Those who got out early (i.e. now) will be happy they acted quickly and those captured in the decline will regret their faith in a high-cost system that was no longer budget friendly or sustainable.

Our confidence that cities are forever is lost. History notifies us that cities occur and decrease much like civilizations: cities decline when the material essentials needed to support their huge populations are no longer cost effective or readily available in sufficient amounts, or when the financial advantages produced by the city no longer surpass its immense costs.

Let’s begin by reviewing why cities have been features of human life for thousands of years.

The human population has actually become significantly urbanized for engaging reasons that have been in play since cities were founded thousands of years back. In a nutshell, cities offer greater economic/ social chances and more novelty, variety and enjoyment.

Cities became possible when agricultural surpluses made it possible for labor to end up being specialized. This increased:

1. productivity, as proficient workers in workshops, mills, kilns, etc could produce more products per unit of time than families;

2. transport, enabling the growth of trade of commodities from backwoods and produced goods from other cities;

3. commerce, as items could be warehoused in protected entrepots and offered in markets that brought in purchasers from the whole area;

4. governmental services, as taxes on all this activity moneyed facilities and state and military functions;

5. non-governmental functions such as temples, schools, the arts and entertainment.

On the downside, cities were crowded and unhygienic and thus eliminating zones. Cities depend on mass in-migration of brand-new locals to offset the horrendous annual death toll from cholera, afflict and other infectious illness.

Other hazards included conflagrations, being sacked by rapacious armies and widespread criminal offense, especially at night (there were no streetlights in ancient Rome).

Elites gathered together in cities because power was wielded face to face. The ambitious of all classes also gathered in cities, as this was where wealth and power used opportunities to get ahead.

As Fernand Braudel observed in his histories of France and European Capitalism, cities have actually constantly had greater costs of living due to this ever-greater need for products, services, shelter and land.

The core utility and function of cities altered as the economy industrialized. The First Industrial Transformation of the 19th century required vast aggregations of capital, which led to the rise of banking and finance: surplus labor and workshops were no longer enough, finance had to scale as much as fund the tremendous financial investments required to construct real-world infrastructure such as trains, ports, mines, factories, and so on.

The expansion of globalization as nation-states expanded into empires also put a premium on financing and its sibling, insurance coverage, as the monetary threats of massive capital had to be hedged. This growth of complexity required a supervisory class trained in an expanded system of education, and a federal government efficient in managing this expanding systemic intricacy.

Cities did not cease being centers of manufacturing and commerce; the so-called FIRE financial functions (financing, insurance, property) were contributed to the city’s core functions.

This mix started changing as innovative nations moved to post-industrial “knowledge” economies. Dirty markets were shipped overseas or transferred outdoors urban areas, container ports replaced labor-intensive ports, and cities hosted the growth of the “knowledge” industries of marketing, digital technologies, interactions, data processing, and so on.

Cities such as San Francisco transitioned from working-class economies of longshoremen, factory workers and shop-keepers to “knowledge/FIRE/tourism” economies, as the traditions of the working class city– the cable television automobiles, port storage facilities, Chinatown, North Beach (the Italian immigrant neighborhood)– became, in Jerry Mander’s phrase, “replicas of themselves,” metropolitan Disneyland-type tourist attractions.

The runaway growth of financialization and globalization that has actually fueled the explosive growth of the international economy for the previous 30 years was kind to “knowledge/FIRE/tourism” cities and unkind to commodity-producing rural areas, as a flood of worldwide supply reduced the value of products. Small towns that did not have the high-paying tasks of the knowledge/FIRE economy rotted as capital and talent moved to mega-cities.

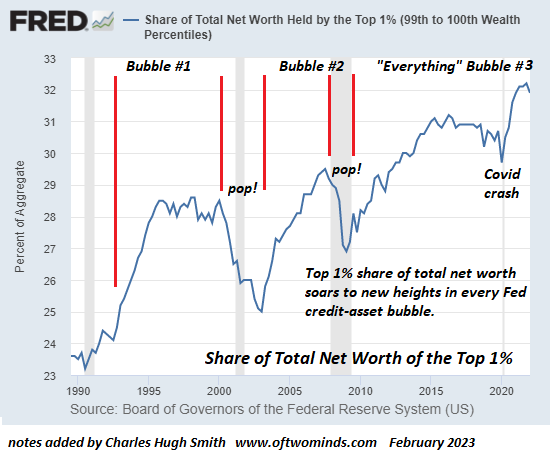

As I’ve frequently discussed, financialization and globalization produce systemic inequality by their very nature. Financialization makes the rich even richer and the poor even poorer. This fact shows up in the lots of Federal Reserve charts I’ve published over the past 15 years. (see chart below)

Globalization has pursued the neoliberal dream of removing barriers to the free circulation of international capital, therefore the top 5% worldwide whose wealth took off in globalization have the ways to buy up realty in prime “globalized” cities such as New York and San Francisco.

By artificially suppressing rates of interest and flooding the system with credit available to the rich, the Federal Reserve has actually pumped up one huge speculative bubble after another in the past 25 years. The net result is cities are no longer budget-friendly down 80%, or even the bottom 90%.

Here is a real-world example. Good friends of ours in the San Francisco Bay Area, a husband and wife who both worked part-time at average-paying municipal tasks, purchased a small, old house in a desirable residential area for $145,000 in the late 1990s. Other buddies purchased slightly larger homes for $165,000 in this Dot-Com Bubble period.

Adjusted for inflation, these homes would now cost in between $270,000 and $300,000. Given the traditional 4-times-income requirement for mortgages, houses in this price variety would still be cost effective to households earning $75,000 a year. This isn’t much greater than the typical wage of full-time employees in the United States (currently $56,000 annually). A family with one full-time worker and a part-time worker could still handle to own a home.

But these houses are now worth in excess of $1 million. Just the leading 10% of wage-earning households can manage to buy a house in the SF Bay Location.

The rent for a modest house in this location is $4,500 to $5,000 a month. Homes earning $100,000 each year take house about $75,000, therefore they can barely scrape by, as 2/3 of their income is spent on shelter (rent and utilities). There is no other way they can pay for either kids or home ownership.

This was not the case 25 years back. This is the bitter fruit of financialization and globalization.

Those who bought homes 20 or more years ago are now wealthy, through no effort of their own. This generational inequality is tearing apart the social fabric. This level of inequality can have no other result.

Now cities are dealing with another transition, one that threatens their high-cost dominance: remote work and the turnaround of financialization and globalization. Interest rates and inflation are rising for systemic, cyclical reasons, and globalization is reversing as nationwide security becomes more important than increasing business profits.

Correspondent Tom D. summarized the systemic crisis of cities in five poetically terse points:

“The city has lost its utility.It was a center of manufacturing– that went away.Then it was

financialization– that’s going away.All that’s left are tradition costs.A terrific unknown story. The impact will be big.”

In summary, here’s what’s taking place: provided the increasing speed of digital communications, the majority of the knowledge/FIRE economy work can be done from anywhere. This has actually long been the truth, but the pandemic lockdown accelerated the acknowledgment of this truth.

Provided the higher earnings paid to knowledge workers and the ridiculously high expenses and life-limitations (kids and homeownership are unaffordable) of living in huge cities, the rewards for those who were too young to buy a house for $150,000 that’s now worth $1 million are to move to a cost effective area and abandon the limited benefits of the city (novelty, entertainment).

The incentives for the poor living on social-welfare benefits and the working-poor who do “real-world” tasks is to stay put, as their opportunities are substantially decreased in less rich areas.

The issue is the bad and working-poor pay a relatively modest percentage of taxes. The high-wage earners who are incentivized to leave pay most of taxes.

Cities are terribly expensive to operate, and the majority of these costs are fixed, meaning they remain the very same no matter the number of consumers utilize the services. About 75% to 80% of all municipal budgets (the basic funds, not tasks paid by borrowing money through selling muncipal bonds) go to labor– government employees and their pension/healthcare costs.

Buses, trains and trains all have the very same set expenses and staffing whether they’re complete or empty.

The BART subway/train system in the SF Bay Area is an example of how high repaired expenses and decreasing ridership produces a “doom loop”— a “doom loop” that hollows out downtown workplace towers and the small companies that depend on thousands of travelling workplace employees, and the transit systems that bring the workers to the office towers.

BART ridership has fallen precipitously, from 400,000 riders a day pre-lockdown to 166,000 today. This 60% decline in rider-paid earnings is far listed below the system’s repaired costs, therefore someone somewhere needs to be taxed more to subsidize the system.

The older generations who have actually become wealthy due to the skyrocketing value of their homes naturally want everything to remain the same: they want their houses to continue deserving $1 million, their real estate tax to stay the very same, the city services to stay the same, and so on. Speculative bubbles, financialization and globalization have been very good to them and they are unwlling to deal with the doom-loop generated by the excesses of financialization and globalization finally coming home to roost.

A Tale of Paradise, Parking Lots and My Mother’s Berkeley Backyard. (NYT.com)

However this isn’t sensible as young remote employees (and those older workers who want to cash out their enormous gains and retire in more cost effective locations) leave, the tradition costs stay sky-high however there are fewer citizens with the wealth and earnings to pay for them.

Someone has to pay more, or these services will disappear. Municipal employees are unionized and will resist reductions in pay and advantages, even in community personal bankruptcy.

Remote work and the systemic inequality produced by financialization and globalization are generating a doom-loop of incentives to leave before the inevitable crash with truth happens: either services are slashed or taxes are raised, or more likely, both.

Higher taxes and fees implies there is less income delegated spend on novelty and entertainment. So raising taxes to pay tradition costs decreases the non reusable earnings required to support the entertainment, dining, arts, etc industries.

There are macro-consequences of the cyclical end of low inflation and low rate of interest that also feed into the metropolitan doom-loop. As the expenses of basics continue climbing, the bottom 90% have less disposable earnings to invest in getaways, novelty and entertainment. This means cities depending upon the free-spending pursuit of enjoyment will only be affordable to the leading 10% who have bubble-generated wealth or unearned earnings from wealth.

Completion of low-cost commodities and money is a global shift which will minimize the non reusable earnings of most of people who are currently free-spending tourists. Tourism, the most susceptible form of non reusable spending, will decrease worldwide, possibly precipitously in high-cost cities.

Yet this “the pleasures of the city” design is what’s being used as the “repair” for the doom-loop: 26 Empire State Structures Might Suit New york city’s Empty Workplace. That’s a Sign. “New York is going through a transformation from a city dedicated to efficiency to one built around enjoyment.”

The problem is only the leading 10% can afford the city’s enjoyments, and that’s simply insufficient to money the immense tradition expenses. Moreover, the top 10% have the ways to invest now, but once the unsustainable bubbles pop and borrowing cash ends up being unaffordable, even the leading 10% will be hard-pressed.

Super-low rates of interest have allowed cities and counties to invest easily on infrastructure by offering municipal bonds. Now that interest rates are rising (and regardless of what lots of claim, they will not be going back to near-zero). This puts rigorous limits on just how much more cities can borrow without deteriorating their credit-rating to “junk.” So the gravy-train of cheap-to-borrow money has ended. Now it will need belt-tightening snd higher taxes to keep cities operating at their existing levels.

All of this alters the incentives and cost-benefit assessments everyone utilizes to make life choices.

The book The Advantage of Down explained that typical people will support a system in which the benefits exceed their expenses, but abandon it when the advantages decline far below their costs. The expenses of city-living will significantly surpass the advantages.

These structural shifts in the core energy of cities are already apparent. Shopping in bustling, interesting districts is enjoyable, however everybody can get virtually anything they want provided to their door now. The bustle is fading, therefore is the enjoyable. When it comes to entertainment, big acts like Taylor Swift still motivate individuals to spend countless dollars, but as a basic rule, we have limitless entertainment (or at least diversion) on our phones, laptop computers, TVs, etc.

These lower-cost forms of entertainment offer stiff competitors for the shrinking swimming pool of discretionary earnings readily available for tourism and entertainment.

There’s another pressure on the top 10%: they’re the only group who can manage to pay more taxes. So they will have to pay all the new taxes needed to pay the city’s repaired/ tradition expenses. And these tax boosts will have to be considerable. Just moneying the employees’ pension will push city spending plans deep into the red.

There is a self-reinforcing feedback loop in raising taxes: at some limit, high-earner homes will conclude the benefits no longer surpass the expenses and they’ll offer out and leave.

Cities are forecasting a nonstop era of free-spending tourists and soaring capital gains taxes produced by stock exchange and property. But these are all exactly what vaporizes in an economic crisis as expenses of basics and borrowing cash rise.

Presuming the glorious free-borrowing-spending of the previous thirty years will continue permanently is impractical to the point of insanity. However anymore reasonable forecast is unacceptable, as it inevitably reveals local bankruptcy as the end-game.

As for the consequences of remote work, they are currently visible in data. The Bureau of Labor Stats (BLS) just recently launched employment and wage data nationally and in the most populated 350 counties in the United States. On the national level, work rose about 2% and wages fell about 2%. County Work and Wages Summary (BLS)

But in the high-wage, high-cost Silicon Valley counties, the decline in wages is staggering:

San Francisco: -22.6%

San Mateo: -20.7%

Santa Clara: -15.0%

High-cost states suffered significant wage decreases:

California: -6.9%

New york city: -5.1%

A few of these decreases might be the outcome of tech-sector layoffs, however the number of jobs in all these regions increased by over 2% from Dec. 2021 to Dec. 2022. The most likely primary cause may be business paying lower earnings when workers change to remote work.

15% to 20% decreases in incomes paid are absolutely significant. They amount to billions of dollars that are no longer readily available to pay taxes or fund city-centric “enjoyments.”

These data raise huge concerns about the viability of housing rates remaining so high that only the top 10% can pay for to purchase homes. The number of in-migrants will earn top-10% incomes? How many out-migrants are taking their incomes somewhere where they can want to manage a household and a home?

Who’s going to be left who is willing and able to pay much higher taxes and fees to pay the sky-high tradition costs developed during the wonderful thirty years of city expansion sustained by speculative bubbles?

Depending on a free-spending leading 10% looking for city-specific enjoyments looks like a method that will speed up the doom-loops now in play. A much better technique would be to transform the city to as soon as again be affordable to the working poor and the middle class. But that shift will need to wipe out all the bubble-generated “wealth” of the past 25 years and diminish legacy costs to what the reduced labor force can afford.

Those familiar with the splendor days of ever-expanding unearned wealth will resist this improvement up until it’s too late to manage a stylish transition. The bubbles will collapse and bankruptcy will clear the excesses. Those who got out early (i.e. now) will be pleased they acted promptly and those caught in the downdraft/ decrease will regret their faith in a high-cost system that was no longer budget-friendly or sustainable.

Minimizing our direct exposure to preventable risks is a key strategy of Self-Reliance.

This essay was drawn from my Weekly Musings Reports sent out exclusively to subscribers, patrons and Substack customers. Thank you very much for supporting my work.

My brand-new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

My brand-new book is now available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

Read the very first chapter for free (PDF)

Check out excerpts of all 3 chapters

Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me (Unique) print $10.95, Kindle $6.95 Read an excerpt totally free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first area for free (PDF)

International Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Check Out Chapter One free of charge (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World (Kindle $8.95, print $20, audiobook $17.46) Check out the very first area free of charge (PDF).

Will You Be Richer or Poorer?: Earnings, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the very first section free of charge (PDF).

The Experiences of the Consulting Thinker: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); checked out the very first chapters free of charge (PDF)

Cash and Work Unchained $6.95 Kindle, $15 print) Check out the very first section free of charge

Become a $1/month client of my work via patreon.com.

Subscribe to my Substack free of charge

NOTE: Contributions/subscriptions are acknowledged in the order got. Your name and email stay private and will not be given to any other specific, company or firm.

|

Thank you, foreverfarm ($5/month), for your marvelously generous Substack membership to this website– I am greatly honored by your assistance and readership. |

Thank you |

, Mike M. ($54), for your splendidly generous contribution to this site– I am greatly honored by your support and readership. |

|

Thank you, Matt V. ($5/month), for your magnificently generous Substack contribution to this website– I am considerably honored by your steadfast assistance and readership. |

Thank you |

, David D. (great t-shirt), for your remarkably generous gift to this website– I am greatly honored by your steadfast assistance and readership. |