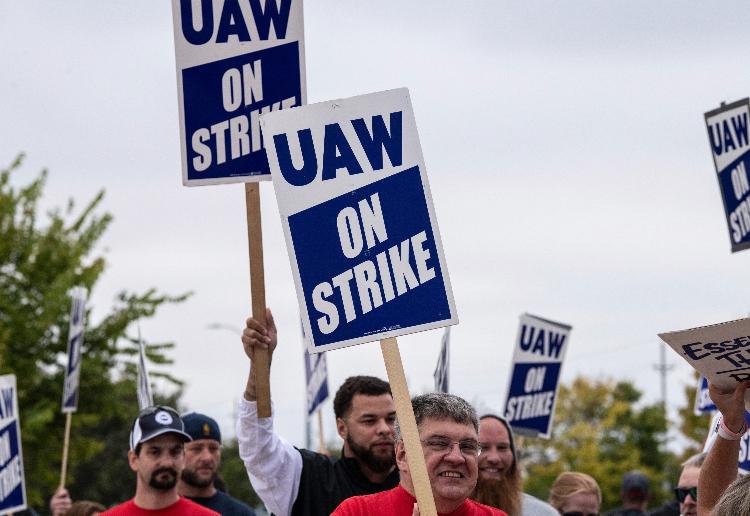

On Friday, September 15, 12,700 members of the United Automobile Employees union (UAW) strolled off the job at plants owned by the “Big Three” automakers– Ford, General Motors, and Stellantis (which owns Chrysler, Jeep, and Ram). The walkout marked the start of a series of long-expected targeted strikes intending to give the UAW utilize as it renegotiates contracts with the three business.

The strike is grounded in frustrations over employee payment. Union members and their supporters indicate high earnings and CEO pay at the Big Three and compare them to stagnant incomes and increasing expenses of living among autoworkers. They seem like they’re being ripped off.

And they’re right. Like the rest of the working class, autoworkers are being swindled. Decades of interventionism have built a financial system that damages workers while assisting the corporate and political classes. The first reason for this is monetary policy. Since President Richard Nixon abolished the gold standard in the early 1970s, a handful of bureaucrats at the Federal Reserve have been charged with figuring out the value of our currency. And those bureaucrats have actually decided that the dollar must decline every year. They aim for a decrease of 2 percent every year, however the rate has actually been higher recently.

Dollar decline is a political option. And it hurts employees. In an unhampered market, cash ends up being more valuable as societies grow wealthier. Goods progress and more affordable. And money saved grows in value.

Under our current inflationist fiat program, the opposite takes place. Cost savings diminish in value by style. The result is spelled out by Saifedean Ammous in his book The Fiat Standard:

The culture of obvious mass consumption that pervades our planet today can not be understood except through the distorted rewards fiat develops around intake. With the cash constantly losing its value, deferring intake and saving will likely have a negative anticipated worth. Discovering the ideal investments is hard, requires active management and supervision, and involves risk. The path of least resistance, the path permeating the entire culture of fiat society, is to consume all your earnings, living income to paycheck.

We can see, then, how monetary policy leads to mass intake, low cost savings, and hyperfinancialization– all at the same time. In fact, among the most notable examples of the financialization of the economy since the 1970s has been the development of the Big 3 automakers’ financial arms– GM Financial, Ford Credit, and Stellantis Financial Providers.

In fact, as Ryan McMaken highlights: “By the early 2000s, a bulk of GM’s profits were coming from its financial operations and not from vehicle production.”

In other words, the automakers have actually made money from the very same federal government policies that cheapen their employees’ paychecks and cost savings.

But financial policy is just one part of the story. Federal governments at all levels limit the supply of real estate by limiting structure. That makes real estate less cost effective. The federal government likewise bids up demand for health care services while limiting the supply of physicians and medical facilities, and it shields drug producers from competitors. That makes health care much more costly. On the other hand, Washington’s farming policy intends to prop up crop costs, which impacts the rate of many foods. All this synthetically increases the cost of living.

That’s bad enough for autoworkers, but the Biden administration is also attempting to require a transition to electric vehicles (EVs). For autoworkers developing engines, transmissions, and exhaust systems, that’s a risk to their jobs. And due to the fact that the ramp-up of EV production is driven by politics instead of customer demand, the shift is set to injure all workers who depend on cars and trucks.

Thinking about all that, it is apparent why autoworkers are frustrated with their monetary situation. However regrettably, their warranted anger has actually been hijacked by another source of their issues, the UAW.

Support for labor unions rests on an financial misconception from the mid-eighteenth century. In other words, it’s the concept that business make earnings by not paying employees the full value of their labor. Eugen von Böhm-Bawerk dismantled this socialist exploitation theory 139 years ago when he introduced time into the analysis. Companies pay employees in today for labor services that might cause commercial goods in the future. Due to the fact that of the universal quality of time choice, the certainty of cash now is often more attractive than the possibility of more money later on, which is why many people select to sell their labor services on the task market.

Böhm-Bawerk’s insights are simple to see in vehicle manufacturing, where workers are paid up front to assist develop cars and trucks that will be offered later on. Still, the flawed concept that revenues signify wage theft caught on, and in 1935, autoworkers established the UAW. Today strikes speak with the determination of this myth.

Labor unions often interest worker uniformity, but in reality, they epitomize the exact reverse. Because as Murray Rothbard has actually shown, they can just raise incomes for some employees by decreasing the wages or eliminating the tasks of other employees. At the Big Three automakers, this can be seen in the heavy use of short-term and part-time employees, who are put on a lower pay tier– the removal of which is paradoxically a core demand of the UAW strike. However this scenario is just what shows up. All those who are obstructed totally from the tasks that would be available to them if not for the union stay hidden.

America’s autoworkers are ideal to be upset about their financial circumstance. However the restrictionist labor demands of the UAW are an interruption that will, at a lot of, help some autoworkers at the cost of others. The real service depends on ending union practices that needlessly pit workers against each other, ending the policies that force business to produce things consumers don’t even desire, ending the wide range of government programs and political advantages that artificially raise the cost of living, and ending the monetary system that ruins the worth of employees’ paychecks and savings while propping up the financial class. Abolish all that, and the advantages will extend far beyond the car industry.