Much of my career has been in banking or associated monetary services including everyday, hands-on management of large-scale deal processing centers for one of the world’s largest banks.

Concern 1: What’s your individual procedure of inflation?

Weekly grocery costs? Filling your tank at the gas pump? 9mm or 5.56 ammo when you find some? Medical expenses? Your private perceptions are affected by personal purchasing preferences, geographical differences, city vs. rural costs practices, size of household, and earnings level.

For starters, take a really doubtful take a look at the 7.5% CPI reported as the 12-month boost for January 2022. The figures published by the Bureau of Labor Data are the ones frequently cited in the news. It’s hard to disregard them specifically the contrast to the CPI as reported in 1979, 1980, and 1981 which reached a high in March 1980 of 14.8%. That number in seclusion offers little financial context. The Fed Funds overnight rate hit 19% in December 1980 and again in June 1981. Home mortgage rate of interest peaked at 18.5% in 1981 while the prime rate reached 21%. In early February 2022, 30-year set rate home loans varied from 3.75% to 4.125%. The prime rate for large corporate borrowers was 3.25%, and Fed Funds had a weighted average of 0.08% (less than 1/10 of 1% or really close to no!)

According to the US Energy Information Agency at the national average fuel rate was $2.00 at the time of the election in 2020. The comparable price today is $3.37 or a 68% increase in 15 months. Even that high price will look low-cost in another 9 months. Energy prices ripple through the economy making them an essential leading indication.

There are two significant issues utilizing CPI as your yardstick. First, these released numbers are a tracking indicator and not a measure of what you will pay next month for groceries, gas, heating oil, or ammunition. Second, by its own released record, the BLS has actually made three major modifications given that 1980 in its methodology (1987, 1998, and 2018) changing from what was formerly a contrast of a repaired basket of items (COGI or expense of goods index) to a lifestyle choice of substitutable products (COLI or expense of living index). Suffice to state that comparing CPI for 1980 to 2022 is a rigged method of reporting a lower rate of genuine inflation. (For readers thinking about the information, take a look at the BLS reported changes. As you can think of, it’s like comparing the cost of one pound of fresh ground hamburger at the regional butcher store in 1980 to 4 Quarter Pounders at a McDonald’s drive through in 2022. What can a great bureaucrat do to keep a cover on stress and anxiety? Change the guidelines …

In the most basic terms, costs increase when demand overtakes supply and when huge budget deficit is paid for by increasing the money supply and keeping rate of interest artificially low.

Question 2: What’s your individual leading sign of an imminent societal collapse?

Leaving billions of dollars of military hardware in the hands of the Taliban who might be itching to utilize it? 2 million unlawful immigrants streaming throughout the borders of Texas and Arizona who might wish to elect more complimentary handouts? The internal revenue service requiring PayPal and Venmo to report to them all electronic transfers greater than $600? The ATF illegally having more than one billion scanned and electronically stored records of gun purchases? Foreign nation-sponsored cyber-attacks against the electrical grid, fuel pipelines, DOD computer systems, and United States banks? Construct Back Much Better? The Freedom to Vote Act? Joe Biden’s newest word salad speech before being led off the podium by Jill Biden for his ice cream cone?

All the risks to normalcy that get any sort of press coverage– Ukraine, Taiwan, Afghanistan, pandemic, earthquakes and cyclones, stock exchange collapse, and arming the Taliban– are simply the warm-up acts for a genuine SHTF crisis. All of those possible interruptions and a number more may make our lives less safe and a lot more bothersome, but by themselves, they will not cause a broad scale social collapse. After all, we can just decrease our expectations as we have actually already been informed to do.

There is one trusted predictor of real problems about to happen– and it will be apparent.

The Schumer will strike the fan when financial transaction processing picks up more than two or 3 days. Within hours of the moment that “money” stops working, extraordinary civil violence will occur in significant cities and many other metropolitan locations with a broad scale collapse following whether or not Biden’s handlers unilaterally buy the US military to intervene.

“NOTHING TO SEE HERE … RELOCATION ALONG … RELOCATION ALONG”

These big volume transaction processing networks are very protected with numerous layers of security procedures, audit tracks, and multiple information backups plus redundant hardware in hardened facilities. Banks, the automated clearinghouses, and the regional Federal Reserve Banks have actually effectively handled numerous cyber-attacks for many years. These systems likewise have backup power materials and independent power generators at numerous places. All of those fantastic security features will be of no worth if/when some of the greatest hackers worldwide succeed in taking down the system.

An abrupt halt in processing, such as one brought on by a total grid failure that can not be bridged would result in financial mayhem way beyond any collapse of the stock exchange and total loss of confidence in the financial system.

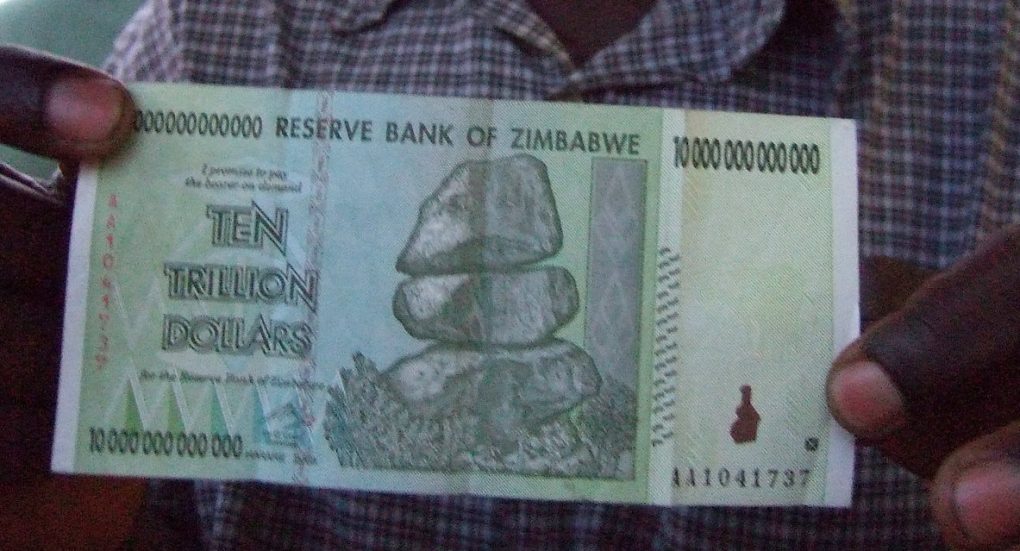

INFLATION IS JUST AS BAD, JUST SLOWER

Less apparent is that runaway inflation would take longer but lead to a similar outcome. Along the path to collapse, bureaucrats in panic mode might mandate bank vacations, limitations on cash withdrawals, and even daily optimums for credit cards. Of course, these steps would be for the higher great and only last for a couple of weeks. Guaranteed. Naturally, you keep all of your money in a bank, right?

Between now and a catastrophe circumstance, we are most likely to experience the grinding impact of increasing inflation in our lives and a political circumstance that makes it unlikely this administration will make a strong effort to suppress a steep climb in CPI or genuine rates of interest. One of the worst components underlying the ongoing price increases is the energy policy executed on Day 1 of Biden’s presidency. Was the Executive Order eliminating the Keystone XL Pipeline just the first step in a grand plan to develop a broad need for more federal government services? Biden’s Build Back Bankrupt proposed legislation and other green initiatives have removed any lingering doubt.

Based on different inflationary periods from the early 20th century and as much as the 1970s as well as modern-day European history, the list below series is plausible but not particular: 2022 might see inflation steadily increasing over the 7.5% yearly rate this January since just fairly restricted actions will be required to curb an inflationary spiral. Unchecked, inflation might double by November 8 and continue to climb in the first half of 2023 despite the result of the midterm elections.

There are three key players responsible for economic and financial policy. Jerome Powell is Chairman of the Federal Reserve. Janet Yellen, who was previously Fed Chair under Obama and Chair of the Council of Economic Advisors (CEA) under Clinton, is Treasury Secretary. Biden’s CEA is composed of 3 social justice economic experts kept in mind for diversity, unusual diversity qualifications, and openly promoting against economic inequality. The Fed, Treasury, and CEA are charged with setting monetary policies consisting of rates of interest such as the Fed Funds rate to keep the economy rolling smoothly, maintain joblessness at appropriate political levels, and pay for the huge spending of the federal government.

From this troika, it is sensible to expect a policy of “Too little, and far too late.” with major concerns about keeping unemployment low and offering a larger safety net for those workers who do get laid off. An abrupt tightening up of interest rates might be off the table since that would probably set off a collapse of the stock exchange and an extreme credit crunch for companies followed by a recession with even higher unemployment. Keep in mind: Raising rates of interest high enough to suppress inflation will also increase the total quantity of interest paid on government financial obligation.

In the next 9 months, no Democratic political leader wants to handle any of the difficult financial or financial policy concerns going into the 2022 midterm elections. That being the case, the CPI could increase by another 6% or 7% reaching an aggregate inflation rate of 13% to 14% by mid-2023 or the exact same level as the March 1980 high of 14.8% with substantial social and political consequences. Democrats and the mainstream media (MSM) will play the blame video game directed against the inbound Republican members of your home and Senate and identify them as racist insurrectionists. If inflationary forces continue to be driven by the Administration’s energy policies, supply chain issues, just modest modifications in financial policy, and a continuous stalemate in Washington politics, which direction do you think inflation is likely to go?

(To be concluded tomorrow, in Part 2.)