In a system preserved by ever-greater extremes, self-confidence wears down extremely quickly once the next severe stops working to move the needle.

Lots of observers expect rate of interest to fall back to absolutely no as inflation dissipates and reserve banks hurry to stimulate flagging economies. This expectation is affordable based on the events of the previous 15 years (2008-2023), but if we zoom out to a 50-year timeline, we get a various perspective and draw a different conclusion.

2023 is not 2008, and the distinction can be summed up in one phrase: global danger has actually been repriced. Rates of interest show not simply inflation expectations and reserve bank stimulus; rates of interest and bond yields also show the danger premium on the expense of credit-money, and if the risk profile has actually altered in basic ways, the danger premium and cost of credit-money will reflect that, despite inflation and reserve bank stimulus.

The global economy is altering in fundamental methods, and this is repricing everything: the cost of money/credit, the cost of possessions, the worth of hedges and insurance, and so on. The core chauffeur in all this repricing is danger, for it’s the reappraisal of risk that requires the repricing of whatever.

When threat is low and transparent, the risk premium is low and this is shown in low, stable costs. When danger skyrockets and is hard to assess, the threat premium increases and this presses costs higher.

In terms of possession appraisals, greater dangers reprice assets higher or lower based on the danger profile: what happens to the asset if liquidity dries up in a risk-driven crisis? If credit dries up, what takes place to demand for the asset?

Danger tends to be self-reinforcing. If we look around and see everyone else is confident that threat is theoretical instead of real, we stop buying hedges versus bad things happening, and we pay a premium for properties that succeed in low-risk periods.

But if we see other people getting defensive– offering assets, paying down debt, reducing costs and risk-on investing– then we pull in our horns, too.

What changed? The international economy began a cycle in the early 1990s of decreasing danger throughout the system due to these risk-reducing changes:

1. The dissolution of the USSR and completion of the hyper-expensive, heightened-risk Cold War.

2. The flood of low-cost oil as all the super-giant fields discovered in the 1970s began peak production.

3. China emerged as the affordable “workshop of the world,” enabling 30 years of skyrocketing corporate earnings as corporations decreased costs by offshoring production to China.

4. This offshoring increased earnings while deflating the costs of production due to much lower labor expenses, lax/ non-existent ecological standards and Chinese producers’ determination to accept razor-thin earnings margins.

5. The reduction in worldwide threat and the deflationary effect of Globalization (offshoring and opening new markets) allowed reserve banks to lower rates of interest for thirty years without stimulating inflation and private-sector banking/lending to expand credit and leverage, successfully globalizing/ commoditizing monetary instruments that hedged threats (Financialization).

6. After a decade-long lag (the 1980s), the advances in personal computing, software application and desktop publishing finally started creating performance increases.7.

The economic faith of Neoliberalism was embraced worldwide. Neoliberalism claims “markets solve all issues” and so the universal option is to turn everything into a market by lowering regulations and state oversight.

All of these forces tended to limit rates of products, items and services and minimize systemic threats while broadening markets, monetary “developments” and earnings. This developed a global “virtuous cycle” in which each dynamic reinforced the others.

This “virtuous cycle” ended in the 2008-09 Global Financial Meltdown, but was papered over for a years by severe policies:

1. China released the largest credit expansion in history (Russell Napier’s expression) to counter the crisis

2. The Federal Reserve and other reserve banks started a policy of financial repression (i.e. centrally handling monetary markets rather than let market forces determine liquidity, cost, risk, and so on), causing Absolutely no Interest Rate Policy (ZIRP) that was effectively negative-rates because inflation continued sputtering along at 1.5% tp 2%.

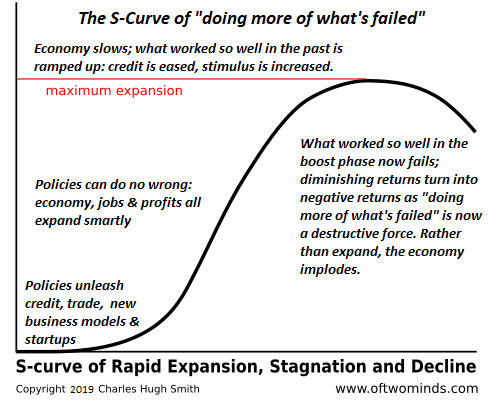

Why did the “virtuous cycle” end? The fundamental answer is decreasing returns: the returns on any brand-new policy or vibrant such as Neoliberalism, globalization or financialization follow an S-Curve (see chart listed below), where the preliminary returns are stupendous (the increase stage) and after that as the characteristics become ubiquitous, the returns lessen till they stagnate. At that point, the system decays unless brand-new more extreme steps are used– for instance, China’s debt to GDP ratio doubling from 140% to 280% and rate of interest being reduced to no.

Another factor is the cannibalization of domestic markets as soon as globalization had actually skimmed the easy returns. Financialization begins looking “ingenious” by claiming it can hedge all risks at low expense, successfully decreasing the danger of playing financial video games to no. As Benoit Mandelbrot and other discussed, this isn’t possible for structural/mathematical factors (markets are fractals, and so on).

As the simple gains reduce, financialization takes assets that were as soon as low-risk and commoditizes them into “instruments” that can be offered internationally as “low-risk assets.” This is what took place to house mortgages, which went from being extremely regulated and low-risk to being poorly controlled/ fraudulent and packaged into highly deceptive mortgage-backed securities that masked the true threat– high– behind flim-flam claims of low danger.

As costs rose in China and other producing countries, labor expenses started increasing, in addition to higher taxes and requireds to minimize the choking air pollution and poisoned water/soil that undoubtedly result from unrestrained industrialization.

Reducing the expense of capital/credit to near-zero generated a tsunami wave of private-generated capital, both within the banking sector and the ballooning non-banking (shadow banking) sectors. This low-cost credit was then unleashed into worldwide markets to chase after any high-yield investment, which obviously suggests gambling on risky possessions while supposedly hedging the bets against losses.

All this financial engineering– ZIRP, low-cost, plentiful credit, the chase for yield– ultimately depends on liquidity, i.e. the presence of purchasers in size to develop a market for anyone who seeks to sell an asset. If liquidity dries up for whatever factor– a bank crisis, a market panic, etc– then sellers lack buyers abd the marketplace reprices the property at lower and lower levels up until buyers emerge. In a bidless/zero-liquidity market, there are no buyers at all up until the price approaches zero.

The potential wipeout of bubble-generated “wealth” would lower the whole international monetary system, for all those assets are collateral for the world’s tremendous mountain of credit/debt.

The evaporation of liquidity in 2008-09 is what former Fed Alan Greenspan recognized as the threat he did not expect.

So what altered around 2007-09? Globalization and Financialization moved from “virtuous cycle” to stagnation/decline, policies became more extreme to mask rising systemic threats, and the addition of a billion new workers desiring all the commodity-consuming luxuries of the middle class lifestyle absorbed excess production of oil and other commodities. With surpluses gone, prices had to begin increasing.

Post-Covid lockdown and recovery, China’s policies altered from “open to the world” and “peaceful increase” to aggressive militarization and the constraint of Chinese society’s access to the outdoors world.

All of these elements exposed the dangers that had actually been successfully masked: the threats that worldwide supply chains can break down or be interrupted by geopolitics; the danger that financialization games can explode; the danger that Neoliberalism failed to reduce threats of fraud and exploitation; the risks that skyrocketing debt outmatches growth of the real-world economy, creating financial obligation crises, and the threats of severe policies producing unintended consequences (moral threat, severe risk-taking, etc) and blowback (re-industrialization, trade wars, etc).

On top of these threats, there are now group, capital, labor and resource sources of dangers. Geopolitical stress are rising, which is traditionally normal in ages where vital products end up being limited and/or unavailable/ pricey. This is incentivizing re-industrialization, reshoring, friendshoring, and so on, all of which are national-security concerns focused on lowering reliance on competitors or dangerous supply chains.

In result, the nation-state has to take the chauffeur’s seat from decontrolled markets, the Neoliberal perfect.

This re-industrialization is also driven by the shift to non-hydrocarbon energy sources, an objective that will require even more capital than most expect even as it underperforms unrealistic expectations. The demand for trillions in brand-new financial investment will press credit for consumption (new houses, vehicles, holidays, and so on), pushing the cost of credit higher despite any other conditions.

In the previous decade, birth rates in many established and developing economies have actually cratered while the labor force ages and enters retirement. Both of these advancements indicate pension and social well-being programs launched when there where 5 employees for every single retiree are no longer sustainable now that there are only 2 fulltime employees for every single retiree/recipient of social well-being.

The decrease of the labor force likewise presents 2 other dynamics: prospective labor lacks and the stagnation of demand, as older people consume far less than new homes having children. As marriage rates and birth rates plummet, so do the prospects for consumption-driven financial development.

The policy extremes of ZIRP, ethical threat, credit expansion and the chasing of yields has inflated The Everything Bubble which has actually put the price of real estate and lorries out of reach of the bottom 60% (or in numerous regions, the bottom 80%) of households.

This increasing inequality erodes social cohesion and cultivates an alternative lifestyle in which young employees opt out of the rat race to obtain an upper-middle class income and wealth. This lessens the swimming pool of potential purchasers of all the overpriced possessions, even more decreasing liquidity on a demographic/structural basis.

Basically, the rising tide of wealth and revenues hasn’t raised all boats. The top 5% have amassed the huge majority of the gains in asset appreciation, capital gains and profits. This generates a background of increasing risk of social disorder.

On top of all this, 30 years of moderate inflation have actually reversed into an age of sustained inflation, which in spite of the hopes of many commentators, will not be transitory. This period of inflation is driven by:

1. Excessive debt levels that can only be managed by inflating the financial obligation to workable levels.

2. Shortages of basics which push costs above what consumers can afford while not being high enough to fund enormous brand-new investments needed to increase supply.

3. The cost of capital must rise to reflect the rising risk premium worldwide.

All the tricks deployed to bring back confidence in 2008-09 have reached such extremes that now systemic threat— of default, disputes, broken supply chains, geopolitical blackmail, shortages of essential commodities and perhaps the least understood danger, the evaporation of liquidity as credit and buyers of risk-on properties become scarce–is rising drastically.

These threats are tough to assess or hedge completely, and the inter-dependence of the worldwide economy and financial system– a securely bound system— imply danger in one location rapidly infects the remainder of the system.

This structural increase in systemic risks raises expenses and changes the risk-reward calculation on every possession.

Take housing as an example. When we’re positive housing will rise 30% every years like clockwork, we’ll pay today’s prices with the expectation that your home will get 30% in the coming years. But as the monetary danger premium increases, and we need to factor in the danger that your home may lose 30% of its worth moving forward, we end up being wary of paying today’s high cost.

As others likewise end up being wary, the recognition of risk reinforces itself and as rates drop, our wariness boosts and we decide to wait till the risks of more decrease become clearer.

The problem with examining risk is the complete dangers are never clear until it’s too late.

Whatever is being repriced, consisting of danger itself, the cost of capital and labor and the worth of all assets. This repricing is currently modest, however as risks manifest, we can expect a velocity of repricing. If liquidity dries up– purchasers for homes all of a sudden withdraw from the market– the cost declines can be significant and self-reinforcing.

In a system kept by ever-greater extremes, self-confidence erodes really rapidly once the next severe fails to move the needle. At that point, all bets are off due to the fact that confidence in the policymakers’ ability to “conserve the day” vanishes.

When confidence vanishes, so does liquidity. When markets are illiquid, the problem isn’t limited to the decreasing valuation– the genuine issue is finding a buyer who will enable you to convert the property into money.

It’s clear the global threat premium has increased drastically and is increasing in an unpredictable arc. This structural trend of higher dangers will reprice everything– consisting of bond yields and rate of interest.

This essay was first published as a weekly Musings Report sent out specifically to subscribers and patrons at the$5/month($50/year)and higher level. Thank you, clients and customers, for supporting my work and totally free site.

New Podcast: Chaos Ahead As We Go Into The New Era Of ‘Deficiency’ (53 min)

My new book is now readily available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

My new book is now readily available at a 10% discount rate ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

Check out the first chapter totally free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Dependence in the 21st Century (43 min)

My current books:

The Asian Heroine Who Seduced Me (Unique) print $10.95, Kindle $6.95 Check out an excerpt totally free (PDF)

When You Can’t Go On: Burnout, Numeration and Renewal $18 print, $8.95 Kindle ebook; audiobook Check out the very first section free of charge (PDF)

Worldwide Crisis, National Renewal: A (Revolutionary) Grand Technique for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One totally free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Check out the first section free of charge (PDF).

Will You Be Richer or Poorer?: Earnings, Power, and AI in a Shocked World

(Kindle $5, print $10, audiobook) Read the first area totally free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); checked out the very first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Check out the very first area for free

Become a $1/month client of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail remain personal and will not be provided to any other private, business or agency.

|

Thank you, Anthony B. ($25), for your much-appreciated generous contribution to this site– I am considerably honored by your steadfast assistance and readership. |

Thank you |

, Andreas K. ($50), for your marvelously generous contribution to this website– I am greatly honored by your assistance and readership. |