This definitive sign of a currency collapse is simple to see …

It’s when fiat money ends up being trash.

Maybe you have actually seen images portraying run-away inflation in Germany after World War I. The German government had actually printed a lot money that it ended up being useless confetti. Technically, German merchants still accepted the currency, but it was unwise. For example, it would have required wheelbarrows filled with paper currency to purchase a loaf of bread.

At the time, nobody would bother to get money off the ground. It wasn’t worth anymore than the other crumpled pieces of paper on the street.

Today, there’s a similar circumstance in the US. When was the last time you saw someone get a penny off the street? A nickel? A cent?

Nowadays, even bums typically can’t be troubled to get anything less than a quarter.

The US dollar has actually become so debased that these coins are basically pieces of rubbish. They have little to no practical value.

Refusing To Acknowledge the Fact

Up up until 1982, the cent was 95% copper.

Today, the melt value of these pre-1982 cents is 2.6 cents– more than double their stated value– as product rates have skyrocketed and the dollar’s purchasing power has plummeted.

That’s why the US Mint no longer uses so much copper to make pennies. Modern pennies are just 2.5% copper, with less expensive zinc comprising the staying 97.5% of the coin.

In other words, the United States government couldn’t even preserve a copper standard.

Even more, even after utilizing a cheaper metal to make the cent, it still costs the US Mint about 2.7 cents to make every penny. For nickels, it costs the US Mint 10.4 cents to make.

Last year, the United States government lost over $171 million making pennies and nickels.

So, why is it squandering taxpayer money making coins bums do not even use?

Since phasing out the penny and nickel would suggest acknowledging currency debasement– federal governments never like to do that. It would expose their incompetence and theft from savers.

This isn’t new or special to the United States. For years, governments worldwide have actually hesitated to phase out useless currency denominations. This helps them reject an inflation issue even exists. They decline to issue currency in greater denominations for the very same reason.

Consider this.

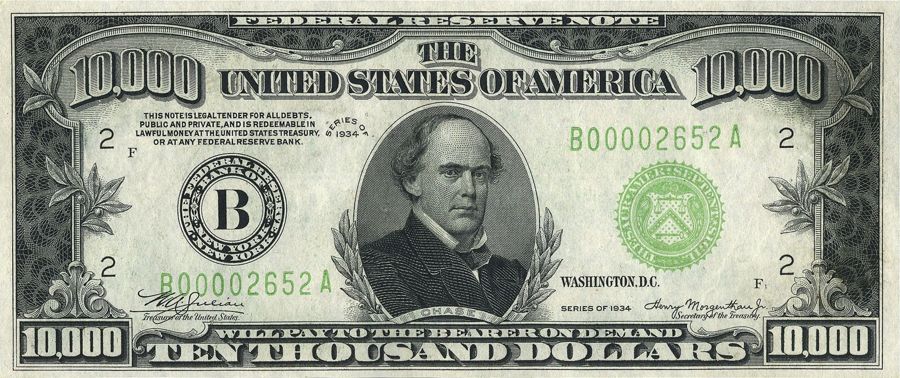

The $100 costs is the biggest in blood circulation. That wasn’t constantly the case. At one point, the United States had $500, $1,000, $5,000, and even $10,000 bills.

The government got rid of these big bills in 1969 under the pretext of fighting the War on (Some) Drugs.

The $100 costs has been the largest ever since. However it has far less purchasing power than it performed in 1969. Years of rampant money printing have debased the dollar. Today, a $100 note buys less than $13 in 1969.

Despite the fact that the Federal Reserve has actually cheapened the dollar by over 88% because 1969, it still refuses to release notes bigger than $100.

Pennies and Nickels Under Hard Cash

Consider what a cent and a nickel would deserve under a tough cash system backed by gold. From 1792 to 1934, gold was around $20 per ounce. Under this system, it took about 2,000 cents to make an ounce of gold.

At today’s gold price, a “difficult cash penny” would deserve about 99 modern-day cents. A “tough money nickel” would be worth about $4.98.

I don’t get pennies off the sidewalk. But I would if pennies represented 1/2,000 an ounce of gold. If that were to take place, I question there would be many pennies on walkways.

Ron Paul stated it finest when he discussed this problem …

“There is an old German stating that goes, ‘Whoever does not appreciate the cent is not worthwhile of the dollar.’ It expresses the sense that those who overlook or overlook the little things can not be relied on with bigger things, and fittingly describes the problems facing both the dollar and our nation today.

Unless Congress puts an end to the Fed’s loose financial policy and returns to a sound and stable dollar, the problem of United States coin structure will be reviewed every few years until inflation finally forces coins out of flow completely and we are entrusted to only useless paper.”

There’s a crucial lesson here.

Politicians and bureaucrats are the most significant risks to your financial security. For many years, they’ve been debasing the currency … and inviting a disaster that now might be impending.

Editor’s Note: The majority of people have no idea how bad things can get when a currency collapses … not to mention how to prepare.

That’s why we have actually just recently released a how-to guide detailing the very best methods to safeguard your savings. It’s called Enduring and Prospering Throughout a Financial Collapse. Click on this link to download the totally free PDF.