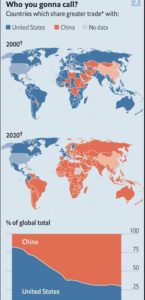

If there ever was a time when you could see a pattern sturdily in motion, now is it.

That the Western, previously civilized world is in decrease has been understood to anyone with an ounce of curiosity and little analysis of data points.

Before Xi’s ascension to power one could have argued that this trend was stressing, however not terrifying.

What makes it frightening is that Xi managed to eliminate the two-term limitation for his presidency with a frustrating bulk (2,959 to 2 and 3 abstaining votes– no rewards for guessing where those 5 men are now). He then proceeded to have his name enshrined in the constitution. Seriously. You may remember Xi’s “anti-corruption” purge from a couple of years back. Well, this was Xi’s own internal secret cops, developed to kill (literally) any opposition from within the CCP (Chinese Communist Party).

Today’s China, or should I state CCP, is not the very same CCP of Deng Xiaoping. Today’s CCP is an ideological worldwide weapon of control, and it is spreading out like a cancer.

Which brings me to …

In some cases understanding where not to be is simply as important as knowing where to be since all financial investments refer opportunity expenses and probabilities.

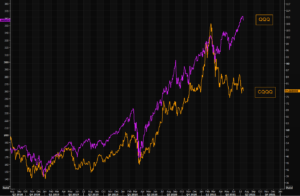

The implosion of Chinese tech continues.

< img src=" https://internationalman.com/wp-content/uploads/2021/09/Image-3-300x92.png "alt =""width="552"height ="169"/ > One can argue regarding what the specific catalyst for this selloff was. Certainly, the CCP pursuing Didi (China’s clone of Uber) hasn’t assisted things, though this is peculiar to me. Due to the fact that, when Jack Ma fell afoul of the CCP and vanished (still yet to be seen) with Ant monetary now an entirely owned subsidiary of the CCP, it was clear that Xi was executing his three Cs: control, consolidate, continue.

It really is simply nationalisation of resources with a carefully constructed veneer to pretend it really isn’t that at all. But that’s all it is– a veneer.

Fact is, much of the world works like this, including Putin’s Russia. China is moving towards controlling the crucial market sectors (not that they didn’t have substantial control prior to since they did) with less pretentiousness than in the past. Why?

The same reason they took Hong Kong. Because they could. And they might since the remainder of the world is distracted, ironically by the Covid pantomime developed by Fauci, Gates, Klaus, and their fellow technocrats.

All of this allows the CCP to do things they had not formerly had the ability to do without effects, both politically and economically.

So now we have this space in between QQQ (United States tech) and CQQQ (China tech), and the ratio between the two tech ETFs closed at another all-time low.

The Chinese tech regulative issue has actually been going on for months, however the huge question here is what is priced in.

What about the longer-term view? Is US tech any better?

US tech manipulates and owns the federal government whereas in China the federal government manipulates and owns China tech.

US investors have been buying up China tech as if it’s the exact same as United States tech. Plainly it isn’t.

However the other question that is worth considering is what the United States tech financiers don’t know about the United States tech? Do they still or should they still trust them to the extent that they do?

Well, you most likely thought my response to that, however actually what I believe does not matter since what the market thinks is what matters, at least for now.

Right now, the debate by the dolly birds on CNBC is around whether or not to purchase these now less expensive Chinese tech stocks.

I would state a much better concern is if you can’t rely on Chinese tech (and you clearly can’t), then pray tell, why would one trust United States tech?

Do you chase after United States tech (like everyone else), barf Chinese tech (like everyone else), or begin looking at the contrarian spread?

We are still a long way off buying China tech here as I don’t like putting out fires with my face … and that is what I believe you ‘d be doing here. However purchasing US tech feels extremely dicey as well.

So what do we make with all this?

We watch and see where these capital flows may go, and for now, we purchase deep value.

Editor’s Note: The 2020s will likely to be a significantly unstable years. More governments are putting their cash printing on overdrive. Unfavorable interests are ending up being the rule instead of the exception to it.

Something is for sure, there will be a good deal of modification taking place in the years ahead.

That’s exactly why famous speculator Doug Casey and his group released an immediate new report titled Doug Casey’s Top 7 Predictions.