There has been a lot of hype surrounding the announcement of a “super battery” for New South Wales in Australia. I’m not sure why they can’t just call it what it is: a massive boondoggle.

Super implies it’s… well, super. It’s not. It’s just a big inefficient battery. People with stern faces tell us that this is going to be “the biggest battery in the Southern Hemisphere and will help replace coal fired power stations.” They’re podium donuts who haven’t a clue what they’re talking about.

So this battery 1.4GWh is to replace (albeit go towards replacing) this mother which produces about 40GWh per day.

So it would take about 28 of the “world’s biggest batteries” to store the electricity generated by this power plant for just one day. Oh, and this power plant accounts for some 20% of NSW’s electricity consumption.

What the hell are we missing here? I hope we are missing something because the consequences of this ideology are truly frightening.

This is scary stuff (if you are blessed with living in the “lucky country”): Australia’s energy market operator is preparing for more coal-fired power stations to close down many years earlier than planned and expects all of Victoria’s coal plants to be shut by 2032, demanding a massive expansion of renewable energy and 10,000 extra kilometers of power lines to connect the grid.

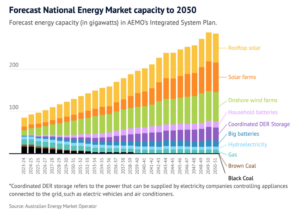

In its official 30-year road map recently released, the Australian Energy Market Operator (AEMO) said it expected 60% of the eastern seaboard’s coal fleet to exit the electricity grid within the next decade by 2030 while the last remaining plant will shut by 2042.

What about costs? Ah who cares about pesky facts:

AEMO, which manages the electricity system across the country, has spent the past two years consulting 1500 stakeholders to deliver its Integrated System Plan to show what it expects the energy grid will look like out to 2050.

In order to maintain reliable and affordable power during the transition to clean energy, AEMO chief executive Daniel Westerman said that by 2050, wind and solar farms must grow ninefold and the amount of backup supply for renewables must triple, while 10,000 kilometers of new power lines is needed – enough to link Sydney to Mumbai.

“It is urgent but it is achievable. And we need to act now,” Westerman said.

If you’re asking the question of where the money is going to come from and at what cost, that’d be a really interesting question to have answered. But we also wonder how much electricity will cost in 10 years (if you can get it).

Backing up the podium donuts rhetoric are impressive forecasts.

What amazes us is how forecasts can be made like this when they are based on myriad often ridiculous assumptions about the climate, which is subject to change. One thing we can assure you of is this: the cost of capital required to build these is going higher and the materials required to build these is going to cost much more than their “assumptions.” We are sleepwalking into a catastrophe led by braindead hall room monitors.

Something else. We notice a distinct lack of nuclear energy. Perhaps this is just because it is politically unacceptable for nuclear energy in Australia. Then, by definition, this forecast is based on a politically acceptable ideology rather than economics and certainly has nothing to do with “protecting the environment.”

Investment implications? My goodness, this will require a hell of a lot of minerals, copper, nickel, aluminum, concrete, steel etc. We will NOT have enough of it. For sure, there aren’t enough 9-year olds in the Congo. Perhaps we’ll need to begin using 7-year olds? Aside from that, the finished product will mostly come from China, and to make the stuff they will require lots of — deep breath — coal.

Editor’s Note: Disturbing economic, political, and social trends are already in motion and now accelerating at breathtaking speed. Most troubling of all, they cannot be stopped.

The risks that lie ahead are too big and dangerous to ignore. That’s why contrarian money manager Chris Macintosh just released the most critical report on these trends, What Happens Next. This free special report explains precisely what’s coming down the pike and what it means for your wealth and well-being. Click here to access it now.