We either make the future or break the future, so pick carefully.

There is a make-or-break financial fork in the road ahead for the United States: there are just 3 alternatives:

1. Slash trillions of dollars in annual federal costs to align with current tax revenues.

2. Raise trillions in additional tax profits from the only entities able to pay more, corporations and the leading 5%

3. Generate income from the soaring federal financial obligation by the reserve bank “printing cash” and using this new cash to purchase Treasury bonds, as providing new Treasury bonds for sale is the method the federal government funds its stupendous budget deficit.

One method might be to do some of each, however there are political challenges to any rational reaction to unsustainable federal financial obligation growth. Any cuts in costs big enough to be consequential will slash-and-burn either the money overruning in the federal trough that politically powerful cartels are making a pig of on, or privileges that purchase the complicity/ passivity of the general people. Neither is politically viable.

Those who can afford to pay more taxes– corporations and the top 5%– are (surprise) the most politically powerful groups in the nation, and they will never accede to tax increases high enough to be consequential.

Politically, the only viable option is the politically pain-free among monetizing the soaring federal financial obligation by means of the Federal Reserve creating $2 trillion a year with a few keystrokes and utilizing this $2 trillion to buy virtually all the recently issued Treasury bonds.

If personal owners of existing Treasury financial obligation discover the yield they’re receiving does not even stay up to date with inflation, they will sell their Treasuries, requiring the Fed to print additional trillions every year to generate income from parts of the existing $30 trillion in debt.

Remember that a substantial percentage of state and local government costs is funded by the issuance of local bonds. This other governmental debt competes with Treasury issued bonds for scarce private capital. Other countries’ bonds are also competitors for private capital.

Because capital streams to the highest and lowest-risk yields, yields need to rise to bring in personal capital. This develops another issue: as yields rise, so does the interest paid on the whole portfolio of bonds.

Higher interest payments then push other government costs. The politically painless service is to generate income from not simply the recently provided debt but the rising interest payments due on the soaring financial obligation.

Generating income from government financial obligation is what I call the continuous money motion machine. Just create another trillion to buy newly released bonds, an additional trillion to pay greater interest and more trillions to purchase up old financial obligation that private owners are offering.

Is there anything that could break the perpetual money motion machine!.?.!? Those indicating Japan’s deflationary stagflation of the past 30+ years declare there are no obstacles to ever-greater monetization. The Federal Reserve can expand its balance sheet by $10 trillion or $50 trillion without any structural issues developing.

Interesting, that $50 trillion number. That’s the amount that the leading 5% skimmed from labor in the previous 45 years. The Bill for America’s $50 Trillion Gluttony of Inequality Is Overdue (September 21, 2020)

Trends in Income From 1975 to 2018 (RAND Corporation)

Reserving the political veto of the most affluent business interests and homes, clawing back this $50 trillion via greater taxes on those who gained the $50 trillion would be karmic justice and present fewer risks that the crazy plan of just “printing more cash” to satisfy every cartel, entrenched interest and entitlement.

Let’s ask an easy concern of history: if monetizing financial obligation works so wondrously, why hasn’t it been the go-to solution for every free-spending federal government? In the excellent old days, creating money out of thin air was achieved by changing the silver or gold in coins with lead or other base metals.

Sadly, individuals figure this decline of money, and inflation increases accordingly. Proponents of including $50 trillion to the Fed’s balance sheet (i.e. generating income from the soaring debt and interest payments) claim this hocus-pocus won’t stimulate inflation. But because all that newly issued currency gets in the economy one method or another, how can it not generate inflation?

The status quo response is: if it just pumps up possessions owned by the wealthy, that inflation is really rather grand. However expect inflation leaks into Cheetos instead of Big Tech stocks? Since “We can’t eat iPhones,” that ultimately matters.

Simply put, there is a guv constructed into the continuous cash motion device: real-world inflation. There is likewise a social governor constructed into the “pain-free” expansion of asset bubbles that prefer the already-wealthy: ultimately this systemic inequality misshapes and destabilizes the social and economic order.

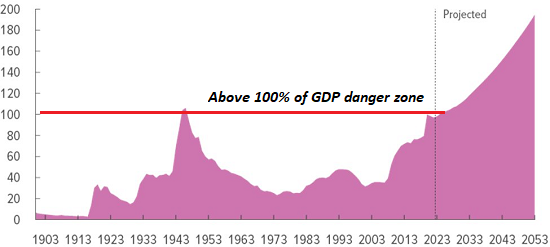

This in one reason history shows government debt in excess of 100% of GDP (the genuine economy) eventually causes disorder, default and insolvency. Or revolution. Take your pick. (Chart courtesy of David Sommers.)

If $50 trillion were clawed back from the most affluent corporations and homes, that would just return overall assets owned by the wealthy to levels that were thought about excessive a decade ago. But considering that this is politically unviable, the “painless” alternative of generating income from financial obligation will be pursued.

However considering that the only possible results of this alternative are condition, insolvency or transformation, the rich might well regret their short-sighted greed. Bane can take different types, but eventually the pendulum swings from one extreme (monetary hocus-pocus and incredible inequality) to the other extreme (clawback of central-bank-bubble “wealth” and a balance of profits and expenses).

The meteor that will eliminate the financial hocus-pocus is currently visible and can not be diverted by dancing the humba-humba and waving dead chickens around the campfire, i.e. Federal Reserve policies. Declaring god-like powers does not give one god-like powers.

There’s no going back when we pick a pathway. The systemic damage can not be reversed, despite what happy stories are told around the campfire by credulous followers in the wonderful powers of waving dead chickens around. We either make the future or break the future, so pick wisely.

My brand-new book is now offered at a 10

My recent books: The Asian Heroine Who Seduced Me (Unique)

print$10.95, Kindle$6.95 Check out an

excerpt totally free(PDF )When You Can’t Go On: Burnout , Reckoning and Renewal $18 print,$8.95 Kindle ebook; audiobook Check out the first area for free( PDF) Global Crisis, National Renewal: A(Revolutionary) Grand Method for the United States (Kindle$9.95, print $24, audiobook )Read Chapter One free of charge(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing World(Kindle$8.95, print$20, audiobook$17.46)Read the first section for free (PDF ). Will You Be Richer or Poorer?: Revenue

, Power, and AI in a Distressed World(Kindle$5, print$10, audiobook)Check out the first section free of charge(PDF). The Adventures of the Consulting Theorist: The Disappearance of Drake(Novel)$4.95 Kindle, $10.95 print); checked out the very first chapters for

readership. Thank you, starucca ($5/month), for your wonderfully generous Substack subscription to this site– I am significantly honored by your assistance and readership.