Select one, and only one: a stock exchange that pumps up and appears a limitless series of ever-more devastating bubbles, or a genuine economy that is no longer in thrall to the engines of wealth inequality and speculative craze.

“The Fed Put”— the implicit Federal Reserve policy of bailing out the stock exchange as soon as it swoons by releasing a flood of financial stimulus–is now accepted as a warranty not unlike monetary gravity. Despite the bleatings of Fed officials, “everyone knows” the Fed will rapidly “pivot” ought to the marketplace swoon, slashing interest rates and increase liquidity via Quantitative Easing (QE).

Remember the definition of excess liquidity: the difference between real money development and financial growth. The Fed juices excess liquidity not to more growth in the real economy however to force-feed new money into the stock market and other risk possessions.

The only possible result of “The Fed Put” is a credit/asset bubble, which is why we’re presently experiencing the third such huge speculative bubble in 23 years.

“The Fed Put” is the logical endpoint of neoliberalism, which puts “markets” (and hence financing) at the core of the real economy. The neoliberal fantasy is that “markets” fix all issues by means of the magic of “the invisible hand” therefore everything becomes subservient to the revolutions of “markets.”

The second part of the fantasy is that “markets” are self-regulating, implying there’s no requirement for a moral order or government guidelines; the magic of markets consists of a godlike ability to restrict its own motivations, i.e. greed and exploitation to make the most of gains by any methods available.

As has actually been shown time and once again, any methods offered reliably includes scams, embezzlement, malfeasance, ruining competition with cartels and monopolies, and so on. (Look at how perfectly uncontrolled crypto-markets have self-regulated themselves. It’s a wonder to witness such perfection, isn’t it?)

Neoliberalism easily disregards Adam Smith’s insight that markets require a strict moral order to avoid collapsing into savage exploitation. The neoliberal dream is that “markets” don’t require no stinkin’ ethical order, greed and optimizing gains by any methods readily available create their own self-regulating structure through magic.

Let those who lost fortunes in the FTX fiasco explain how perfectly this magic functions in the real world.

The Fed has taken on the function of Savior of the stock markets as a method of cementing its pre-eminence over the real economy. Fed apologists declare goosing the stock exchange promotes “the wealth impact” in which fatter stock valuations encourage the wealthy to spend more and obtain more than they would have otherwise done.

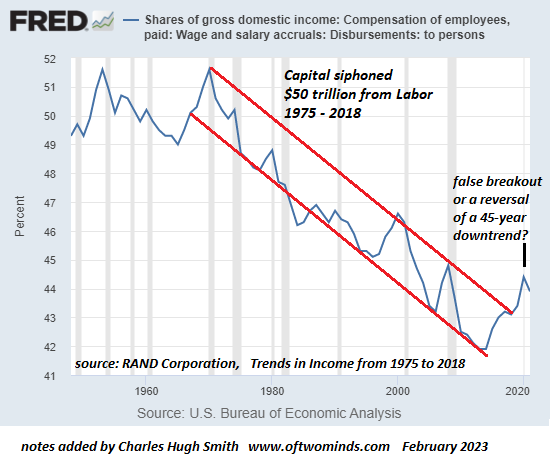

This happy story neglects the truth that goosing the stock market vastly increases wealth inequality, in impact making the already-rich much, much richer while leaving all those who didn’t or couldn’t own huge stakes in equities stuck in the swamps of the real economy, where labor’s share of the economy has declined as capital’s share has actually soared.

Making the genuine economy subservient to all-powerful markets and finance has destabilized the economy and society. Elevating markets to supremacy has produced an unlimited series of credit-asset bubbles, each of which enhances wealth inequality (see chart of the top 1%’s wealth listed below) even as they ravage the genuine economy when they inevitably pop.

Raising markets and financing to supremacy was all fun and video games until some of the loot dripped into the worldwide economy at an inconvenient time when supply and geopolitical restraints emerged from a decades-long sleep to transform a deflationary hyper-globalization/ hyper-financialization into an inflationary period of unhinged, destabilizing financial excess.

In other words, “The Fed Put” has completely misshaped the real economy, and these structural distortions are now bearing the bitter fruit of the Fed’s delusional embrace of neoliberal fantasies.

Couple of if any seem to believe the Fed might have awakened to the harmful capacity of their misconception. Couple of if any consider the possibility that the entire exercise of “battling inflation” is also a backdoor policy of ending “The Fed Put”, but doing so without creating mass hysteria in all those betting the farm on the Fed “pivoting” to conserve the stock market yet once again from its excesses.

If we check out in between the lines, the abandonment of “The Fed Put” is currently clearly visible. No Fed authorities is going to state clearly that “we’re no longer going to save the stock exchange every time it swoons.” That would crash the market as every punter who relied on the Fed panics.

The Fed’s implicit policy is to let all the True Believers in “The Fed Put” become bagholders, holding stocks all the way down to a “Fed-Putless” reality. The Fed will continue to release statements about “being encouraging” of this which, and they might well “pause” raising rates, letting loose a short-term euphoria. But they won’t drop rates back to absolutely no or improve their balance sheet by another $4 trillion just to keep a miscalculated stock market plumply misestimated.

While speculators concentrate on the damage of stock market valuations, they overlook the damage of the real economy wreaked by “The Fed Put.” Choose one, and only one: a stock exchange that pumps up and appears a limitless series of ever-more devastating bubbles, or a real economy that is no longer in thrall to the engines of wealth inequality and speculative craze.

For the previous 25 years, the Fed has conflated the stock exchange and the genuine economy. This fantasy is no longer affordable. Either the Fed devotes itself to supporting the genuine economy, or it hastens the demise of the real economy by continuing to goose ever-more devastating speculative bubbles. It can no longer do both, and in choosing the genuine economy over the stock exchange, it is finally selecting carefully.

Maybe “battling inflation” is supplying much required cover for the supreme objective of ending “The Fed Put.”

That the Fed has actually chosen the real economy over the stock market is “impossible,” of course, simply as inflation was “impossible.” What’s possible and impossible might well alter rather considerably in the years ahead.

Please keep in mind that no one needs to “be in the marketplace.” There are lots of ways to buy yourself without owning a single share (or zero-day to expiration option). This is the path of Self-Reliance.

New Podcast: Chaos Ahead As We Get In The New Age Of ‘Scarcity'( 53 min)

My new book is now offered at a 10 % discount rate ($8.95 ebook,$

18 print): Self-Reliance in the 21st Century. Check out the first chapter for

free (PDF)Check out excerpts of all 3 chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt free of charge (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first area for free (PDF)

Worldwide Crisis, National Renewal: A (Revolutionary) Grand Technique for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One free of charge (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the first section for free (PDF).

Will You Be Richer or Poorer?: Earnings, Power, and AI in a Shocked World

(Kindle $5, print $10, audiobook) Read the first area totally free (PDF).

The Experiences of the Consulting Thinker: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Cash and Work Unchained $6.95 Kindle, $15 print) Check out the first area totally free

Become a $1/month customer of my work by means of patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail remain confidential and will not be given to any other individual, company or company.

|

Thank you, Robert J. ($50), for your superbly generous contribution to this site– I am greatly honored by your steadfast assistance and readership. |

Thank you |

, Michael ($54), for your marvelously generous contribution to this website– I am significantly honored by your support and readership. |