When this bubble bursts, there will be no 4th or 5th bubble, there will only be debris.

The US economy and its monetary system operate under the implicit belief that the Federal Reserve controls the direction of the economy and finance. This belief isn’t in Fed impact, it remains in Fed control: the Fed can reverse a stock exchange decrease on a penny, it can reverse a recession, it can do “whatever it takes” to keep markets steady and expansive.

The history of the past thirty years appears to support this belief. Each time a monetary crisis has actually manifested, the Fed has “saved the day” with some new policy extreme, changing the rules, boosting its balance sheet 10-fold, and so on.

The flaw in this confidence in Fed control is the three speculative bubbles that have inflated and burst in the period of Fed Control, 1995 to the present. These bubbles could not have actually inflated without a “dovish” Fed pushing rate of interest down and juicing the financial system with liquidity/ credit. Because all speculative bubbles eventually rupture, the Fed is pushed into “rescue mode” which needs ever more extreme adjustment, oops, I mean intervention, to stabilize the bubble breaking and inflate the next bubble.

What couple of entertain as a possibility is the Fed is losing control of the economy and finance for systemic factors that have nothing to do with Fed Policy per se. To put it simply, it’s not a “Fed policy error” that brings the system down, it’s much bigger forces: diminishing returns and second order impacts.

The instant impact of brand-new Fed policy extremes is strong, much like a brand-new drug has an immediate impact. However as the drug is injected once again and again, it loses its effectiveness. In medicine this is a biological procedure; in financing, it’s a mental process as participants habituate to every new Fed policy extreme and depend on its 1) permanence and 2) continued effectiveness.

For example, the Fed’s trick of lowering bond yields/ rates of interest. Participants can confidently increase their exposure to run the risk of to outrageous levels and ignore hedges because they’re confident the Fed will drop rate of interest back to zero if the stock market fails.

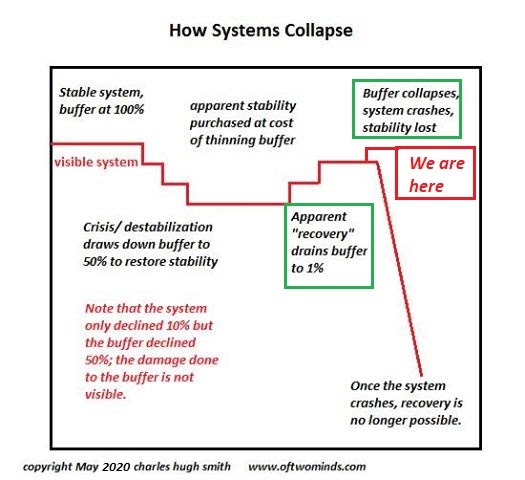

This self-confidence in the efficacy of Fed policies can be comprehended as a buffer, supplying resilience and a backstop (“the Fed Put”) to any monetary/ financial instability. Participants stop worrying the minute the Fed reveals a new dovish policy, even if the policy has actually restricted result on real-world conditions. The decline of real-world efficacy is masked by the instant ecstasy of participants, who have actually come to count on the Fed’a actions resolving crises literally overnight.

The decay of diminishing returns takes place under the radar. Couple of comprehend all the Fed’s actions (reverse repos, and so on) or the scale of these operations, or their efficacy in terms of correcting dis-equilibrium/ instabilities in the real-world economy and markets.

While individuals continue to believe these buffers will always safeguard the system from danger, the buffers have actually worn down. The next Fed “save” fails, revealing the buffers have actually collapsed. Put another method, the Fed has actually lost control.

Every new Fed policy severe generates 2nd order results which unleash unintended effects. The prime example is ethical danger, the belief that risk can be taken on to boost speculative gains without suffering any consequences of that risk exploding.

Because individuals think the Fed will slash rate of interest back to no as soon as markets swoon, they increase their gambles based upon that self-confidence. Any financial obligation taken on today can be rolled over into lower rates in the future, so there’s no limit on danger or credit expansion. The riskiest possible growths of credit– to fund stock buybacks, acquisitions of competitors, etc– are greenlighted based on the self-confidence that the Fed will always push rate of interest back toward no as soon as conditions wobble.

This confidence sets up a feedback loop in which Fed policies push participants to extremes of danger and financial obligation that guarantee speculative bubbles inflate and then burst, requiring fresh Fed policy extremes. In other words, the Fed has developed a doom-loop in which the most ridiculous risk is transformed into a “sure thing” based on the expectation of a Fed “save.”

However what if the Fed is not able to push policies to new extremes due to systemic restrictions? What if policies that worked like magic before no longer work this time around due to diminishing returns/ collapse of buffers?

What if the Fed can not reverse the doom-loop of 2nd order impacts its previous policy extremes have produced? These outcomes don’t appear unrealistic to anyone who studies systems characteristics. Rather, they appear inevitable and foreseeable.

What if the Fed has currently lost control but nobody dares concern the confidence in Fed omnipotence? It’s not the Fed policy extremes that work the magic, after all; it’s the self-confidence of individuals that resolves the bubble breaking crisis.

Those who take a look at systems dynamics have strong reasons for seeing this third massive Whatever Bubble as the last bubble. When this bubble bursts, there will be no 4th or fifth bubble, there will only be rubble.

New Podcast:

Its a Waterfall- Risk, Collateral & Productivity( 48 min) My brand-new book is now offered at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Read the first chapter free of charge(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli : Self Reliance in the 21st Century (43 minutes)My

Its a Waterfall- Risk, Collateral & Productivity( 48 min) My brand-new book is now offered at a 10 % discount rate($ 8.95 ebook, $18 print): Self-Reliance in the 21stCentury. Read the first chapter free of charge(PDF)Check out excerpts of all three chapters Podcast with Richard Bonugli : Self Reliance in the 21st Century (43 minutes)My

current books: The Asian Heroine Who Seduced Me(Novel)

print$10.95, Kindle$ 6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout

, Numeration and Renewal$ 18 print,$ 8.95 Kindle ebook; audiobook Read the first section totally free(PDF)Global Crisis, National Renewal: A(Revolutionary )Grand Strategy for the United States(Kindle$9.95, print$24, audiobook)Read Chapter One for free (PDF ). A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet(Kindle$ 8.95, print$20, audiobook$17.46)Check out the first area free of charge(PDF). Will You Be Richer or Poorer?: Revenue, Power, and AI in a Traumatized World

(Kindle $5, print$10, audiobook) Read the first area for free(PDF). The Adventures of the Consulting Philosopher: The Disappearance of Drake

(Unique)$4.95 Kindle,$ 10.95 print); read the very first chapters free of charge (PDF)Cash and Work Unchained $6.95 Kindle,$15 print)Check out the first area totally free End up being a$1/month customer of my work via patreon.com. NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail stay personal and will not be given to any other private, business or firm. Thank you, Swedekev($15), for your most generous contribution to this site– I am greatly honored by your assistance and readership. Thank you, Mark S. ($10/month), for your outrageously generous pledge to this site– I am greatly honored by your unfaltering assistance and readership. Thank you, William M.($5/month), for your monumentally generous pledge to this site– I am significantly