park their excess wealth, and with interest rates falling due to the Fed, real estate was the location to put that bubble-generated capital

to work: mortgage rates struck historical lows, and the resulting bubble was self-reinforcing: merely securing the purchase rights to an as-yet unbuilt house with a small deposit could produce remarkable gains in a couple of months. Financial fraud– oops, I mean “developments”– added icing to the Fed’s bubble cake: liar loans, zero down payment home loans, adjustable rate mortgages, deceptive packaging of hazardous home loans into extremely ranked mortgage backed securities, etc, sustained the bubble’s last blow-off top. Massive, continual Fed stimulus pumped up Real estate Bubble # 2, a bubble that went ballistic in 2020 as the Fed participated in unprecedented stimulus, doubling its balance sheet to$9 trillion, dropping the Fed Funds Rate from a weak 2.4 %back to zero, and increasing its portfolio of mortgage-backed securities to$2.6 trillion. Fed stimulus also pumped up bubbles in stocks and bonds: as interest rate was up to near-zero, bonds skyrocketed in worth, and the S&P 500 index of stocks soared from 666 in early 2009 to 3,380 in early 2020– a five-fold increase. 4. The large majority of these enormous gains accumulated to the leading 10%, approximately 13 million families. (There are 131 million homes in the U.S.)The top 10% includes the Monetary Nobility(billionaires and those worth numerous millions, the top 0.01%); the Financial Upper class( households worth 10s of millions, the leading 0.5%), the wealthy(net worth in the numerous millions, the top 1%), and the upper middle-class (the bottom 9%of the top 10% ). Historically speaking, the upper-middle class has actually frequently owned more than one home: a trip cabin on the lake or beach, raw land held for investment, or a rental home.

With rate of interest locked by the Fed at unmatched lows, the 12 million households in this class who had seen their stock, bond and property portfolios zoom to shocking heights, tapped their new-found wealth and ample credit to go on a real estate/ real estate purchasing spree. Recall that real estate was still affordable in the mid to late 1990s.

Mechanics and curators might still buy a modest home in a good neighborhood in the San Francisco Bay Location and many other now-unaffordable city areas. When the Housing Bubble # 1 lastly popped, housing was extremely quickly inexpensive circa 2012. 5. Many penny-wise, investment-savvy upper-middle class households acquired residential or commercial properties when they were still economical. It’s not at all unusual for families to own multiple income homes in addition to the family house. Villa bought years earlier

at low rates were transformed to short-term holiday leasings for part of the year, generating income when the household wasn’t using the home. Neighboring cabins were grabbed for investment leasings. The upper-middle class also inherited homes and other possessions. Possessions– for instance, homes– purchased years ago for$30,000 or$40,000 have actually soared to$1 million appraisals in many metro areas– or even$ 2 million in preferable areas. Offering a house for$1+million leaves sufficient capital to purchase numerous residential or commercial properties in less pricey regions. 6. Regrettably for the upper-middle class, the Financial Upper class and the wealthy already own the most desirable properties in the most desirable locations. So the upper-middle class reduced their sights to what was still cost effective, and this has actually driven gentrification: as those with excess capital and credit seek a place to park that wealth that will rise in value, areas that were once inexpensive rapidly become unaffordable down 90%as the leading 10%bid prices to the moon. 7. The tremendous wealth created by the Bubble Economy hasn’t just enhanced a couple of billionaires; it’s created an entire class of rich

numbering in the millions. When 10 million families have the wealth and credit to purchase homes beyond the household house they reside in, that’s a huge pool of buyers– purchasers who have actually seen their preliminary purchases skyrocketing in worth, incentivizing additional purchases of housing. 8. Real estate is priced on the margins, so a relative handful of purchases can push the appraisals of an entire area to the moon. Compared to stocks and bonds, housing is illiquid; deals are couple of and take months to settle.

The last five sales will adjust the appraisal(through appraisals seeking close-by comparables)of the surrounding 100 homes. Corporations and the super-wealthy have actually likewise been on enormous buying sprees, buying hundreds or thousands of homes as rental properties. The $55 trillion in excess”bubble wealth”is always seeking a higher return, and as rents have actually skyrocketed(see chart below), rental housing has been viewed as a safe

and lucrative sanctuary for the trillions of dollars drifting around seeking a low-risk high return. As the last chart programs, the existing housing bubble is even more extreme than Real estate Bubble # 1. It took a much shorter time period to reach far higher heights of overvaluation. This is why the bottom 90 %can’t afford a home: the Bubble Economy developed$55

trillion out of thin air and 90%of that went to the top 10%, a class historically attuned to owning realty for earnings and investment. The bottom 90%skimmed a few dollars in the past 25 years of the Bubble Economy, but nowhere near enough to compete with corporations, the Financial Upper class or the upper-middle class. This is the direct repercussion of the Federal Reserve’s years of unprecedented stimulus: extremes of wealth and earnings

inequality that gave the most affluent households the means to bid up real estate to the point it’s no longer budget friendly to the bottom 90 %. My brand-new book is now readily available at a 10%discount ($8.95 ebook,$18 print): Self-Reliance in the 21st Century. Read the very first chapter for free(PDF )Read excerpts of all three chapters Podcast with Richard Bonugli

: Self Dependence in the 21st Century( 43 min )My recent books: The Asian Heroine Who Seduced Me(Unique) print$10.95, Kindle$6.95 Check out an excerpt totally free (PDF)When You Can’t Go On:

: Self Dependence in the 21st Century( 43 min )My recent books: The Asian Heroine Who Seduced Me(Unique) print$10.95, Kindle$6.95 Check out an excerpt totally free (PDF)When You Can’t Go On:

Burnout, Numeration and Renewal$18 print,$8.95 Kindle

:

A(Revolutionary)Grand Technique for the United States(Kindle$9.95, print$24, audiobook)Read Chapter One free of charge (PDF). A Hacker‘s Teleology: Sharing the Wealth of Our Shrinking Planet(Kindle$8.95, print$20, audiobook $17.46)Check out the very first section totally free(PDF). Will You Be Richer or Poorer?: Earnings, Power, and AI in a Shocked World (Kindle$ 5, print$10, audiobook)Read the first area totally free(PDF). The Experiences of the Consulting Thinker: The Disappearance of Drake(Unique)$4.95 Kindle ,$10.95 print); checked out the very first chapters for free(PDF)Cash and Work Unchained$6.95 Kindle,$15 print)Read the very first section free of charge Become a$1/month customer of my work by means of patreon.com. Sign up for my Substack totally free NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail remain confidential and will not be provided to any other specific, business or company. Thank you, Tom($50), for your magnificently generous Substack subscription to this site– I am significantly honored by your support and readership. Thank you, mjover($50), for your magnificently generous Substack membership to this website– I am greatly honored by your assistance and readership. Thank you, vailsail ($ 50), for your splendidly generous Substack subscription to this site– I am significantly honored by your support and readership. Thank you, Gosho($50), for your marvelously generous Substack membership to this site– I am significantly honored by your support and readership.