The EU’s crisis isn’t limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization.

The European Union (EU) was seen as the culmination of a centuries-long process of integration that would finally put an end to the ceaseless conflicts that had led to disastrous wars in the 20th century that had knocked Europe from global preeminence.

Wary of the predations of the U.S. and rising Asian powers, European nations sought the economic and diplomatic strength of a confederation that would be greater than the sum of its parts, a union that would restore Europe’s rightful place as a global power.

This worthy goal was undermined by the destructive dynamics of the past forty years: Neocolonialism, Financialization and Globalization.

These dynamics are unstable due to their internal contradictions. In classical colonialism, the Core dominates the Periphery with force, extracting economic value by exploiting the subject states’ commodities and forcing the colonies to buy the valued-added finished goods produced by the colonial power’s domestic economy.

This extractive model was at odds with the liberal worldview of the colonial powers which held self-rule and open markets as necessary to stable prosperity. The contradictions of classical colonialism led to its collapse as colonies broke free and the colonial powers were forced to navigate a more open global economy.

Beneath the glossy vibe of strength through unity, the EU institutionalized a Neocolonial Model in which some EU members are more equal than others, a divide that was starkly revealed in the debt crisis of 2011-2012.

I described the EU’s version of the Neocolonial Model in 2012: The E.U., Neofeudalism and the Neocolonial-Financialization Model (May 24, 2012)

In Neocolonialism, the forces of financialization (debt and leverage controlled by State-approved banking cartels) are used to indenture the local Elites and populace to the banking center: the peripheral Neocolonials borrow money to buy the finished goods sold by the Core, doubly enriching the center with 1) interest and the transactional skim of financializing assets such as real estate, harbors, etc. and 2) the profits made selling goods to the debtors.

(China’s Belt and Road Initiative (BRI) is another version of the Neocolonial Model in which credit and financialization indebt and disempower the Periphery nations to the benefit of the Neocolonial Power.)

In essence, the Core nations of the EU colonized the Periphery nations via the euro which enabled a massive expansion of debt and consumption in the Periphery. The banks and exporters of the Core extracted enormous profits from this expansion of debt-fueled consumption.

The Periphery’s neocolonial status was starkly revealed by the debt crisis: the assets and income of the Periphery flowed to the Core as interest on the private and sovereign debts that are owed to the Core’s commercial and central banks.

This was the perfection of Neocolonial Neofeudalism. The Periphery nations of the E.U. are effectively neocolonial debtors of the Core countries’ banks, and the taxpayers of the Core nations are now feudal serfs whose labor is devoted to making good on any bank loans to the Periphery that go bad.

In effect, the importing Periphery nations were given the same expansive credit limits of their Mercantilist siblings. In a real-world analogy, it’s as if someone prone to financing life’s expenses with credit was handed a no-limit credit card with a low interest rate, backed by a guarantee from a credit-averse cousin.

Credit duly expanded oh-so profitably, but the contradictions eventually unravel the utopia: the Periphery borrowers soon borrow more than they can actually support, and the Core has to bail them out without actually writing off any of the debt, as writedowns would crush the profitability of the Core banks.

This is a colonialism based on the financialization of the smaller economies to the benefit of the Core’s financial institutions and Mercantilist economies.

In the EU, the opportunities to exploit captive markets were even better than those found abroad, for the simple reason that the EU itself stood ready to guarantee there would be no messy expropriations or defaults by local authorities who decided to throw off the yokes of neocolonization.

The EU attempted to reconcile this intrinsically unstable private-capital/State arrangement– profits are private but losses are public–by shoving the costs of the bad debt onto the backs of the Core’s taxpayers (now indentured serfs).

The profits from the euro arbitrage and Neocolonial exploitation were private, but the costs are being borne by the taxpaying public of both Core and Periphery.

Globalization also has its own set of internal contradictions. Using financialization (credit and all the speculative schemes leverage enables) to boost mercantilist exports and consumerist imports was highly profitable, but both the exporters and importers are now exposed to the inherent vulnerabilities and fragilities of dependency on credit-fueled investment and consumption and the unstable private-capital/State arrangement–an arrangement that’s coming apart everywhere from the EU to China.

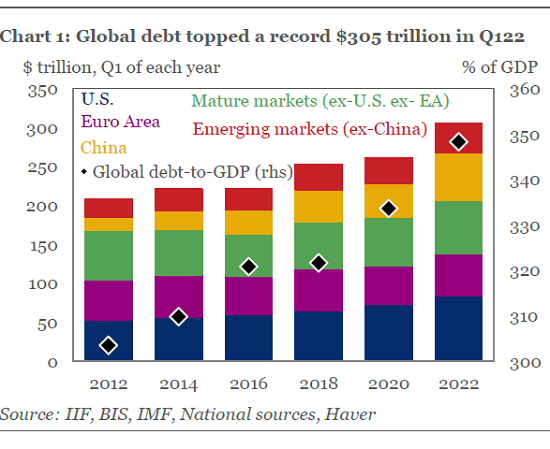

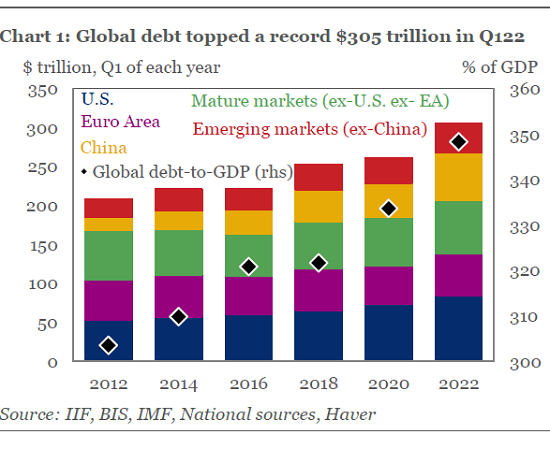

The Neocolonial-Financialization Model has reached its limits globally. There are no more markets to exploit with financialization, the discretionary incomes of the debt-serfs have stagnated to the point they cannot take on any more debt and the reality that the speculative gains are phantom and the mountains of debt are unpayable can no longer be masked.

As I endeavored to explain in The Global Power Shift Isn’t West to East–It’s Not That Simple (June 24, 2022), currencies are the bedrock of financialization, and the internal contradictions of the global economy’s credit-currency regime are finally unraveling the illusory stability of currency markets.

The EU’s crisis isn’t limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization. No one will be unaffected as the internal contradictions destabilize a global economy that was presented as permanent.

What’s the status quo fix? Cannibalization: The System Is Busy Cannibalizing Itself (August 31, 2022).

Recent podcasts/videos:

Roundtable Insight: Charles Hugh Smith on the Insanity of Central Banks in Addressing Inflation (38 min.)

My new book is now available at a 10% discount this month: When You Can’t Go On: Burnout, Reckoning and Renewal.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My recent books:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 Kindle, $8.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Eugene M. ($5/month), for your marvelously generous pledge to this site — I am greatly honored by your support and readership. |

Thank you, Thomas S. ($1/month), for your most generous pledge to this site — I am greatly honored by your support and readership. |