But the status quo has much to unlearn, and it appears the only pathway to a brand-new understanding is a Terrific Depression.

There are two approaches to examining a circumstance:

1. Pick the wanted result– usually the one that doesn’t require any significant changes, sacrifices or downward mobility

2. Identify the initial conditions and systemic dynamics and then follow these to a conclusion back-tested by contrasts with historical results.

Our default setting as humans is 1: choose the result we desire and after that discover whatever bits and pieces supports that conclusion. Cherry-pick data, draw incorrect examples– the field is broad open.

This is why we get so upset when our “analysis” is challenged: we’re forced to ask what occurs to us if our wanted outcome does not transpire, and since the response might be something less than ideal, we violently decline any data or examples that contravene our carefully curated “analysis.”

A great deal of what passes for analysis today is cherry-picked bits and pieces that support a delighted story of endlessly expanding success– AI, fusion, and so on– without any mention of limits, restrictions, costs or worst-case results rather than best-case results.

Let’s begin with a historic analogy most decline: the Great Anxiety of 1929 to 1942. The standard account claims that the Anxiety was the outcome of a “Federal Reserve policy mistake”: the Fed tightened credit when it need to have loosened it.

This is nonsense. What actually happened was credit expanded quickly in the Roaring 1920s, which is why they were Roaring. Farmers could borrow money to buy prairie land to put under the plow, speculators might borrow $9 on margin to play the stock exchange with $1 in cash, and so on.

To put it simply, what occurred was a gigantic credit bubble pumped up that pushed stocks and other properties to unsustainable heights of over-valuation, evaluations based on the Roaring 20s growth of credit and consumption continuing permanently.

But all bubbles pop, and so the weather altered for the even worse and recently plowed prairie turned into a Dust Bowl, erasing greatly leveraged farmers. Given that there was no federal bank deposit warranty (no FDIC), the bankruptcies of overleveraged customers erased countless small banks, erasing the savings of prudent depositors.

So even sensible savers got erased in the crash of the credit bubble.

Stock speculators gambling on margin (i.e. obtained money) were quickly wiped out, and the selling became self-reinforcing, accelerating the cascading crash.

The real policy error was safeguarding the rich who owned the financial obligation from a debt-clearing write-down. The wealthy own financial obligation, the non-wealthy owe financial obligation. When the financial obligation is defaulted on, the lending institution/ owner of the debt has to absorb the loss. The debtor is devoid of the problem. In a debt-clearing event driven by defaults, insolvencies and insolvencies, the wealthy are the losers and the debtors are without the concern of debt.

Different programs were implemented to stave off the repercussions of default, as if pressing losses into the future would somehow enable the credit bubble to reinflate. That’s not how it works: the financial system is like a forest, and if the dead wood of uncollectable bill accumulate and isn’t enabled to burn, then the forest can not foster new growth.

Economies that contradict the wealth damage that arises from credit bubbles popping stagnate. This is the story of Japan from 1990 to today: the status quo in Japan refused to accept the losses, concealing uncollectable bill (i.e. non-performing loans) behind artifices such as brand-new loans that covered the interest due, listing the non-performing loans in “zombie” categories, i.e. as assets that were still on the books at amount although they were basically worthless, and so on.

The net outcome was 33 years of stagnation and social decay as young people quit on owning homes and having households.

Now the US has actually inflated another “debt super-cycle” credit bubble that has actually pressed properties into over-valuation. Once once again the objective is to prevent handing the rich owners of all this financial obligation the huge losses that need to be accepted to clear the dead wood of bad debt, cash provided to customers and tasks that were not creditworthy except in a bubble.

The lesson the status quo drew from the Great Depression is to cover up private-sector over-valuations and bad debts with vast expansions of credit via the Federal Reserve and the federal government. Please look at these 4 charts below:

1. overall credit (TCMDO)

2. the Federal Reserve balance sheet (2 charts)

3. federal debt

All are in visibly unsustainable parabolic ascents.

Predictably, the status quo will contradict the requirement of clearing the dead wood and accepting the trillions of dollars in losses that will accrue to those who own the unpayable financial obligations.

Consider CRE, business property. Workplace towers are now worth one-third of their pre-pandemic valuations, the appraisals on which their home mortgages were based. There is no chance these properties can be magically restored to their previous over-valuation. Huge losses need to be accepted by the owners of the debt. If those losses make them insolvent, so be it. That is unacceptable in a system tailored to safeguard the wealthy at all costs.

However bubbles pop anyhow, no matter policy tweaks. Consider these stock market charts of the Roaring 20s and the Great Anxiety and today (below). The similarity is exceptional– perhaps even spooky.

The big difference between the Great Depression of the 1930s and the Anxiety we’re entering is the world still had enormous reserves of resources to tap and a (by today’s standards) modest population in the resource-consuming established countries.

Remember that a developed-world customer uses up to 100 times more energy and resources than a bad individual in a rural undeveloped country. Recycling a few bottles does not alter this.

This means the planet’s “cost savings account” of abundant, cheap-to-access resources has been depleted. Yes, there is still oil and copper, and so on, however it’s of far lower quality and much more difficult to get now. The abundant ores have been mined and the shallow super-giant oil fields have all been tapped long back. Now the Saudis need to pump stupendous quantities of seawater into their oil wells to preserve production. All these innovations take in vast quantities of energy.

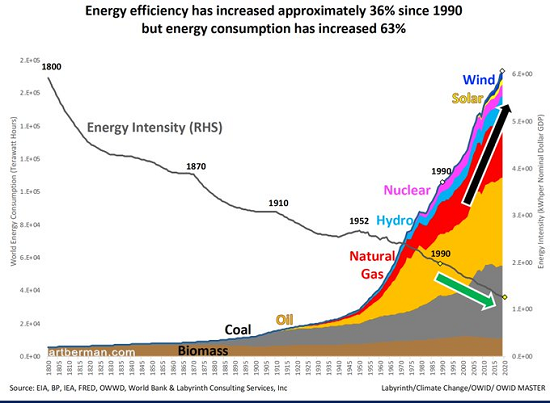

The unavoidable result is the energy efficiency– just how much energy is needed to access, process and transportation the energy– has plunged even as usage has actually skyrocketed.

The outcome numerous wish for is some brand-new miraculously low-cost and plentiful sources of energy such as fusion. However combination is even more complex and challenging than pumping oil, and oil is a high-energy-density fuel that can be kept rather easily. All the electricity created by various technologies can’t be kept quickly or inexpensively, therefore the pleased story is that a brand-new amazing battery innovation is simply around the corner.

But batteries are likewise made complex and resource-dense, so they’ll always be as costly as the products needed to make them. There will never be “affordable” batteries if the products needed to make them are limited and costly to remove of the ground, procedure and transportation.

So the policy options are simple: either protect the rich from write-downs of uncollectable bill and the collapse of asset bubbles and usher in years of stagnancy, or require the rich to take the losses and clear away the dead wood.

However either choice will be constrained by the reality that mankind has already drained pipes the easy-to-get “savings account” of worldwide resources.

I get e-mails from readers who say things like “mining methods are even more effective now.” That’s great, however the majority of these brand-new mines are frequently countless kilometers far from railways or seaports, and thousands of kilometers away from the processing plants that turn the ore into helpful metals.

Remember the enormity of the expense and effort needed to construct a single two-lane highway thousands of kilometers to a brand-new mine, and the oceans of diesel fuel required to power the mining equipment and trucks transporting the ore to railways or seaports. Recall the immense quantities of energy needed to smelt/ procedure these ores, and the near-zero portion of lithium-ion batteries that are currently being recycled.

Batteries are challenging to recycle because they’re not produced to be recycled, and they’re not made to be recycled since that would raise costs significantly, reducing profits.

So on today course, the concept is to make billions of batteries, throw them all in the landfill in ten years, and then my own enough minerals to construct another couple billion batteries and then repeat the cycle of throwing them away in ten years permanently.

That isn’t reasonable, so the status quo will have to get used to this undesirable reality.

This is why I keep writing books about relocalizing, degrowth, utilizing less rather than more to yield a higher level of wellness. The resource “savings account” won’t support dreams of constantly broadening intake of hard-to-get resources.

But the status quo has much to unlearn, and it seems the only path to a brand-new understanding is an Excellent Depression that will not end with a new expansion of credit since the resources required for that new expansion just won’t be readily available or economical.

Decreasing our direct exposure to avoidable risks is a key method of Self-Reliance.

This essay was drawn from my Weekly Musings Reports sent specifically to subscribers, clients and Substack customers. Thank you very much for supporting my work. My brand-new book is now readily available at a 10%discount rate($8.95 ebook,$18 print): Self-Reliance in  the 21st Century. Read the first chapter totally free (PDF)Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Reliance in the 21st Century(43 minutes) My recent books: The Asian Heroine Who Seduced Me(Novel)print$10.95, Kindle$6.95 Check out an

the 21st Century. Read the first chapter totally free (PDF)Check out excerpts of all 3 chapters Podcast with Richard Bonugli: Self Reliance in the 21st Century(43 minutes) My recent books: The Asian Heroine Who Seduced Me(Novel)print$10.95, Kindle$6.95 Check out an

excerpt for free( PDF)When You Can’t Go

, National Renewal: A( Revolutionary) Grand Method for the United States( Kindle$ 9.95, print$24, audiobook

readership. Thank you, themc-k( $50), for your remarkably generous Substack

membership to this website– I am significantly honored by your assistance and readership.