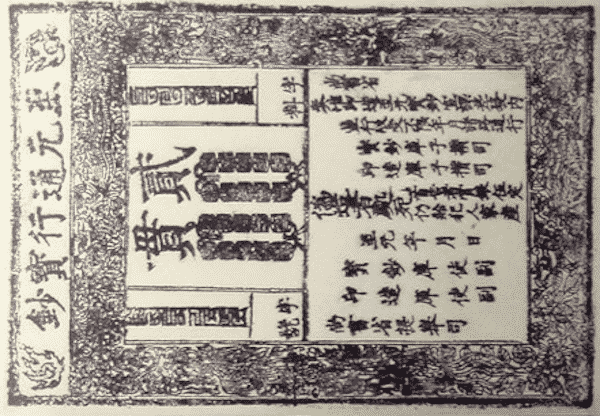

In 1260, Kublai Khan developed the very first unified fiat currency. The jiaochao was made from the inner layer of bark of the mulberry tree. It’s of interest that the mulberry tree was quite typical in Mongolia. What enabled Kublai Khan to get away with dealing with tree bark as currency was that each expense was cut to size and signed by a range of authorities. They affixed their seals to each bill. To even more ensure credibility, forgery of the chao was made punishable by death.

But even then, why would people accept bark as being of the exact same value as gold and silver, which had effectively functioned as “money” for thousands of years? Well, to begin with, the chao was redeemable in silver or gold. However just to make certain it was accepted, Kublai decreed that contradicting it as payment was likewise punishable by death.

Today, we’re more advanced. Federal governments no longer threaten to kill people for refusing to utilize a fiat currency; they just make it very hard to deal in anything however fiat currency.

At the time, Kublai was associated with a continuous war with the Song. The war had drained the treasury and Kublai was finding it hard to continue to fund the war. And so, in 1273, he issued a new series of the currency without having increased the gold and silver in the treasury.

In 1287, Kublai’s minister, Sangha, created a 2nd fiat currency, the Zhiyuan chao, to bail out the previous one, to deal with the spending plan shortage. It was non-convertible and was denominated in copper money.

There’s an old saying that, if you find yourself in a hole, the first thing to do is stop digging. Yet, throughout history, leaders, having actually created a Ponzi scheme of fiat currency and discovering that it has its risks, usually keep digging ever much faster.

In Kublai’s case, as in a lot of other cases in subsequent history, inflation of the chao resulted in financial disaster. The chao became an utter failure.

Today, the majority of dictionaries define inflation as being “an increase in the rate of products”; nevertheless, the traditional definition is “an increase in the quantity of currency in circulation.” A boost in the cost of products due to an increase in the quantity of currency in flow is a near-certain scenario, however it must not be the meaning. This distinction is an essential one, as it permits us to concentrate on the root issue rather than the result.

Marco Polo checked out Asia just in time to see the initial success of the chao. Upon his return to Venice, he informed Europe of the principle of fiat currency. Although he had been in Asia long enough to see the collapse of the currency, Europe required to the idea of fiat currency like ducks to water, and fiat currency has been used in the Western world since.

Not remarkably, European fiat currencies experienced the exact same result as the chao. With time, every fiat currency ever produced has stopped working and always for the same reason: Governments become overextended (generally due to warfare), extreme printing is executed to bail the government out, and the resultant inflation collapses the currency.

Fast-forward to the US in 1971. President Richard Nixon had a problem. The treasury was being drained of gold by trading partners such as France. The US was waging war in Vietnam, which was likewise draining pipes the treasury. Mr. Nixon’s Treasury secretary, John Connolly, with support from other governmental consultants, advised that the president dig the hole deeper, by going off the gold requirement and printing dollars.

Noise familiar?

It’s not likely that Mister Nixon understood that he was making exactly the same error Kublai had actually made, seven hundred years previously, which he was doing so for the precise same reasons, and based upon the exact same recommendations from his consultants.

Nevertheless, the US, at that time the best lender nation in history, stepped off the economic cliff.

And yet, that occurred almost fifty years back. In the past, fiat currency collapse has generally been far swifter. Why has the dollar remained in suspended animation for so long?

Well, for that, we look when again at real cash: gold and silver.

The United States had joined both world wars late. In the early years, the US became the providers of munitions, devices and vehicles for the 2 wars. And more to the point, they insisted on being paid in gold.

(It must be kept in mind here that, as frequently as the United States government and the Federal Reserve have actually attempted to argue to Americans that gold is not actually money, during wartime, the United States would accept absolutely nothing else in payment for products delivered to other nations.)

By the end of the 2 world wars, the United States held the lion’s share of the world’s gold in its vaults and therefore might dictate to the post-war world what the economic requirements would be.

They turned up, first, with the concept that the world would utilize the dollar as the default currency and, later on, that it would be the petro-dollar– the currency to be utilized for the settlement of all oil-related deals.

This put the US on an unique pedestal. After 1971, the US could print all the dollars it wanted and the world would just have to accept it. This, in turn, produced a bubble of debt such as the world has actually never ever seen. The United States became the world’s biggest debtor nation.

But along the way, weaknesses started to appear in the bubble. Oil producers such as Iraq and Libya revealed that they would start dealing in currencies aside from the dollar. The US reacted swiftly, killing their leaders and damaging their federal governments.

Quickly, Iran made the exact same choice and, this time, it was supported by India, China, Russia and even the EU. Furthermore, both China and the EU created their own worldwide payments systems, bypassing the dollar.

Further, countries began disposing United States treasuries back into the United States system.

At present, the dollar is stable, but has a vital health problem. And it has taken place at a time when the United States has actually been in a state of constant warfare for years and is pouring billions each year into that effort. It’s likewise spoiling for war in China. The Federal Reserve has mentioned openly since 2004 that if deflation occurs, it will print as much money as it takes to “fix” the problem– a dedication to massive inflation.

And so, history repeats. On this event, it’s taken longer to play out, as the dollar has actually had such a fantastic benefit over other fiat currencies. However we’re quick approaching the point at which the dollar, like so much mulberry bark, ends up being useless, as have numerous fiat currencies prior to it.

When this takes place, we will find what Kublai Khan found in the thirteenth century– that when fiat currencies fail, the world when again returns to genuine cash: silver and gold.

Those in our own age who recognize this might choose to prepare themselves by transforming their endangered currency into genuine cash.

Editor’s Note: It’s clear the Fed’s cash printing is about to go into overdrive. The Fed has actually currently pumped huge distortions into the economy and inflated an “everything bubble.” The next round of cash printing is likely to bring the scenario to a snapping point.

Its clear that the world is facing a severe crisis on numerous fronts.

Gold is practically the only location to be. Gold tends to do well during periods of chaos– for both wealth preservation and speculative gains.

That’s exactly why we simply launched an urgent video. It reveals how it will all play out and what you can do about it. Click on this link to watch it now.