Who’s delegated buy miscalculated houses? Too couple of to prop up bubble valuations

If as numerous presume the Federal Reserve has an unstated required to produce a “wealth effect” by propping up real estate, they’ve handled to develop a no-win scenario. As longtime correspondent K.M. just recently documented, approximately half of the 50+ million home mortgages in the United States were refinanced in 2020 and 2021 to lock in historically low rate of interest of less than 4%, with many around 3%.

Almost 25% of house owners refinanced in 2021.

About half (51%) of house owners have a rate under 4%.

As K.M. observed:

“That does not consist of the millions who bought homes 2020 – 2021 at rates listed below 4%, who likewise are unlikely to sell unless rates drop well below 5%. Those who got rates listed below 3% or thereabouts, might be permanently off the market.

Think about it – why would I offer and surrender a 2.75%, 3.00% or 3.25% 30-year home loan, only to move into another home with a loan at 5.5% – 6.5%? I’m locked into my house and loan for several years if not decades.

And after that there are reverse mortgages, which essentially lock the senior in their homes for life. That’s been a housing stock decrease force for years now and might discuss the increase in the variety of houses in apparent disrepair.

I think you can see where I’m choosing this. The synthetically low rates of 2020 – 2021 have at least semi-permanently (and permanently in millions of cases) got rid of lots of millions of housing units from the market.”

We all understand what occurred to real estate valuations as home mortgage rates dropped and post-pandemic panic-buying swept through the market: valuations increased, pushing housing price to near-record lows. (See chart below of the Case-Shiller Index which soared from listed below 100 to 174 in the 2020-2022 bubble mania.)

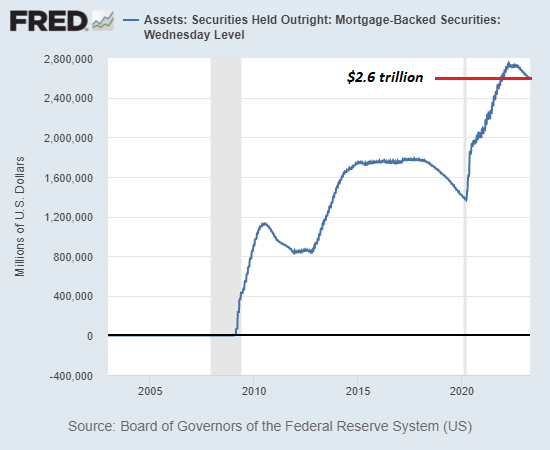

This was not “market forces”– this was straight-out intervention by the Federal Reserve and federal housing companies. As the chart listed below of mortgage-backed securities (MBS) held by Federal Reserve banks shows, the Fed went from owning zero MBS prior to the bursting of the very first housing bubble in 2007-08 to owning approximately 20% ($2.6 trillion) of the entire United States home mortgage market for standard single-family houses: ($13 trillion).

Federal firms such as the Federal Housing Administration (FHA) and Veterans Administration (VA) offer low-down payment home loans and other incentives. The mortgage-backed securities are ensured by Fannie Mae, Freddie Mac, or Ginnie Mae, quasi-governmental firms. The whole state-central-bank financial machinery has actually collaborated to pump up a housing bubble that makes those who bought long back feel rich while making real estate unaffordable to younger purchasers who don’t have the high-end of getting assistance from rich moms and dads.

So the Fed has actually succeeded in pumping up a real estate bubble that makes the already-wealthy feel even wealthier, but just by tossing the younger generations of prospective property owners under the bus. As I have argued here, (Why Interest Rates Are Not Returning to Absolutely No), the danger profile of the worldwide economy and monetary system has changed, and this threat is repricing the expense of capital (rate of interest) and all financial possessions.

K.M. summed it up thusly:

“The entire problem with housing in the previous a number of decades has actually been the control of the market by government gamers – The Fed, HUD, FNMA/FHLMC, and the other alphabet-soup agencies that rule the real estate market. It has far less to do with natural demand and supply than is typically thought. I’m stating this as one who operated in the home mortgage business for many years.”

Unless the Fed is going to buy up the entire $13 trillion mortgage market, market forces will keep home loans rates in the historical range of 5% to 7%.

On the other hand, those with 3% home mortgages are caught in their existing homes which are successfully off the marketplace, and prospective young homeowners deal with the unaffordable combination of bubble-valuations and high home loans rates. As I concluded in my previous commentary on the housing bubble (This Real Estate Bubble Is Various: It’s Much More Precarious), Distortions eventually have effects. Concentrate wealth and income in the leading 5% and corporations, and give the already-wealthy abundant affordable credit to focus ownership of assets, and you get a distorted economy in which the older and wealthier have actually outpriced the young.

Who’s left to purchase overvalued homes? Too couple of to prop up bubble assessments. This Fed-engineered generational wealth-opportunity inequality will generate more than a phantom “wealth result”– it will also generate second-order impacts of social fragmentation and the erosion of the social contract that the Fed is helpless to repair.

New Podcast: Turmoil Ahead As We Enter The New Era Of’Deficiency’ (53 min ) My brand-new book is now offered at a 10 % discount rate($8.95 ebook,$ 18 print): Self-Reliance in the 21st Century. Check out the first chapterfor free(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 min)My

New Podcast: Turmoil Ahead As We Enter The New Era Of’Deficiency’ (53 min ) My brand-new book is now offered at a 10 % discount rate($8.95 ebook,$ 18 print): Self-Reliance in the 21st Century. Check out the first chapterfor free(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 min)My

current books: The Asian Heroine Who Seduced Me(Unique)

print$10.95, Kindle$ 6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout

, Reckoning and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the first area free of charge(PDF)Worldwide Crisis, National Renewal: A(Revolutionary )Grand Method for the United States(Kindle$9.95, print$24, audiobook)Check Out Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet(Kindle$ 8.95, print$20, audiobook$17.46)Read the first section totally free(PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Shocked World

(Kindle $5, print$10, audiobook) Read the very first section totally free(PDF). The Experiences of the Consulting Thinker: The Disappearance of Drake

(Novel)$4.95 Kindle,$ 10.95 print); read the first chapters totally free (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Check out the very first area for free Become a$1/month customer of my work via patreon.com. NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other specific, business or firm. Thank you, Karen K.($100), for your outrageously generous contribution to this site– I am greatly honored by your unfaltering support and readership. Thank you, Doug

W.($ 10/month) , for your insanely generous pledge tothis website– I am greatly honored by your steadfast support and readership. Thank you, Josiah B.($1/month), for your most generous promise to this website– I am significantly honored by your support and readership. Thank you, James R.($50), for your stupendously generous contribution to this website– I am greatly honored by your steadfast support and readership.