German engineering used to be world prominent. Revered, the embodiment of production and perfection. You didn’t desire a German girlfriend. She ‘d beat you up, but you certainly desired a German cars and truck. That’s how well known it was.

And now take a look at what Germany does … Germany– or should I state, German pointy shoes. In their woke quote to fix a problem that does not exist (climate modification) with a plan that won’t work (renewables and 15 minute cities) has actually finally done it. They’ve closed down their last staying nuclear power stations.

Hours Prior To Closing Reactor, German Utility Reveals 45% Cost Rise

Countless customers in North Rhine-Westphalia have to dig deeper for electrical energy: market leader Eon increased to 1. June its fundamental supply costs, as he tells many consumers these days. „ In parts of NRW, the brand-new labor price is 49.44 cents gross per kilowatt hour, which means an adjustment of around 45 percent for average consumption “, verified a spokesman for Eon Energie. The Verivox contrast website calculates what that indicates for a three-person family in NRW that Eon supplies in basic services: From June, he pays 2125 euros for an annual intake of 4000 kilowatt hours of electrical energy.

As Eon (one of Europe’s biggest operators of energy networks and energy infrastructure), and in fact all of Germany, proceeds to close nuclear, without a doubt its most inexpensive trustworthy power, it (Eon) revealed a 45% rate dive for clients from what are currently some of Europe’s greatest costs.

Hahaha, take that you beer-drinking sausage eaters. Ultimately you’ll own nothing and enjoy. You can’t say you weren’t alerted.

We have actually assured prior to that at a domestic level these lethal policies (the connection between energy consumption and death well established) would produce internal bickering and combating, and ultimately, if enough pressure is applied, contribute to the fragmentation of and collapse of the criminal cartel European Union itself.

German government rejects Bavaria’s request for nuclear power comeback:

Germany’s Environment Ministry on Sunday turned down a demand from the state of Bavaria to enable it to continue operating nuclear power plants, stating jurisdiction for such centers lies with the federal government.

Remember that our sauerkraut-eating good friends don’t have the very same political setup as the yanks do. Each state (Bavaria in this instance) does not have anywhere near as much self decision as do states within the US. So they’re hamstrung by Berlin, which truly suggests they’re hamstrung by the unelected EU official pointy shoes in Brussels, which really means they’re all determined to by Davos male. That, nevertheless, does not suggest that there isn’t anger and bitterness about this down at a more local level. The people will significantly, via whatever means possible (local governments, for example), wake to the asylum they’re now residing in.

Approaching the Tipping Point I think we ‘re quick approaching tipping points all across the EU, where the peasants will state ENOUGH!

It is worth keeping in mind that the state of Bavaria is the most significant net contributor to the German Federal budget plan and likewise to the EU. Folks will rightly figure out that it’s time to leave both. Small independent states serve people.

A separation of the EU power base is definitely most likely as the system implodes. This means two things. One, the globalists will face this issue with increased tyranny. Where there are relative flexibilities individuals will move. We’ve already been enjoying the migration of the wealthy out of the EU. Next comes the newly impoverished middle class and bringing with it the implosion of the EU.

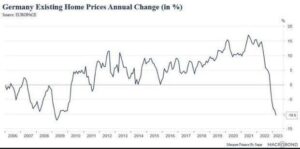

This is currently in procedure. In fact, it is contributing to what is now shown in house costs.

It truly is a race versus time. As complex systems collapse the ability to implement control modifications asymmetrically. This is why they’re hurrying as fast as they can to implement CBDC’s. A method of overall control.

Regretfully the large bulk of individuals are still roaming through life in a baffled daze. They’ll be entirely screwed and I do not state that to be hyperbolic however that’s the lesson of history. The Pareto distribution will excerpt itself with 80% of folks being enslaved. Do not be among them.

The pace of change is quicker:

Today, at the International Monetary Fund (IMF) Spring Conferences 2023, the Digital Currency Monetary Authority (DCMA) revealed their official launch of a global central bank digital currency (CBDC) that enhances the monetary sovereignty of getting involved central banks and abide by the current crypto possessions policy recommendations proposed by the IMF.

They’re plainly not ready yet as this organization didn’t even exist a couple of months earlier. It seems like they’re patching together a patchwork of ideas.

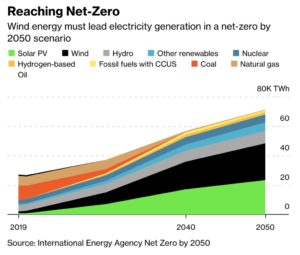

What’s Next? Back to Dirty Old Coal

That’s the response to the natural question: how or with what this nuclear energy will be changed with?

These coal companies aren’t always going to trade at P/Es of 15x or something like that. They’ll probably trade at 5x, however simply keep returning money to investors. You take those dividends and reinvest them for the duration of the years (plus or minus) and the returns will be really great certainly.

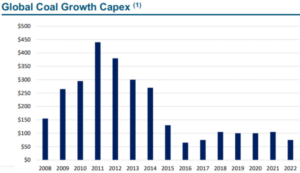

Why? Well inspect this out. We encountered this graph and now for the life of me I can’t recall where from. In any event, we weren’t too shocked.

The unusual thing is the lack of capex invest provided the significant increase in the coal price. Whatever has been turned backwards. It’s as if guys are wome … ah, let’s not go there. It’s upside down … in reverse.

The important things is coal miners hesitate to develop brand-new resources for fears of properties being stranded, political risk, or– and this is considerable– they simply can’t raise capital to develop new resources, what with Wall Street too busy holding diversity meetings and putting tampons on the young boys’ loos.

Do not undervalue all the rhetoric that goes with the net-zero “objective. This might represent the majority of the under investment.

One thing is for sure. It is extremely unlikely we will see any significant boost in coal supply over the next five years or two.

Take a look at coal futures here …

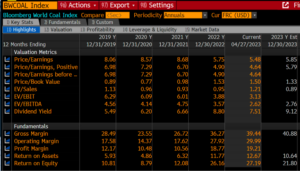

And simply for good step, this is how coal searches a relative basis.

Bloomberg World Coal Miners Index vs S&P 500 Coal miners are still inexpensive, very low-cost.

The tough part of the coal trade (in truth most of the trades we are on) is staying with it. In other words, doing nothing and not ending up being a hostage to volatility.

Editor’s Note: The Western system is going through substantial modifications, and the signs of moral decay, corruption, and increasing debt are difficult to overlook. With the Great Reset in motion, the United Nations, World Economic Online Forum, IMF, WHO, World Bank, and Davos male are all promoting an unified program that will affect us all.

To get ahead of the chaos, download our complimentary PDF report “Clash of the Systems: Ideas on Investing at an Unique Point in Time” by clicking here.