“This work was strictly voluntary, however any animal that absented himself from it would have his rations reduced by half.”

George Orwell, Animal Farm

Everything is now political.

ESG, climate change, racism, gender, vaccines. Ask yourself why is it that all of these things are non-negotiable? Why can’t they be gone over? Why is there no space for dissent, questioning, and discourse?

Something is wrong. Consider it.

The pointy shoes at the IMF inform us that the pandemic will cost the world $28 trillion by 2025, which means it’ll be much, far more.

The reality is the pandemic isn’t the cause. The lockdowns, nevertheless, are.

Understanding just what this “pandemic” is, is actually crucial to comprehending everything happening worldwide and in financial markets both now and in the future.

This virus is statistically as hazardous to the population as a bad flu. “No, not possible, Chris. Look at the action by governments. Definitely that’s disproportionate.” Yes, it is, but there is a reason.

To understand the response to this more fully we require to go back to 2008 and then walk forward tracking the unfolding events.

Following the real estate crash and subsequent banking crisis QE was brought in as the tool to “fix” what could have and must have been fixed by letting the banks fail and prosecuting and jailing Wall Street bankers in addition to regulatory agencies who were all willfully and intentionally involved in an enormous fraud.

The economy has been hanging by a thread since.

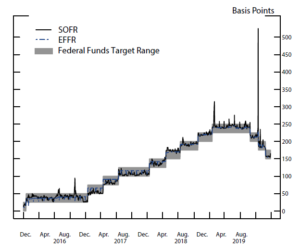

Then in 2019 the money market seized up with the over night financing rate shooting up, causing the pointy shoes at the Fed (and the ECB in coordination with the BOE, too) to action in to “fix” it.

They printed upwards of 100 million smackaroos PER NIGHT.

Lenders must have been shouting … however they’re not

. Why? Since the start of 2020 the major central banks around the globe have expanded the money supply by anywhere from 30% to … how do I even say this without my throat catching? Better yet a visual to show the circumstance.

The reserve banks would have struggled to do this without drawing attention to their scandalous behaviour if it weren’t for the scapegoat of Covid. “This is extraordinary,” they inform us. “We need to do something,” they state.

To convince the public of the absolute need for the tyranny now enforced, they have actually utilized every lying trick in the book, and when discovered and exposed quickly and mercilessly acted to guarantee the reality is “canceled”.

Breach of community standards. No reference made of what this community is or what the guidelines are. The level of diversion availed by the Covid fraud is spectacular and has permitted the most outright transfer of wealth in history.

This money has actually been printed not to supply “covid relief” as is being offered to a gullible public but to bail out the banks in a more tasty fashion.

If direct bailouts were enacted, the outrage would have likely been of far greater magnitude than the 1% protests that followed the 2008 fiasco. Instead, they selected to funnel the capital straight to the consumer.

Make no error about it however, without this we ‘d remain in a full-blown banking crisis. This is why we don’t have banks failing and the fat cats on Wall Street chewing their fingernails.

Less than 3% of money supply remains in physical format. The balance is all debt-based cash. Cash is brought into blood circulation by the development of financial obligation. This debt problem has actually grown to uncontrollable eye watering levels. It will collapse and remained in the process of doing so back in 2008. It will do so once again in 2019 when the cash market seized up.

The desperate requirement to hold this ball of wax together was why in 2014, bank bailouts not sufficing, they enacted laws to permit bank bail-ins. Meaning that they can (and will when necessary) seize client deposits in order to bail out the lenders.

That it is legalized theft won’t matter. As is always the case the average Joe has no concept about any of this and happily plonks his hard-earned incomes in the bank thinking that he is a customer which the bank exists to serve him. Consumers of Cypriot banks thought the very same thing right up till they received a stunning jolt of truth back in 2013.

Something to remember is that you can’t have a collapse like this without taking the currency down with it. Never ever happened prior to in history and it isn’t going to happen this time around either.

The coming issue is this. We have a truly monstrous increase in money supply, and if we open the worldwide economy back up, we’re going to then get a boost in velocity. I.N.F.L.A.T.I.O.N.

. While the money invoked and offered to the banks in 2008 caused an explosion in “growth possessions,” the money now printed has been fed to the general people (who then do not default on their financial obligations to the bankers).

It solves 2 problems for the pointy shoes. To start with, it guarantees the bankers don’t go bankrupt. And secondly, it turns a working class into a servant class.

You see, when you work for a living and vote for your federal government, they are dependent on you. But when you don’t work for a living and are reliant on your government then you are a servant to them. The functions are entirely reversed.

To sum it up

We have actually entered a time period where ideologies are driving actually everything.

Concepts and viewpoints are becoming weaponized.

What is essential to comprehend is that this absolutely is and will drive capital streams more than ever.

This will affect economies and sectors.

This is the fourth turning, and it will run till it collapses or implodes on itself.

Editor’s Note: The Fed has actually currently pumped massive distortions into the economy and pumped up an “whatever bubble.” The next round of cash printing is likely to bring the scenario to a snapping point.

If you wish to browse the complex financial and political scenario that is unfolding, then you require to see this recently launched video from Doug Casey and his team.

In it, Doug reveals what you need to understand, and how these unsafe times might affect your wealth.