The unencumbered realist concludes that there are no options within a status quo structure that is itself the problem.

Realists who question received knowledge and conclude the status quo is illogical are rapidly labeled pessimists since the zeitgeist anticipates a service is constantly at hand— preferably a technocratic one that requires absolutely no sacrifice and does not distress the status quo apple cart.

Realists ask “what if” without choosing the “solution” initially. The traditional approach is to pick the “answer/solution” first and then develop the question and cherry-pick the proof to support the pre-selected “solution.”

What if all the status quo “solutions” don’t in fact address the genuine issues? This line of inquiry is strictly verboten, for there need to be an option that resolves whatever in one fell swoop.

Examples of this approach are plentiful: a one-size fits all service that resolves all the systemic issues by itself. All we need to do is execute it.

Changing fiat currencies is one example that I have checked out:

You Want Really “Sound Money”? An Idea Experiment

Contrarian Thoughts on the Petro-Yuan and Gold-Backed Currencies

I have actually likewise explored how genuine modification works: it takes many years (or even years) of sacrifices and high expenses with none of the immediate payoff we now expect as a birthright. Genuine change pits those benefiting from the status quo against those finally grasp that the status quo is the problem, not the solution, and these political/social battles are unlimited and brutal because any gains come at somebody else’s cost.

The Forgotten History of the 1970s

The 1970s: From Rotting Carcasses Drifting in the River to Kayak Races

Fiat currencies consist of the seeds of their own self-destruction, however developing a gold or bitcoin basic creates its own problems. As I explained in the essays noted above, trade imbalances are intrinsic in a world of scarcity therefore exporters of essentials will end up with all the gold/ bitcoin and the importers of basics will end up without any gold or bitcoin, and no ways to purchase exports. Given that the exporting economies are mercantilist by nature, they can not import enough from their clients to stabilize trade asymmetries.

The other issue with the gold/ bitcoin standard exists is absolutely nothing naturally decentralized, fair or democratic about these requirements. Simply put, any basic based on wealth distributed by scarcity is inherently neofeudal, as the wealthy/ powerful acquire asymmetric ownership of all types of wealth and use this to buy political influence to keep this asymmetry to their benefit.

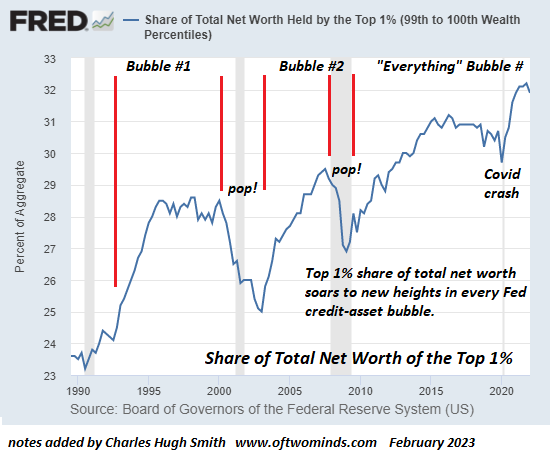

Wealth and political power are 2 sides of the same coin, therefore most of gold/ bitcoin/ quatloos/ land constantly end up in the hands or control of the few.

This asymmetry then enable the few to influence political procedures to defend their ownership/ control and lower the expenses of their supremacy while increasing the expenses/ taxes paid by the peasantry.

The ownership/control of gold and bitcoin is currently incredibly uneven, and making either the sole type of “money” will considerably benefit the few who already own/control these properties. The few peasants who acquire a gold coin or slice of bitcoin will remain as powerless as the bulk who own none.

This doesn’t suggest I do not see the worth of precious metals or cryptocurrencies, it just suggests I recognize that all kinds of “cash” dispersed by deficiency or power are naturally uneven, which indicates the couple of constantly get a consequential share of these assets, just as they acquire a substantial share of all other properties. Neither gold nor ‘bitcoin are immune from this vibrant, which is inherent to all properties dispersed by shortage or power, be it existing wealth or political/financial power.

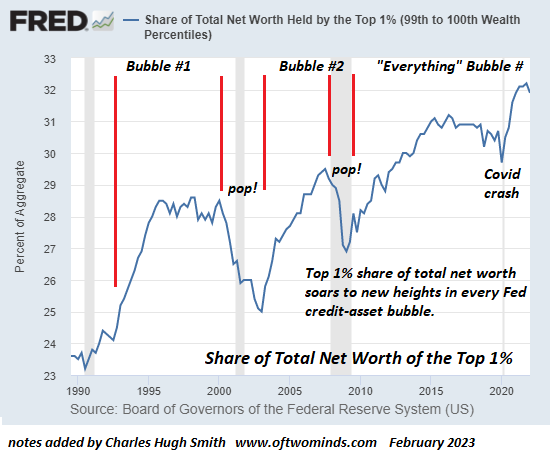

The Pareto Distribution is rather callous. The top 20% ultimately wind up with 80% of the possessions even when everyone begins with the same stake (a historic rarity, to be sure).

The genuine problem is what takes place within the leading 20%. If central power holds sway (and protects its perquisites), then the bottom 19.9% in the leading 20% are slowly stripmined of wealth and power, leaving the large majority of substantial wealth and political power in a small elite at the top.

There is nothing inherent in a gold or bitcoin requirement that prevents this concentration/ centralization of ownership. There are various historic examples of how this dynamic focuses wealth and political power at the expense of social/ economic stability. (Late-era Western Rome, to name however among lots of.)

To be a real solution, “money” has to be inherently decentralized in distribution and ownership, naturally fair (i.e. not distributed by power/scarcity) and inherently democratic, i.e. the way it is created prevents the concentration of wealth and power. I have actually proposed one such option, a labor-backed currency, i.e. a currency that is originated and dispersed solely in exchange for human labor. (I describe how this may work in my book A Drastically Beneficial World.)

Yes, it’s pie-in-the-sky, blah-blah-blah, but let’s not puzzle “services” that preserve the status quo with genuine services. Genuine solutions overthrow the status quo, not simply little pieces of the status quo however the totality of the power structure of focused wealth and power.

Meet the new manager, same as the old employer is not an option, it’s simply substituting another team at the top. Asymmetries ensure that some will always be more equivalent than others.

Real decentralization is hard because as I discuss in International Crisis, National Renewal, it needs a social transformation that renders the existing structure no longer appropriate. Financial or political tweaks aren’t enough. Genuine modification requires a total transformation of worths at the most profound level.

The same issue applies to all the techno-“options” of unlimited energy. All this unlimited energy will be owned/ managed by the few at the top of the extremely centralized status quo, and this asymmetry ensures that the couple of will benefit from the endless energy at the expense of the lots of politically helpless peasants.

The unencumbered realist concludes that there are no options within a status quo structure that is itself the issue. The “options” being used replacement another neofeudal asymmetry for the existing neofeudal asymmetry.

All of us desire options, but let’s not fool ourselves into thinking that altering pieces of finance or politics will really resolve the huge issues of centralization (i.e. inequality and corruption) and the dream of endless growth on a limited planet via our “waste is growth” Landfill Economy. If a “service” doesn’t directly fix those problems, it isn’t a genuine option.

The only real solutions require changing our own lives instead of engaging in dreams that brand-new asymmetries in centralized systems will transform a status quo doomed by asymmetries.

Realists are neither optimists or pessimists, they focus on increasing what they straight manage by advancing their Self-Reliance.

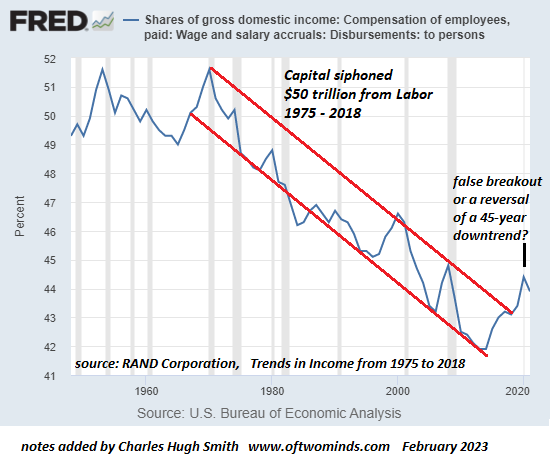

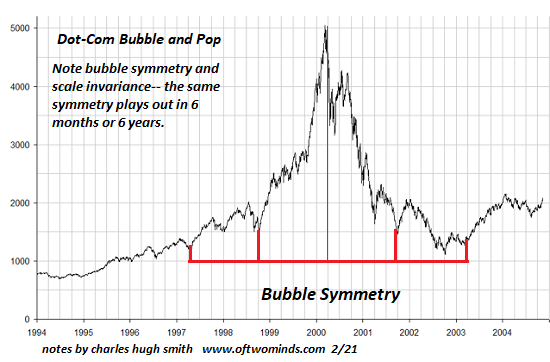

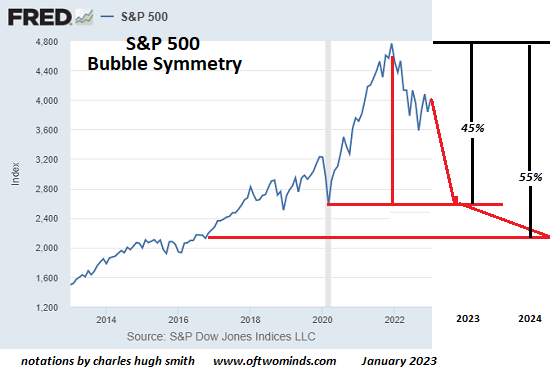

These charts inform the story.

New Podcast: Turmoil Ahead As We Enter The New Period Of ‘Shortage'( 53 min)

My brand-new book is now offered at a 10 % discount rate ($8.95 ebook,$

18 print): Self-Reliance in the 21st Century. Read the very first chapter for

free (PDF)Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 minutes)

My recent books:

The Asian Heroine Who Seduced Me (Unique) print $10.95, Kindle $6.95 Check out an excerpt free of charge (PDF)

When You Can’t Go On: Burnout, Numeration and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first area totally free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Method for the United States (Kindle $9.95, print $24, audiobook) Check Out Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Read the very first section totally free (PDF).

Will You Be Richer or Poorer?: Earnings, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Check out the first section for free (PDF).

The Experiences of the Consulting Philosopher: The Disappearance of Drake (Unique) $4.95 Kindle, $10.95 print); read the first chapters totally free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Check out the first area for free

Become a $1/month client of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail remain confidential and will not be offered to any other individual, company or agency.

|

Thank you, Robert J. ($50), for your magnificently generous contribution to this website– I am considerably honored by your steadfast support and readership. |

Thank you |

, Michael ($54), for your marvelously generous contribution to this site– I am considerably honored by your assistance and readership. |