The eNaira is Africa’s first central bank digital currency (CBDC).

Central lenders, academics, political leaders, and a variety of elites from over 100 countries intending to release their own CBDCs have actually carefully followed the eNaira.

They used Nigeria– Africa’s biggest nation by population and size of its economy– as a trial balloon to check their nefarious plans to get rid of cash in North America, Europe, and beyond.

Are you worried about CBDCs?

Then you must be taking notice of what is taking place in Nigeria.

That’s due to the fact that there’s an excellent possibility your government will reach for the exact same playbook when they choose to enforce CBDCs in your location– which could be quickly.

CBDCs allow all sorts of terrible, totalitarian things.

They permit federal governments to track and manage every cent you make, save, and invest. They are a powerful tool for political leaders to seize and rearrange wealth as they please.

CBDCs will also make it possible for devious social engineering by allowing federal governments to punish and reward people in ways they formerly couldn’t.

CBDCs are, without a doubt, an instrument of enslavement. They represent a quantum leap backwards in human flexibility.

Regrettably, they’re coming quickly …

Federal governments will probably mandate CBDCs as the “service” when the next genuine or contrived crisis hits– which is most likely not far off.

That’s why you should take note of what is taking place in Nigeria. That way, you can understand what to anticipate and take preventative action.

Here are the top five insights from the eNaira.

Insight # 1: Don’t Take the Bait … Reject CBDC Incentives

In Nigeria, the federal government carried out discount rates and other rewards to increase the adoption of eNaira.

In North America and Europe, expect the federal government to require CBDCs to get well-being payments, a prospective universal standard income, so-called “inflation relief checks,” or whatever the next cockamamie scheme is.

Consider these incentives like the cheese in a mousetrap.

Insight # 2: Synchronised Transfer To Get Rid Of Cash

To help boost eNaira adoption, the Nigerian government announced a strategy to eliminate the legal tender status of various high denomination expenses, rendering them useless.

According to the World Bank, over 55% of the adult population in Nigeria does not have a checking account and is dependent on physical money.

The Nigerian government should have known phasing out money would be a catastrophe for a majority of the population, however they plowed ahead anyways– a lot for democracy.

When your federal government enforces a CBDC, expect simultaneous steps to force people out of cash, regardless of the costs.

Those procedures might be available in lots of flavors, however I would wager they would initially look to phase out big denomination bills by removing their legal tender status.

We’re currently seeing this occur …

For example, the EU has currently phased out the 500 euro note.

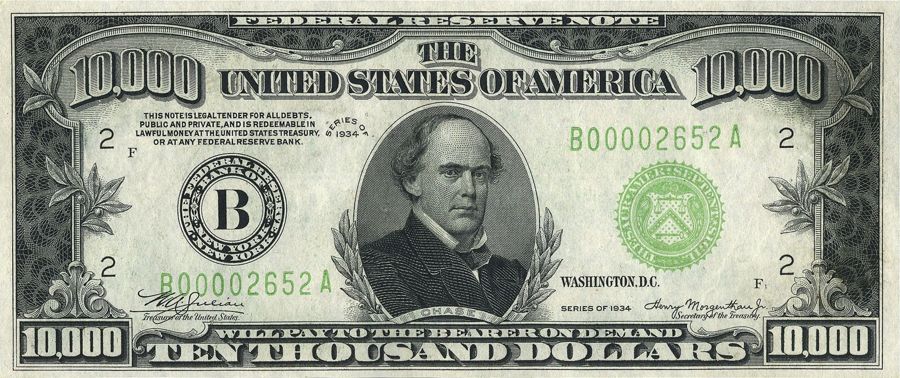

The $100 bill is the biggest in blood circulation in the US, but that wasn’t constantly the case. At one point, the United States had $500, $1,000, $5,000, and even $10,000 bills.

The government removed these large costs in 1969 under the pretext of fighting the War on (Some) Drugs.

The $100 expense has been the largest since. But it has far less purchasing power than it carried out in 1969. Years of widespread cash printing have actually debased the dollar. Today, a $100 note purchases less than $12 in 1969.

Even though the Federal Reserve has actually cheapened the dollar by over 88% given that 1969, it still refuses to release notes bigger than $100.

With CBDCs on the horizon, I believe the US government will not only never release another costs higher than $100 but will most likely want to phase out the $100 bill under numerous pretexts.

Insight # 3: Bank Restrictions

The majority of people think about the money they transfer into the bank as an individual asset they own.

But that’s not real.

Once you transfer cash at the bank, it’s no longer your home. Rather, it’s the bank’s, and they can basically do whatever they desire with it.

What you actually own is the bank’s guarantee to pay you back. It’s an unsecured liability, that makes you technically and legally a financial institution of the bank.

And since the banking system is linked with the federal government all over, it’s just prudent to anticipate governments to put more constraints on checking account as CBDCs launching.

This is exactly what took place in Nigeria.

Money withdrawal limitations and debit card deal restrictions were imposed, to name a few measures. In addition, capital controls made it challenging to send out cash out of the nation.

I would not be shocked to see the forced conversion of bank deposits into the eNaira– at an unfavorable rate.

Here’s the bottom line. Anticipate all sorts of limitations– and possible confiscations– to be troubled savings account when a CBDC is launched.

Insight # 4: Rising Inflation

Amid the eNaira rollout, Nigeria is experiencing some of the highest inflation levels in its history.

This is not unexpected. CBDCs make it even easier for the government to debase the currency.

So, it’s reasonable to expect more inflation when CBDCs pertain to town.

Insight # 5: Social Unrest

In another foreseeable advancement, frustrated Nigerians required to the streets over the government’s actions to restrict cash and bank accounts. There was a violent scramble to exchange old notes prior to the federal government considered them worthless. Riots broke out in several locations.

There’s an excellent chance the damaging restrictions imposed together with CBDCs might develop social unrest anywhere.

Conclusion

To summarize, here are the leading 5 insights from Nigeria’s CBDC experience.

Insight # 1: Do Not Take the Bait … Turn Down CBDC Incentives

Insight # 2: Simultaneous Relocate To Get Rid Of Cash

Insight # 3: Bank Restrictions

Insight # 4: Increasing Inflation

Insight # 5: Social Unrest

As CBDCs come to your area, you now know what to anticipate.

Federal governments will probably mandate CBDCs as the “option” when the next genuine or contrived crisis hits– which is most likely not far off.

There’s an outstanding possibility more inflation and monetary chaos is coming soon.

Are you ready for it?

That’s why I simply launched an urgent PDF guide, “Endure and Flourish Throughout the Most Unsafe Recession in 100 Years.” Download this free report to find the leading 3 techniques you require to implement today to protect yourself and potentially come out ahead.

With the worldwide economy in turmoil and the threat of a “Terrific Reset” looming, this guide is a must-read. Click here to download it now.