The post-bubble-crash stage is already being prepared: ‘no one might have seen this coming’– except anybody who took notice of anything aside from self-centered shills.

It’s actually quite easy to determine a speculative bubble of impressive percentages in stocks: if Wall Street states it’s not a bubble, it’s a bubble. As I discussed in The Smart Money Has Actually Currently Offered, from the long view the whole game of “investing” (wink-wink) boils down to one dynamic:

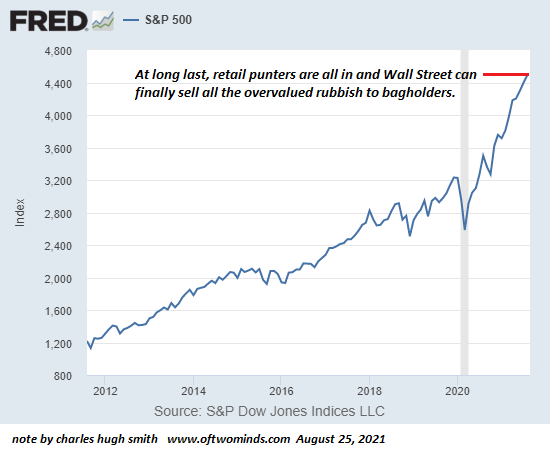

Wall Street and the Federal Reserve pump up an unmatched debt-funded speculative bubble and after that draw retail “investors” (i.e. bettors) in with the pledge that the enormous gains are just starting, there’s so much more easy cash ahead, and so on. Then Wall Street disperses (offers gradually so as not to notify the contented herd of retail punters) its shares of expensive rubbish (“financial investments”, heh) to bagholders, and then to everybody’s surprise (or not), the marketplace suddenly crashes as the unsustainable bubble pops.

Wall Street has long practice in how to assure the herd: given that experts have juiced the market greater for several years at every dip (with the Fed’s complimentary trillions using an assisting hand), the bagholders have been trained to purchase the dip even as the wheels come off the entire “this time it’s various” fraud.

Human psychology being what it is, desperate retail bagholders hold on to the delusional belief that a recovery to new highs is simply around the corner, since that’s what the market has provided for 13 straight years.

Every decade or so– 1999-2000, 2007-2008, and now 2020-2021– Wall Street’s roving army of shills spews the very same paper-thin reasons for “this is not a bubble”: this rally is just getting started, we’re assured because 1) business earnings are increasing and will support much greater assessments; 2) the Federal Reserve will never ever let any bubble pop (stated in numerous words) and 3) if we look at relative charts of quatloos, the British pound in the 1820s, the current cost of sake on the Sendai Exchange and bat guano futures, it’s apparent the S&P 500 is still undervalued. (Use as lots of arcane charts as possible to wow the bagholders.)

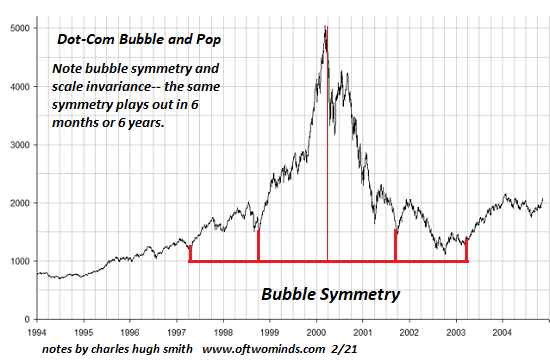

Regretfully, it’s all so simple. The hardest part is waiting for the discomfort from the last bubble popping to diminish enough for greed to overwhelm care. Wall Street just needed to wait 5 years from the nadir of the dot-com bubble in 2003 to the next bubble appear 2008; the wait from 2008 to 2021 has been excruciatingly long. Thirteen years we have actually needed to wait on the retail herd to go all in, for margin financial obligation to soar to brand-new extremes, for brief interest to fall to multi-decade lows.

But it’s lastly showtime, and the bagholders continue buying trash that’s guaranteed to collapse in worth. The post-bubble-crash stage is currently being prepared: no one might have seen this coming— except anybody who focused on anything aside from self-interested shills.

The problem and gnashing of teeth will be gigantic for the bagholders, as will the earnings for Wall Street insiders. Fortunately they have long practice in looking woeful in public, as if they’re sharing the pain, and concealing their glee at getting away with the same old “this isn’t a bubble” scam yet once again.

What nobody dares ask is: will the bagholders have anything left after this “3rd time’s the appeal” bubble pops? Please do not inform us this is completion of the road for the “this isn’t a bubble” rip-off. Without greed-fueled credulous bagholders with cash/credit to gamble, the game is over.

If you found value in this material, please join me in seeking services by ending up being a $1/month customer of my work via patreon.com.

My brand-new book is available! A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet 20% and 15% discounts (Kindle $7, print $17, audiobook now offered $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Intro.

Recent Videos/Podcasts:

Gadfly Interview with Charles Hugh Smith (Host Carlos Gonzalez, 22 minutes)

My current books:

A Hacker’s Teleology: Sharing the Wealth of Our Diminishing Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section totally free (PDF).

Will You Be Richer or Poorer?: Earnings, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section totally free (PDF).

Pathfinding our Fate: Avoiding the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Check out the very first section free of charge (PDF).

The Adventures of the Consulting Theorist: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Cash and Work Unchained $6.95 (Kindle), $15 (print) Read the first area free of charge (PDF).

End up being a $1/month patron of my work via patreon.com.

KEEP IN MIND: Contributions/subscriptions are acknowledged in the order received. Your name and e-mail remain confidential and will not be offered to any other specific, company or company.

|

Thank you, George A. ($54), for your marvelously generous contribution to this website– I am significantly honored by your support and readership. |

Thank you |

, Denise S. ($5/month), for your magnificently generous pledge to this website– I am greatly honored by your steadfast support and readership. |

|

Thank you, Rob S. ($50), for your magnificently generous contribution to this website– I am significantly honored by your support and readership. |

Thank you |

, Amber ($5/month), for your splendidly generous promise to this website– I am greatly honored by your assistance and readership. |