Now that debt is rising quicker than “development,” and “growth” depends on speculative credit-asset bubbles, the collapse of the Keynesian dream looms large.

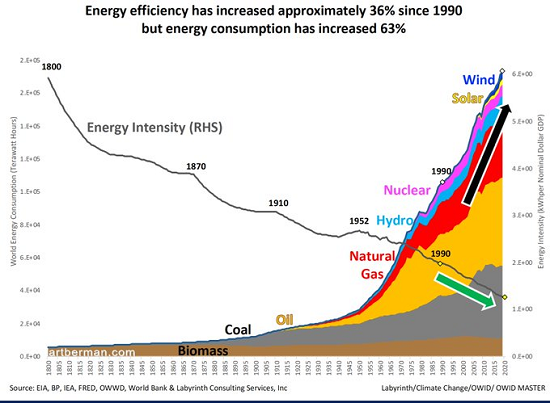

Unbeknownst to economists, the Keynesian bedrock of modern economics— utilizing monetary repression and government costs funded by debt to handle business cycle of growth and economic crisis–is an artifact of a century of expansive inexpensive energy and virtuous demographics.

Provided as quasi-scientific “laws of economics,” Keynesian policies of reducing rate of interest and moneying stimulus with debt were only possible in an age in which energy per capita (per individual) always ended up being more plentiful and budget-friendly in regards to the purchasing power of earnings, i.e. the number of hours of labor does it take to buy the energy to sustain an automobile, prepare a meal, and so on.

The demographics of the 100 years of Keynesian supremacy were also uniquely favorable. The workforce paying taxes and moneying pay-as-you-go social benefits to senior citizens (Social Security and Medicare) and the less lucky (welfare, Medicaid) broadened smartly years after years, expanding federal government revenues and spending as the natural result of a broadening workforce.

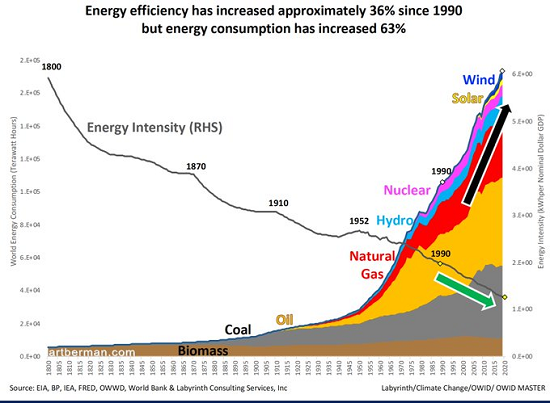

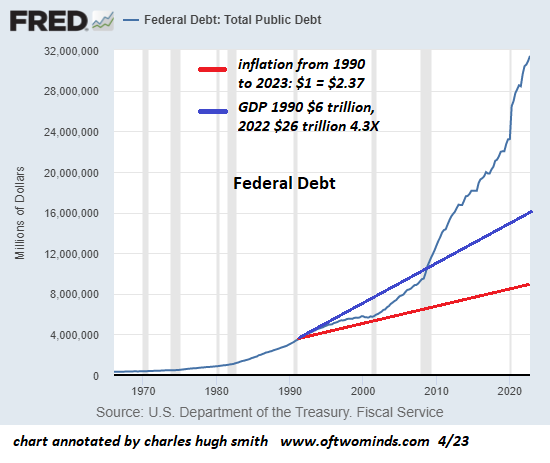

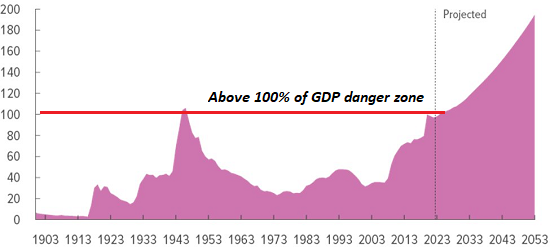

A 3rd uniquely beneficial condition was the vast swimming pool of natural capital that had not yet been financialized, i.e. developed into a commodity that could be used as security for brand-new financial obligation and leverage. Tapping this untapped swimming pool of capital enabled the huge expansion of dent, public and personal. (See charts below)

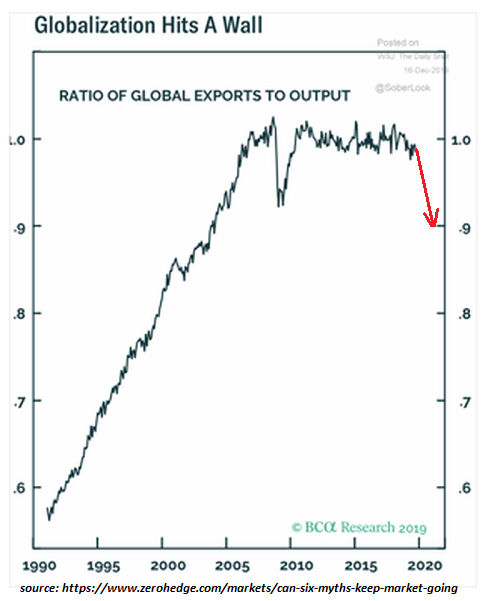

A fourth uniquely beneficial condition was globalization, a benign-sounding term for the brazen exploitation of the world’s staying reserves of resources and cheap labor. Revenues swelled as these last pockets of easy-to-exploit sources of wealth were tapped.

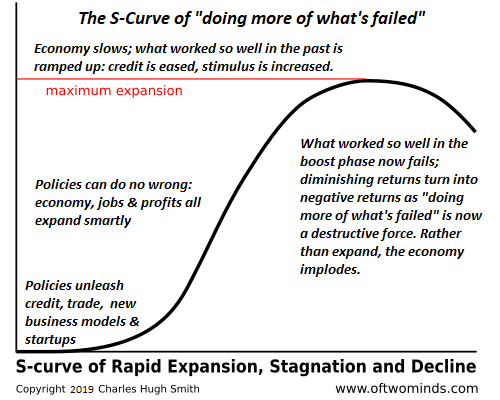

These 4 conditions have all peaked and are now reversing. The cheap-to-access energy has been consumed, the workforce has actually shifted from expansion to stagnancy while the people of senior citizens explodes, globalization has run its course, having stripmined the planet and human populace, and every prospective source of new security has been financialized/ leveraged to the hilt.

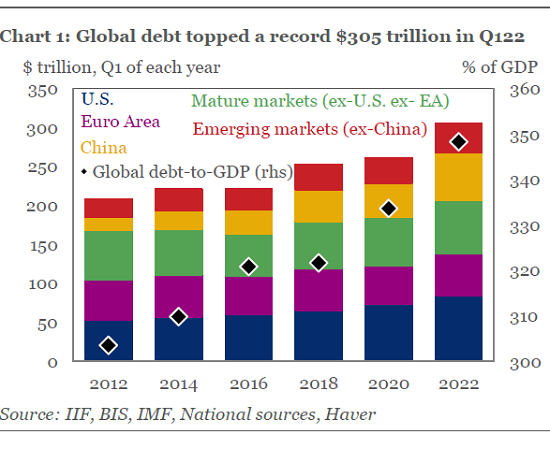

Keynesian policies of pushing interest rates to near-zero to enhance personal debt and government budget deficit morphed from being “emergency policies” to permanent status quo. Considered that greed and laziness are the human default settings, it was always impractical to think that the “emergency situation tools” of borrow-and-spend would be booked for economic crises/ anxieties. Now intake, personal and public, depends totally on the permanent growth of debt to fund not only consumption but the increasing expenses of servicing the ballooning financial obligation.

The Keynesian fantasy constantly rested on one dynamic: we can expand production and usage faster than we’re broadening financial obligation and the expense of maintenance that debt. With the four virtuous conditions now reversing, the expense of financial obligation is increasing far quicker than the lukewarm boosts in production and consumption created by debt-funded costs.

The final desperate technique of the Keynesian dream is the wealth impact created by speculative credit-asset bubbles, in which properties that were when grounded in energy and expenses get away gravity and skyrocket into the stratosphere, producing trillions of dollars in “free cash” for those lucky to have bought the assets before the bubble inflated.

The usage managed by this bubble-generated “free money” was the last source of Keynesian “development”: simply suppress rate of interest to juice personal loaning, flood the financial system with liquidity, and voila, trillions in unearned “free cash” streams to those who were already abundant enough to own the possessions catapulted to the moon.

But all dreams end, even the Keynesian one. The risks and costs of increasing financial obligation can not be dreamed away, and the inevitable outcome is the cost of capital increases in addition to the risks and expenses of skyrocketing financial obligation. Bubbles pumped up by policies motivating speculative leverage all pop, ravaging those who believed the “totally free money” would never end.

The planet has actually already been stripmined of cheap-to-access resources and cheap labor. Costs are rising and playing financial games with rate of interest can’t reverse real-world expenses or the rising costs of capital. Demographics can’t be reversed by monetary trickery, either.

The Keynesian fantasy is drawing to a close. Financialization and unlimited debt-funded stimulus were artifacts of 4 distinct conditions (inexpensive, plentiful energy, demographics, globalization and financialization) that have actually all peaked and are now sliding down the behind of the S-Curve. AI can put lipstick on the mirror but it is incapable of reversing the end-game decay of these four special conditions.

Given that there’s no option to the Keynesian imagine everlasting “growth” moneyed by magic, we’re doing more of what’s stopped working up until the system collapses in a heap: we’ll do more of what’s stopped working till it stops working stunningly.

It’s worth remembering Peter Drucker’s observation that business do not have profits, they only have costs. The very same can be said of governments and entire economies. Loaning to pay increasing costs has a short-half life due to the fact that debt accrues its own costs and piles up risks which have their own uniquely asymmetric dynamics.

Now that financial obligation is increasing faster than “growth,” and “growth” depends on speculative credit-asset bubbles, the collapse of the Keynesian dream looms big. Plan accordingly, i.e. lower your own direct exposure to risk by means of Self-Reliance.

My new book is now available at a 10

My current books: The Asian Heroine Who Seduced Me (Unique)

print$10.95, Kindle$6.95 Check out an

excerpt free of charge(PDF )When You Can’t Go On: Burnout , Reckoning and Renewal $18 print,$8.95 Kindle ebook; audiobook Read the very first area for free( PDF) Global Crisis, National Renewal: A(Revolutionary) Grand Method for the United States (Kindle$9.95, print $24, audiobook )Check Out Chapter One free of charge(PDF). A Hacker’s Teleology: Sharing the Wealth of Our Shrinking World(Kindle$8.95, print$20, audiobook$17.46)Read the first section for free (PDF ). Will You Be Richer or Poorer?: Earnings

, Power, and AI in a Shocked World(Kindle$5, print$10, audiobook)Read the very first area totally free(PDF). The Experiences of the Consulting Thinker: The Disappearance of Drake(Novel)$4.95 Kindle, $10.95 print); checked out the first chapters for